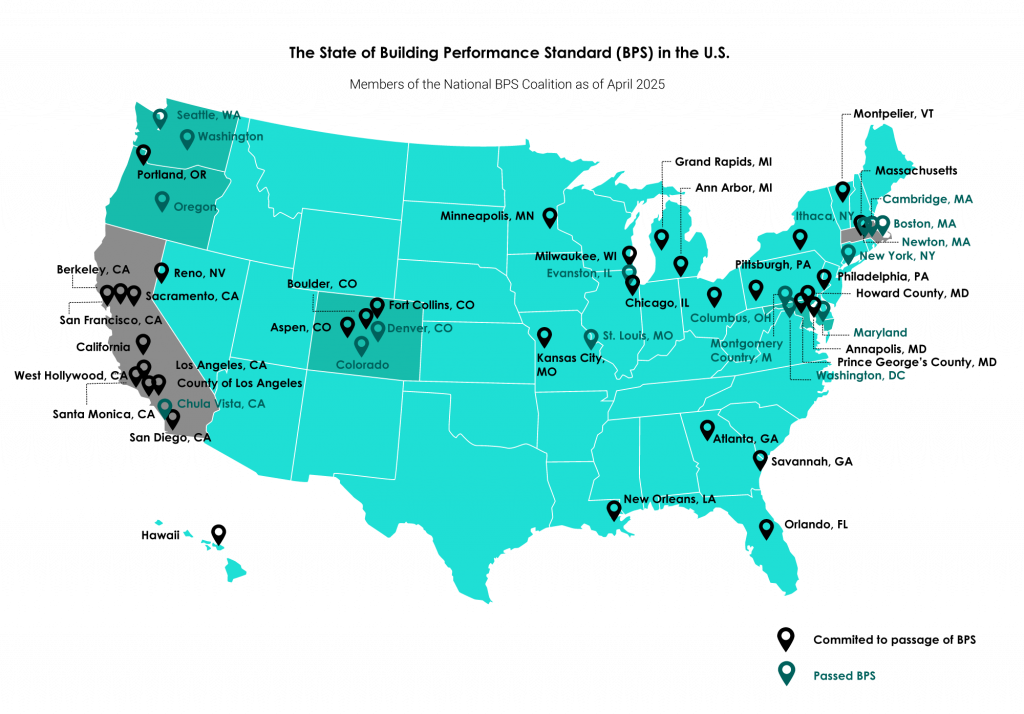

Across the United States, cities and states are rolling out Building Performance Standards (BPS) to reduce carbon emissions and improve building efficiency. Cities like New York, Boston, and Washington D.C. are already enforcing rules that directly affect net operating income (NOI), asset valuations, and liquidity. By 2026, more than 40 U.S. cities will enforce BPS programs, each with unique rules, deadlines, and penalties.

For asset managers, understanding which buildings are impacted, when compliance is required, and how to meet performance targets is critical to protect portfolio value and stay competitive.

Why Building Performance Standards matter

Buildings are one of the largest sources of greenhouse gas emissions in the U.S., as homes and commercial properties accounted for 31% of total U.S. emissions in 2022. While new construction meets energy codes, most emissions come from existing buildings. BPS focuses on improving the energy performance of these assets, offering the fastest path to carbon reduction and and a smarter approach to identifying cost-effective, high-impact financial opportunities.

The National BPS Coalition, launched in 2022, supports cities moving from prescriptive codes to performance-based standards, letting owners choose how to meet targets. About 15 cities already have BPS in place, with 30+ committing by next year.

A typical BPS includes:

- A performance target, such as a specific energy use per square foot.

- A compliance timeframe, for example, full compliance by 2050 with interim goals in 2030 and 2040.

Because timelines and targets vary by city, owners with assets in multiple regions often struggle to know where to focus their resources first.

Failing to plan for BPS can hurt asset liquidity and limit resale potential. Acting early, however, turns compliance into a value-creation opportunity.

How rules differ across cities

Each jurisdiction has taken its own approach to regulating building performance. New York City’s Local Law 97 sets carbon emission limits for large buildings and imposes steep fines for non-compliance. Boston’s BERDO tightens emissions targets every five years, while Washington D.C.’s BEPS measures performance against ENERGY STAR medians and requires improvements for lagging properties.

Even states like California (AB 802) have layered performance-based rules atop existing benchmarking laws. For asset managers overseeing multi-city portfolios, this patchwork of regulations can make compliance planning complex and resource-intensive.

Some key upcoming deadlines

Here’s a snapshot of upcoming BPS deadlines across major markets:

| City/State | BPS name | Coverage | Submission deadline |

New York City, NY | Sustainable Buildings NYC (Local Law 97) | >25k sq. ft. buildings (emissions caps & annual reporting) | May 1, 2026 (grace until June 30 for 2025 data) |

| Boston, MA | BERDO (Building Emissions Reduction & Disclosure Ordinance) | >20k sq. ft. | May 15, 2026 (annual, emissions standards tightening) |

| Washington, DC | Clean Energy DC Act / BEPS | >25k sq. ft. | May 1, 2026 (annual benchmarking + performance verification cycles) |

| Chicago | Energy Benchmarking Ordinance | >50k sq. ft. | June 1, 2026 |

| Los Angeles | EBEWE / Benchmarking | >20k sq. ft. | June 1, 2026 |

| California | AB 802 (Statewide Benchmarking) | >50k sq. ft. | June 1, 2026 |

| Seattle, WA | Building Emissions Performance Standards | >20k sq. ft. | 2031 |

The financial stakes are real

Deadlines in markets like Boston and Washington, D.C., are approaching quickly. Fines can reach tens of thousands of dollars per building each year. A JLL study found that across major BPS jurisdictions, 14 percent of buildings are likely to face fines in the first compliance cycle, while 62 percent could face fines in the second.For example, a500,000 sq. ft. Class A office in New York City powered by natural gas and electricity could invest $15 million in a Net Zero Carbon retrofit to avoid $2.5 million in penalties while reducing energy costs by 35%. (Source: JLL) Although the upfront cost is significant, the payoff extends far beyond compliance. Retrofits improve operating efficiency, strengthen NOI, and enhance valuation metrics. More efficient assets appeal to sustainability-driven tenants and investors, reducing vacancy risk and supporting rent premiums. In markets where sustainability is now a baseline expectation, this competitive edge is critical.

How Deepki helps you stay ahead

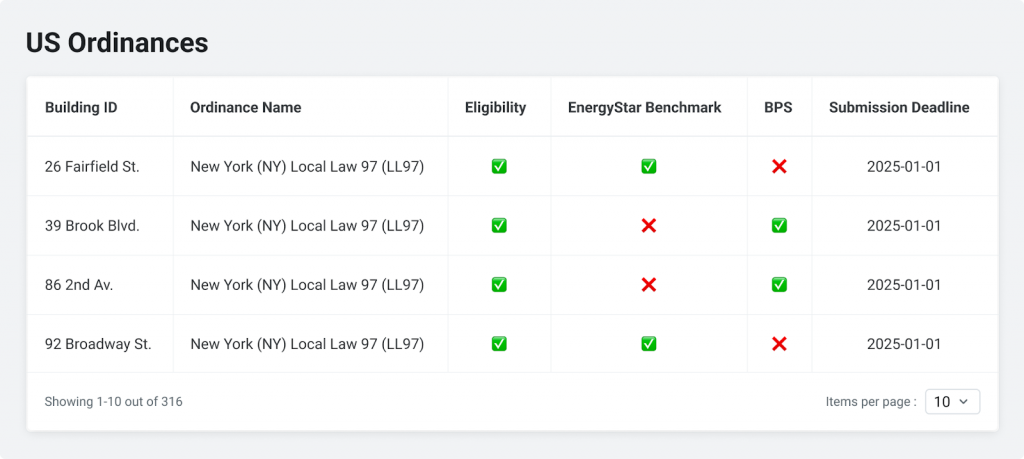

With different rules in each city and complex reporting requirements, staying compliant can overwhelm even experienced managers. Deepki simplifies this process, helping you navigate eligibility, deadlines, and compliance pathways with confidence.

1. See what’s coming

With Deepki’s U.S. Ordinances feature, you can instantly identify which of your buildings are impacted by Building Performance Standards, which deadlines apply, and what submission requirements you need to prepare for. The feature also addresses eligibility for benchmarking and retrocommissioning requirements, giving you a complete view of compliance without spreadsheets or guesswork, just a centralized view of your entire portfolio. You can also upload and store supporting documents directly at the asset level, ensuring everything you need for compliance is in one place. At the same time, it ensures all your energy and emissions data is accurate, reviewed, and securely stored, minimizing risk and making reporting audit-ready.

2. Stay on track

Deepki’s sustainability and project management experts help you monitor compliance pathways, track penalties or exemptions, and measure progress against performance targets. You’ll see exactly how far each asset is from meeting BPS requirements and the most efficient way to close the gap. Deepki connects seamlessly with ENERGY STAR Portfolio Manager (ESPM), allowing you to both import existing building data and push updated information back to ESPM, while all official reporting continues to take place within ESPM. This two-way integration ensures your data stays synchronized across platforms. Some ordinances — such as Washington, D.C.’s BEPS — rely directly on ESPM data to determine which buildings meet or fail the standard. Combined with Deepki’s robust information security framework, all your energy and emissions data is securely managed within your platform, making compliance tracking and reporting more automated, accurate, and audit-ready.

3. Plan your next move

Deepki’s Virtual Retrofit tool and Action Catalogue turn compliance insights into a forward-looking retrofit strategy. You can model different investment scenarios, evaluate ROI, and build an evidence-based roadmap for decarbonizing your portfolio. Browse recommended retrofit and adaptation actions to improve performance and meet requirements.

The risk of waiting

Many organizations still react only after receiving notices from authorities. Waiting is risky. Gathering data, implementing projects, and validating performance can take years. Starting early allows for quick wins, coordinated upgrades, and better financial planning, reducing the risk of fines and reputational damage.

Read more: The premium on trusted sustainability data in commercial real estate

BPS as a catalyst for long-term value

BPS compliance is more than a legal requirement, it’s a pathway to resilience and profitability. Energy-efficient assets consistently achieve higher occupancy, lower operating costs, and better access to green financing. They also align with sustainability objectives, attracting investors focused on sustainability performance.

As capital markets increasingly price in carbon and efficiency risk, compliant assets gain liquidity and competitive advantage. For asset managers, integrating BPS readiness into investment strategy is now a financial imperative.

Next steps

By 2026, dozens of cities will enforce new standards. Acting early provides the flexibility to plan upgrades, manage budgets, and avoid costly penalties. The first step is understanding your exposure, which properties are affected, by what rules, and when. From there, use performance data to build a strategic roadmap that aligns capital planning, goals, and compliance milestones. Ultimately, staying ahead of BPS requirements positions portfolios not just for compliance, but for resilience, profitability, and future growth.

CONTACT US

Ready to stay ahead of BPS?

Build a strategic advantage and optimize your portfolio’s energy performance with Deepki guiding every step of the way.