A collaboration by Hélène Lecointre and Kahina Hamouche.

For this new quarter, this blog post explores the latest feature releases of Deepki’s ESG SaaS platform, Deepki Ready. The article dives into the Report Builder and Climate Resilience features, new additions designed to help you build customized ESG reports in just a few clicks and assess real estate portfolio’s exposure and vulnerability to physical climate risks.

REPORT BUILDER

Make the most of your ESG data with custom reports

The growing need for ESG KPIs to meet regulatory, voluntary, and annual reporting requirements underscores the importance of effective management of ESG performance. Yet, financial professionals across all industries are still in the process of streamlining their ESG reporting. An EY and Ferf survey on ESG data and controls, conducted with a sample of chief accounting officers and controllers of US companies, revealed that their ESG reporting process remains largely manual, with 55% of respondents housing their ESG data in spreadsheets. In fact, Financial professionals across all industries, including real estate asset management and investment companies, face the same struggles when reporting on their portfolio’s ESG performance. These challenges necessitate a prioritization and implementation of integrated reporting to increase transparency and enhance progress toward net zero.

Reporting can present a real burden for asset and fund managers. A high number of ESG metrics have to be reported on a quarterly or monthly basis. Having to juggle multiple spreadsheets, data sources, and visuals makes it difficult and time-consuming to produce good quality ESG reports for ESG, asset, and fund managers.

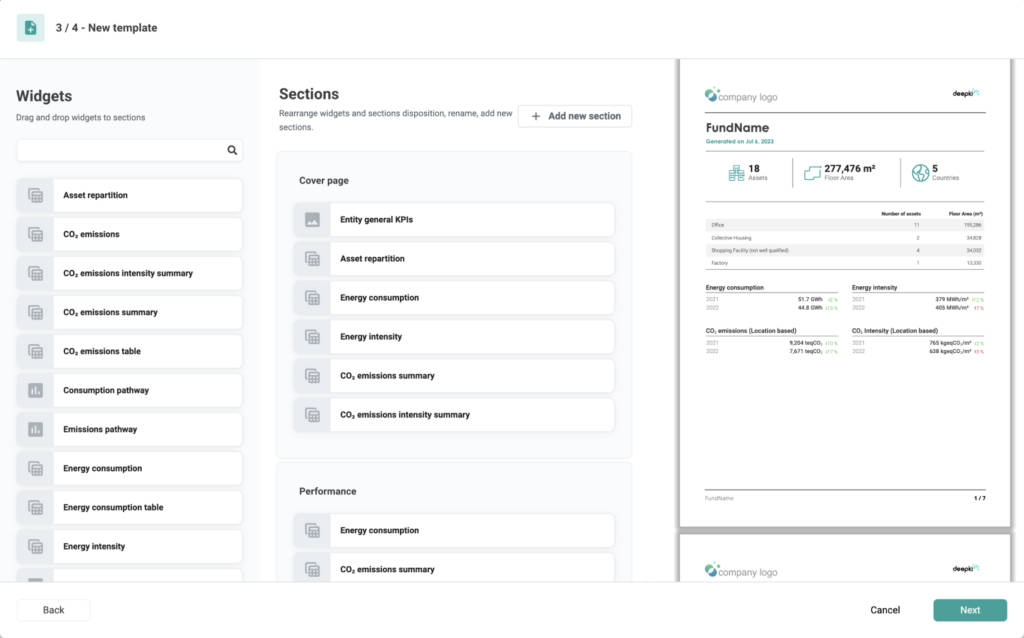

This is where Deepki’s new Report Builder can assist in facilitating the efficient creation of high-quality reports on your portfolio’s ESG performance. Thanks to its built-in visual and drag-and-drop tool, this new feature will enable you to:

- Create in a few clicks custom documents or templates with the wide library of data visualizations available on the Deepki Ready platform,

- Adapt your report for different use cases or stakeholder requirements, from incentivizing your Property Manager on data collection completeness to showcasing your portfolio’s progress towards net zero to your investors,

- Harmonize and streamline your reporting process by creating a library of reusable templates,

- Ease communication with internal or external stakeholders.

Report builder panel in Deepki.

ESG increasingly impacts the long-term value of real estate assets and investment decision-making, making integrated reporting a priority. It helps stakeholders, banks and investors get better visibility into ESG metrics and projections in a single report. Deepki’s new Report Builder allows you to create customized and reusable reports, optimizing your workload, and informing operational and strategic decisions. Start producing and sharing relevant insights with your stakeholders based on reliable data!

CLIMATE RESILIENCE

Mitigate climate risks with advanced exposure and vulnerability insights

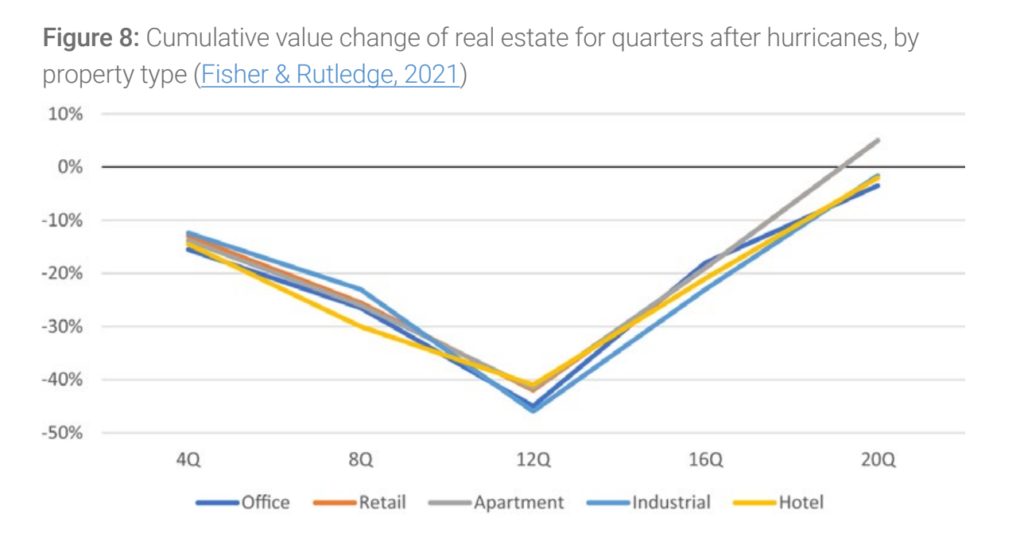

Extreme weather and climate-related events due to climate change confront the entire economy with substantial economic losses. Recent studies show that the cost of climate change is unlikely to decrease in the coming decades. For instance, at the European level, 17% of the total economic loss of EU member State assets was reached in just two years over a range of four decades according to the European Environment Agency. In the real estate market, repair costs and insurance premiums are expected to keep rising, and lasting asset devaluation has already been observed following extreme events. Therefore, it is critical for real estate players to integrate both attenuation and adaptation to climate change in their sustainability strategy to ensure the resilience of their core activity.

Source: Climate Change in the Real Estate sector, UN environment program finance initiative, 2023.

Still, the integration of physical climate risks in business decision-making appears as a great challenge for the industry. While real estate asset owners continue to grapple with solutions to comprehend climate models, expertise is still needed across the entire value chain to interpret climatic data, perform on-site vulnerability investigations, and plan effective adaptation measures. In addition, whereas disclosure demands keep strengthening from lenders, investors, and regulations such as the EU Taxonomy and TCFD, owners still face difficulty providing sufficient climate risk analysis to their stakeholders.

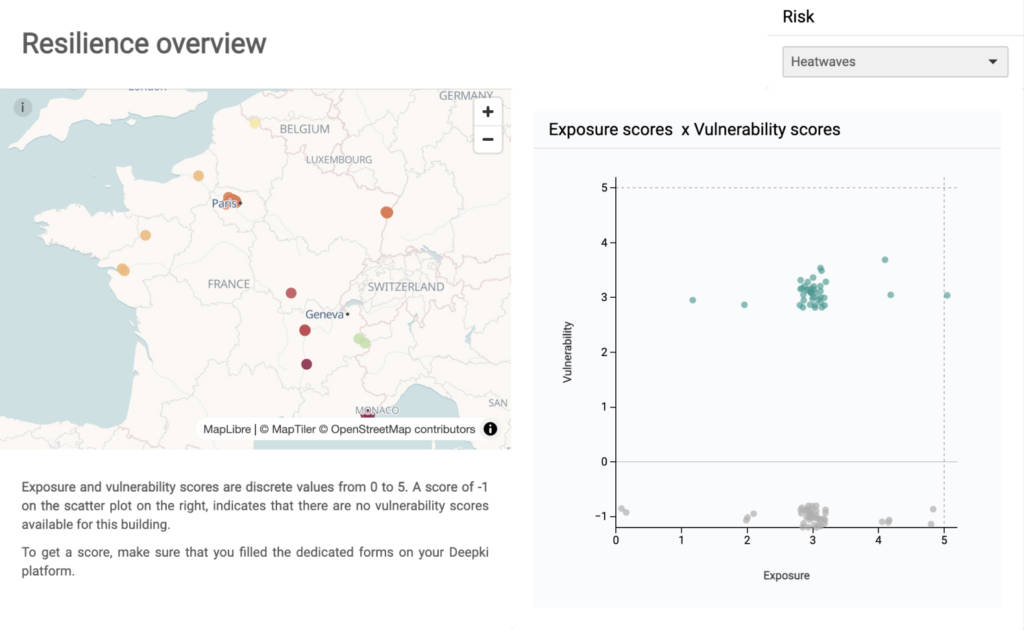

Deepki’s new Climate Resilience feature is here to help mitigate physical climate risks with advanced exposure and vulnerability insights. This new feature simplifies the process of assessing both exposure and vulnerability of extensive portfolios to climate-related and physical risks. It enables asset and risk management teams to better identify climate change risks and opportunities. With this new module, you will be able to:

- Instantly screen your real estate portfolio’s exposure to climate-related and physical hazards, wherever your assets are located, with the latest state-of-the-art climate projections,

- Deepen your climate risks analysis by assessing the vulnerability of your most exposed assets, consolidating information on your asset’s environmental conditions, structure, equipment, and occupancy,

- Provide robust physical risk exposure and vulnerability assessments for banks, investors, regulations like EU Taxonomy, and certifications at the entity or asset level,

- Inform your adaptation strategy and prioritize further investigation to plan adaptation measures necessary to build your portfolio’s resilience.

Climate resilience panel in Deepki Ready™.

By leveraging the latest climate projections in our end-to-end ESG platform for real estate and factoring in asset vulnerability in your physical risk analysis, gain crucial insights to protect your asset value and profitability, unlock investment opportunities and provide robust physical risk assessments to your stakeholders. Leverage climate risk analysis now to future-proof your real estate portfolios.

Deepki Ready: the all-in-one ESG SaaS platform for real estate

By integrating client feedback, industry knowledge, and specialist ESG expertise, Deepki Ready empowers companies to make a significant impact. This way, the comprehensive ESG SaaS platform, combined with the expertise of our ESG specialists, transforms data into actionable insights, revealing opportunities for real estate sector players.

WEBINAR

Don’t miss out on catching these features in action

If you missed our dedicated webinar on June 26th, you can access the replay, to learn more about our latest product releases included in Deepki Ready platform. Get your questions answered and discover best practices from our community!