Faced with increasingly strict regulations (Tertiary Decree, Paris Agreement, Energy Transition Act, etc.) and the growing sensibility of market stakeholders, real estate players can no longer focus on financial valuation alone. Now more than ever, these actors need to integrate ESG* criteria into their overall corporate strategy. This week’s Deepki blog offers an overview of the Sustainable Finance Disclosure Reporting regulation (SFDR). What it’s about, who it concerns, and how to comply. Let’s take a look..

What is the SFDR regulation?

The EU enacted the SFDR regulation to address shortcomings in sustainability reporting and promote environmental and social criteria in investment decisions. Meant to provide transparency for investors, the SFDR is in line with the Global Action Plan, a worldwide network of organizations that aims to advance truly sustainable lifestyles.

Effective March 10, 2021, the European Regulation (EU) 2019/2088 on sustainability disclosures in the financial services sector (or SFDR regulation)imposes transparency standards on financial market participants and advisors (including real estate-based savings and investment solutions) regarding:

– the incorporation of sustainability risks to avoid greenwashing

– environmental and social responsibility in financial markets

As part of the European Commission’s Sustainable Finance Action Plan – along with the EU Taxonomy – the SFDR aims to improve assets’ ESG traceability for financial market participants and financial advisors in the EU.

Did you know?

The European Commission’s “Sustainable Finance” strategy is 3-fold:

– Redirecting capital flows towards a more sustainable economy

– Integrating sustainability into risk management

– Promoting transparency and long-term commitments

The SFDR allows investors to better assess the ESG component of their investments, based on the principle of dual materiality: financial and sustainability.

Who is affected by the SFDR?

The SFDR applies to financial market participants and advisors, including asset managers, UCITS and AIF. Concerned entities must comply with Level 1 measures as of March 10, 2021.

The SFDR Level 1 measures require reporting entities to:

– Describe their sustainable investment strategy at the product and management company level

– Explain their plan for integrating sustainability risk management into their investment decisions

The financial product categories concerned by the SFDR are classified as follows:

– Article 6: applicable to products with sustainable objectives

– Article 8: applicable to products that value environmental and social criteria in their overall investment strategy

– Article 9: applicable to products whose investment process takes ESG risks into account

Note: the AMF (Autorité des Marchés Financiers) specifies that the classification of products subject to articles 6, 8 and 9 of the SFDR is entirely at the discretion of reporting entities.

Setting up a pragmatic approach to SFDR compliance

SFDR compliance requires setting an ESG benchmark to measure assets’ risk exposure and their impact on the environment.

Also read: Climate risk management: GRESB and OID look at the ESG performance of French real estate companies

This process involves gathering and publishing a variety of data:

1. Data from management companies: information on extra-financial performance, sustainability risk and remuneration to be published on the corporate website

2. Data at the financial product level:

– a clear description of sustainability risk, impact and compliance to be provided in the company prospectus

– periodic reports on compliance with environmental and social criteria to be published on the corporate website

Importantly, all information published on the website and in any prospectus must be confirmed and substantiated in an annual report. Data reliability and traceability are core components of the SFDR.

Financial actors seeking to comply with the SFDR must also publish a statement on their website including the following elements:

– Information on their policy for identifying and classifying major adverse impacts

– A detailed description ofthe major adverse impacts involved

– A summary of commitments undertaken

– Compliance with codes for responsible corporate behavior and alignment with Paris Agreement objectives

Also read: Data collection: going for a pragmatic approach

The following steps are key for a pragmatic approach to SFDR disclosure:

1. Building a unified asset repository to obtain a global view

2. Centralizing access to information for all stakeholders

3. Measuring the completeness and reliability of information collected

4. Defining the KPIs (Key Performance Indicators) to be monitored

5. Monitoring the match between carbon trajectories and risk exposure

Also read: Real estate: the compelling case for automatic data collection

Also worth noting: actors may opt to disregard negative sustainability impacts in their investment decisions, in which case the reasons for this decision must be explained on their website.

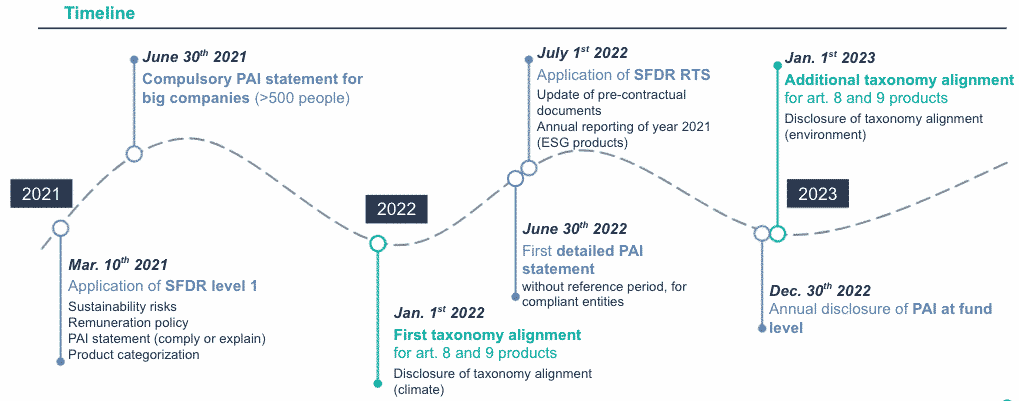

SFDR compliance: timeline and next steps

The initial SFDR provisions will take effect on March 10, 2021, with certain grey areas to be clarified subsequently by the European Commission. Since these areas don’t impede the application of existing SFDR provisions, actors subject to the regulation must comply as of now.

The stringency of SFDR regulations creates a number of challenges:

- Deciphering these regulations and understanding the issues at stake

- Collecting and verifying the data required for compliance

- Identifying and properly classifying products subject to articles 6, 8 and 9

- Respecting each element of the ESG triptych when defining strategy

Also read: Understanding the environmental certifications and labels for your buildings

SFDR compliance starts with measuring the climate risk exposure and carbon impact of your assets, using the data at your disposal. The final step: tracing a path toward asset performance that supports your objectives, while satisfying those of the SFDR.

Take stock of your non-financial performance now, by downloading our free white paper “Data & CSR: using data to enhance your non-financial performance”.