Gone are the days when a company was evaluated on financial performance alone. In today’s regulatory environment, property management companies must now focus on extra-financial value as well. In the quest to enhance their appeal to investors and tenants, landlords would do well to consider voluntary initiatives like GRESB. But what exactly does this entail, and how do you make it worth your while? Blog by Deepki has the answers…

What is GRESB?

Based in Amsterdam, GRESB was created by a group of investors looking to compare CSR (Corporate Social Responsibility) data on their real asset investments, as a way of ensuring performance. The organization’s goal is to guarantee sustainable assets that meet today’s needs, without compromising the ability of future generations to meet their own.

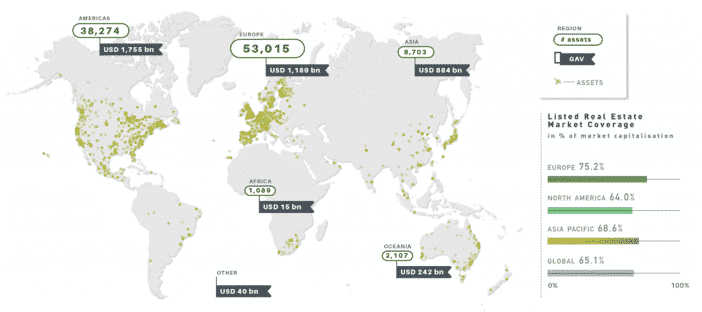

To this end, GRESB assesses and compares the ESG performance of property management companies by providing financial markets with standardized, confirmed data. This enables investors and other stakeholders to compare companies based on pre-defined criteria, aligned with international reporting frameworks like the GRI (Global Reporting Initiative) and PRI (Principles for Responsible Investment). Given the growing interest in CSR, environmental and ecological issues, this benchmarking tool empowers real estate companies to make their investment portfolios more attractive. Looking at GRESB data, we can see that Europe and the US are currently leading the way in terms of sustainability efforts.

As this map indicates, the US and Europe showed the strongest commitment to the GRESB process in 2019 – with 38,274 and 53,015 assets evaluated, respectively.

Good to know:

- GRESB provides traceability for companies’ ESG information

- Among the organization’s goals: promoting commitment and communication between CSR departments and stakeholders

- One of the assessment’s many advantages: making your funds more attractive

Three strategic pillars

To support its guiding principles, GRESB has established a 3-fold strategic focus:

- Assessment: defining standardized evaluation criteria, so that assets can be compared to each other

- Technology: providing an innovative technology platform for rating and comparing assets’ ESG performance data, to facilitate decisions for stakeholders

- Stakeholders: building a global community committed to a common vision for sustainable assets

What are the benefits of working with GRESB?

Collaborating with GRESB empowers you in many ways, allowing you to:

- Promote your company based on extra-financial criteria

- Compare your ESG performance with that of your peers

- Manage your asset portfolio more easily

- Create an effective ESG strategy, if you don’t already have one

- Improve your ESG performance monitoring, and identify areas to improve

- Encourage better communication with your stakeholders, including investors

- Build investor loyalty and develop new opportunities

- Optimize your tenants’ satisfaction

What requirements for the GRESB assessment?

Completing the GRESB assessment requires a fair amount of information:

- Entity and reporting characteristics: entity name, nature of ownership, reporting period, etc.

- Management: ESG targets, responsibility for decision-making, etc.

- Policy and disclosure: ESG policies, sustainability statement, etc.

- Risks and opportunities: relating to governance, the environment, staffing, etc.

- Environmental management systems: data management, consumption monitoring, etc.

- Performance indicators: energy consumption data, etc.

- Building certifications: green building certifications, energy assessment, etc.

- Stakeholder engagement: employees, suppliers, tenants, community, health and well-being, etc.

- New construction and major renovations: sustainability requirements, materials and certifications, energy efficiency, water conservation, waste management, supply chain, etc.

To complicate things, this information is often scattered across in-house departments and outside service providers. CSR departments can find themselves scrambling to gather it all, with countless phone calls and email reminders…

The good news is that software solutions are now able to help:

- Automating the collection of your existing data, regardless of its source and format

- Ensuring the reliability of data collected, with tests to evaluate quality and completeness

- Centralizing all useful data to facilitate access for stakeholders and make reporting easier

- Optimizing your GRESB rating and your overall ESG strategy

To find out more about facilitating your GRESB response, check out these best practices here: