Europe’s real estate market is in a decisive phase. Building owners and asset managers face a challenging mix of rising energy costs, evolving climate regulations, and growing investor pressure to demonstrate measurable sustainable progress. From Paris offices to Berlin warehouses, Milan hotels to Madrid retail, the key question is no longer why efficiency matters — but where to act first. Now in its fourth year, the Deepki Index provides the insights to make these decisions. Based on real energy consumption from 400,000 assets using the Deepki platform and aligned with ISAE 3000 Type II standards, it provides insight into sector trends, risks, and opportunities, showing where progress accelerates and how top-performing portfolios turn efficiency into financial advantage.

Why the Deepki Index matters

The Deepki Index is more than a tool. It shows real energy performance across offices, hotels, logistics, residential, and retail buildings. By revealing which assets consume the most energy (or are improving fastest), it helps asset managers identify cost-saving opportunities and reduce risk while aligning with the EU Taxonomy and SFDR.

Sandrine Fauconnet, Senior Associate, ESG & Sustainability at Stoneweg:

“The Deepki Index is much more than just a tool: it is the benchmark that the market needs to transform its ambitions into concrete actions.”

Deep dive into the Index FAQ to explore the methodology.

Europe’s energy performance: uneven progress across sectors

The 2025 Index shows that Europe’s energy transformation is advancing but not evenly across sectors. Offices and logistics hubs are gradually using less energy thanks to retrofits and hybrid work models. And housing and healthcare follow similar trends.

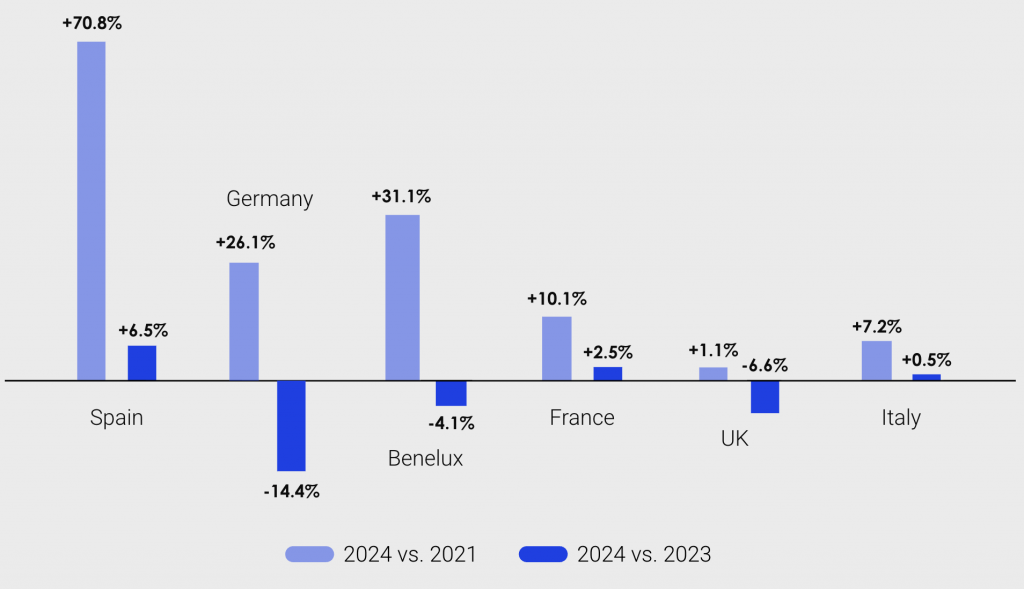

Yet the picture is uneven. Hotels are bustling back to life after the pandemic. Energy use in this sector is up 18% since 2022. Retail has evolved erratically, reflecting its economic sensitivity. It remains unpredictable due to inflation, shifting consumer habits, and political uncertainty across Europe.

Take a look at last year results in detail.

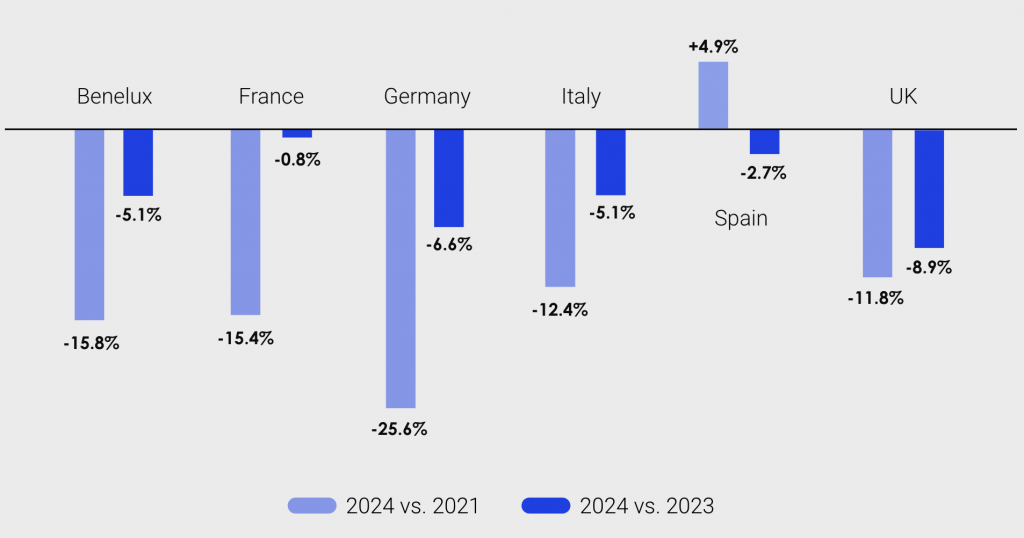

Country highlights: where to target action

Energy consumption is falling across offices, logistics, and healthcare. Logistics alone is down 24 percent since 2022. Hotels are stable, signaling recovery rather than growth. The only exception is Retail which saw a rebound in 2023, especially driven by prime/luxury retail. As evidence of this attractiveness, London has been ranked first in attractiveness since 2022.

Yet the UK remains one of Europe’s highest CO₂ emitters. The lesson is clear: efficiency gains must continue alongside investment in renewable energy.

France continues to post some of the strongest efficiency gains across all real estate typologies, driven by the binding requirements of the Tertiary Decree. Logistics energy consumption fell 20% vs 2022, as e-commerce levels return to normal after a post-pandemic boom, and a lot of warehouses are now under-used.

Hotels, however, rose 10% in average final energy use in 2024 compared with 2022, likely due to the country hosting the 2024 Olympic and Paralympic Games, which took place in the seven biggest French cities and drove occupancy and international arrivals up by double digits.

While minor, we see that office consumption rose slightly by 0.8% due to a more rigorous climate (colder winter, hotter spring requiring more cooling) and the continued return to the office post-pandemic, increasing building occupancy.

Germany’s offices and logistics hubs have achieved significant reductions—26% and 21% since 2022. But this is partly due to an economic slowdown and rising vacancy rates. The office vacancy rate in major German cities increased by 27% in 2024 compared to 2023. Less activity means less energy use, not just more efficient buildings.

While Germany did not achieve significant reductions in energy consumption, its CO2 emissions reduced significantly. This is because renewable energy production reached nearly 60% of electricity generation in 2024, and coal production dropped by 31%.

Spain stands out. Strong GDP growth and booming tourism have pushed energy use higher in hotels and retail. Retail growth, driven by consumer demand—especially in Prime Street assets—saw vacancy rates drop in 2024, reaching full occupancy in Malaga, Valencia, and Sevilla. Meanwhile, hotel energy use rose alongside tourism, with a 10.1% increase in visitors vs. 2023, lifting occupancy rates by 5% in 2024.

Housing and offices remain stable, largely due to newer, more efficient buildings. Spain shows that economic vitality and energy efficiency can sometimes pull in opposite directions.

Offices in the Benelux region have reduced energy intensity by 8% since 2022. Luxembourg and the Netherlands increased solar and wind capacity, while Belgium cut gas consumption to a record low 17.6%.

From data to financial strategy

By benchmarking real energy consumption against peers and regulatory standards, the Deepki Index highlights underperforming assets, helping asset managers pinpoint where efficiency gains and financial returns are most achievable.

Take a Paris office, for example. Targeted retrofits costing €2,000–2,500 per m² could yield 3–10% return on cost, depending on submarket and measures (JLL, 2023). These interventions improve performance, enhance tenant appeal, and protect asset value.

A strategic approach to efficiency should follow these key points:

- Benchmarking assets: Compare against peers and regulatory thresholds to identify high-priority investments. Compare the performance of your buildings to your peers, based on 20+ building subtypes in 20+ countries.

- Prioritizing interventions: Start with low-cost, high-impact measures. You can start with maintenance, operational adjustments like aligning heating and cooling with occupancy, and behavioral changes, then move to equipment upgrades and envelope improvements (insulation, glazing, etc).

- Operational alignment: Train facility managers, optimize schedules, and engage tenants to maintain gains.

- Scenario planning: Simulate costs, savings, and ROI using tools like Deepki Virtual Retrofit to focus capital where it delivers the most value by modeling costs, savings, and ROI.

This hierarchy ensures that each euro invested generates measurable returns, improves asset value, and supports regulatory compliance.

Efficiency as a financial lever

Efficiency is a financial lever. Europe’s real estate market is at a crossroads, with some buildings improving steadily and others lagging. The 2025 Deepki Index highlights where energy performance intersects with financial outcomes, providing opportunities for strategic action.

Proactive management, data-driven investment, and operational excellence turn energy efficiency from a regulatory necessity into a tool for protecting and growing asset value. Asset managers who understand their buildings, prioritize high-ROI investments, and integrate energy performance into portfolio strategy are better positioned to safeguard revenue, reduce costs, and maintain competitiveness.

Visit Deepki’s website to consult all values from the 2025 update for Europe and the U.S.

WEBINAR

What’s new in Deepki: November 2025

Want to see how your portfolio compares?

Join us live on November 19th to explore the latest innovations that make sustainability reporting faster, simpler, and more reliable. Discover exclusive insights from the 2025 Deepki Index, highlighting how top performers are reducing emissions and accelerating audit readiness across global portfolios. Plus, get your questions answered directly by our experts.