CapabilitiesImpact at heart

Data

The journey to managing your ESG performance begins with collecting data from all assets and energy suppliers into one platform. Collect reliable data to gain a comprehensive overview of your best and least performing assets, ultimately safeguarding the value of your portfolio.

- Automate your data collection process with the help of 1,000+ utility connectors and cutting-edge technologies such as APIs.

- Make the most of structured data at the asset, fund, or portfolio levels and benefit from automatic data filling.

- Monitor the coverage rate to identify gaps and rely on the most complete, credible, and coherent data to improve decision-making.

Insight

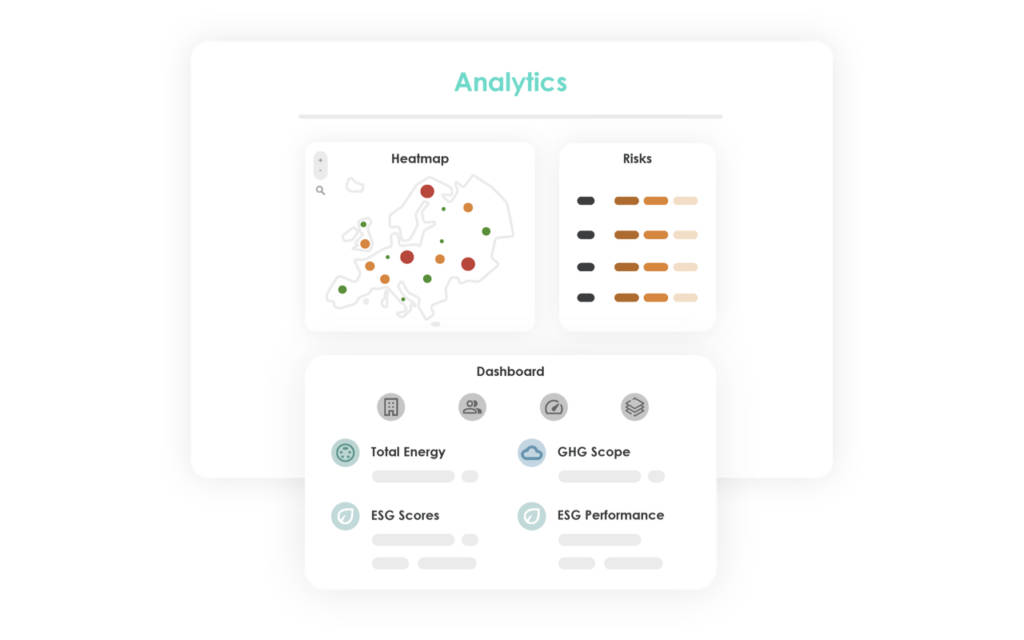

Transform data into insights that inform your ESG strategy, reporting, and achievement of your targets, providing performance analysis of your entire portfolio. Identify gaps to ensure you are on track to reach your net-zero targets, thanks to projected carbon pathways.

- Navigate through your aggregated ESG data at the asset, fund, or portfolio levels using insightful visual analytics.

- Monitor your ESG performance closely with automatically updated energy and carbon KPIs to enhance decision-making.

- Compare your asset and portfolio performance with peers based on climate exposure, energy, and CO2 benchmarks to aid compliance with regulations like SFDR and Taxonomy.

Reporting

The ability to showcase and assess your company’s ESG performance while promoting credibility is now essential for raising capital. Reporting is all about transparency and auditability and will be a key pillar in your future decision-making.

- Access dedicated reporting modules for each certification or regulation, allowing you to meet every stakeholder’s needs at any time.

- Use audit-ready, reliable data, key KPIs and visualizations to streamline audit phases and increase investor confidence and transparency.

- Assess extra-financial performance at any given time to monitor progress on your ESG strategy and share commitment and results information with various stakeholders.

Action

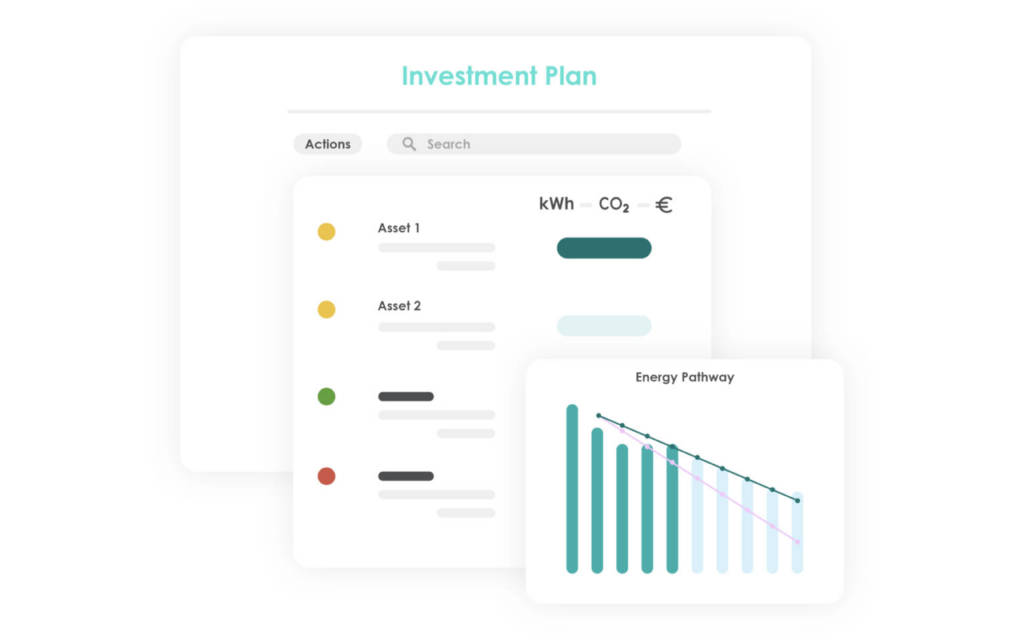

Create an investment plan aligned with your ESG objectives, monitor progress, and track the impact of your actions. Manage your journey to net zero with confidence by having complete visibility of your pathway and receiving recommendations to ensure you achieve your goals.

- Plan and execute portfolio investments in line with your organization’s ESG objectives, such as CRREM or SBTI.

- Visualize asset value based on energy and carbon trajectories to ensure alignment.

- Adjust the long-term action plan based on portfolio performance to match your ESG strategy.

The power of Deepki

Get a glimpse at some of the features that make Deepki the ideal platform for collecting and processing

your data into actionable ESG insights for achieving net zero

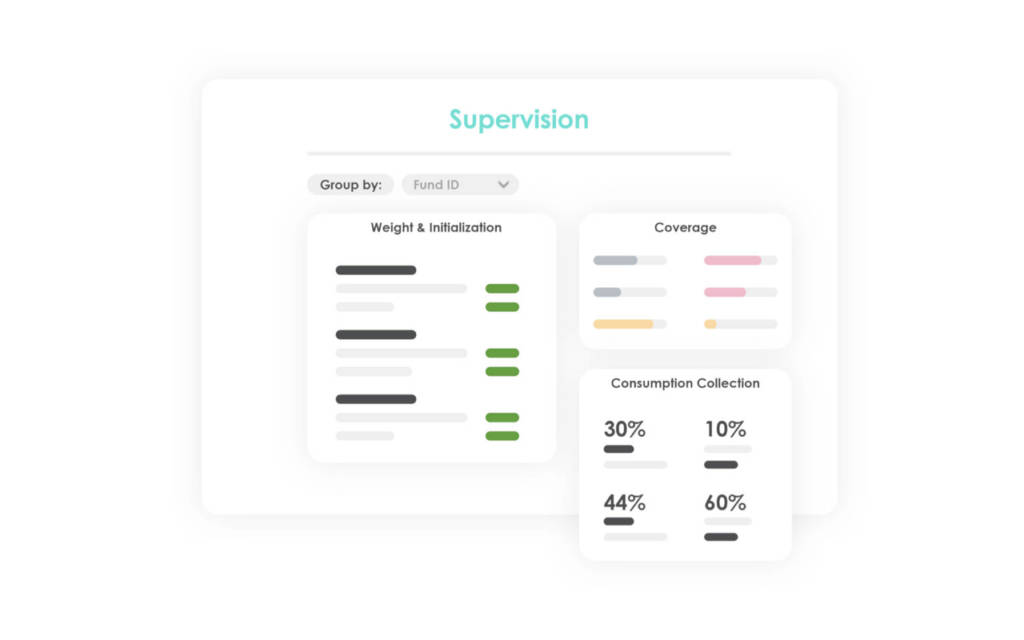

Automated data collection

Gain a consolidated view of data collection progress across streams and assets, enhancing decision-making for ESG strategies

ESG Benchmarking

Compare your asset’s ESG performance with similar assets in terms of location and type, aiding in action prioritization

Physical Climate Risk Assessment

Identify assets with the highest exposure to various physical risks and implement the appropriate mitigation strategies

ESG Reporting & Compliance

Gather reliable data to meet market and investor requirements, including GRESB and regulations such as Tertiary Decree, SFDR, and Taxonomy, to boost their confidence

CO2 & Energy Pathways

Visualize energy consumption and GHG emissions projections for your assets in the coming years, helping you prioritize which assets to focus on in alignment with your company’s targets

Carbon emission calculation

Access automated CO2 emission calculations using location or market-based methodologies to facilitate the implementation of a net-zero carbon pathway

Deepki Success

A 5-pillar customer experience

Deepki Success is a professional service offering technical support, training and customer success guidance for real estate stakeholders using the Deepki platform

- Implementation: Our team assists you in data identification, structure, and module setup

- Onboarding: Together, we establish a framework for long-term success.

- Training: Gain proficiency in platform use through insightful training sessions and best practices sharing.

- Adoption: Join a user community and participate in regular meetings to track adoption.

- Support: Benefit from multilingual 5/7 days support for your daily platform usage.

Deepki Advisory

Deepki Advisory is a consulting service designed to assist real estate stakeholders in developing and implementing their ESG strategies and action plans using Deepki.

Our advisors possess strong expertise in ESG gained through hands-on experience with leading real estate players. With their expert guidance and insights from Deepki, you can enhance your decision-making process through customized analysis, saving time and enabling a focus on strategic choices.

Our team of experts helps you quickly adapt to new regulations and anticipate long-term trends that will impact the value of your real estate assets.