A collaboration by Maria Eugenia Ortiz and Kahina Hamouche.

This blog post takes you through the most recent product releases within Deepki’s end-to-end platform: the Investment Plan, ESG Reporting, and Supplier Account Management features.

We invite you to dive into these robust new capabilities designed to prioritize investment decision-making, streamline reporting processes, and automate data collection.

Investment Plan

Improve ESG CapEx Investment Plan efficiency to generate green premia & achieve net zero

According to CBRE’s European Investor Intentions Survey 2023, 28% of European investors are willing to divest real estate assets that do not meet their environmental, social, and corporate governance (ESG) criteria, indicating a lasting trend. But how can real estate owners prioritize and operate the necessary investments to prevent ESG obsolescence in a net zero world?

Upgrading an extensive real estate portfolio to meet net zero targets presents a daunting task for asset and fund managers, as they need to mobilize the right stakeholders, expertise, and tools to plan CapEx investments while ensuring their business plans remain on track.

Here’s where Deepki’s new Investment Plan capability comes in handy. Having analyzed over one hundred client decarbonization audits, Deepki’s ESG, energy management, and thermal modeling experts have selected over 130 actions to support asset owners in prioritizing their retrofitting and ESG investments.

With the comprehensive ESG top actions catalog at their disposal, the Investment Plan feature enables asset owners to:

- Ease decarbonization audit processes by pre-identifying underperforming assets,

- Prioritize CapEx investment by estimating energy and carbon savings as well as associated costs,

- Visualize the impact of investments on net zero trajectories according to different decarbonization scenario projections (CRREM, SBTi, or Custom trajectories),

- Centralize information in one place with the possibility of importing existing investment plans and projected savings provided by engineering offices.

Coupled with the Investment Plan module on the Deepki Ready ESG SaaS platform, Deepki’s ESG consultants provide robust advisory support, helping real estate asset management companies understand their specific needs and develop the perfect CapEx planning for them. By helping to achieve the most complex goals, the Investment Plan enhances asset owners’ competitiveness within their market.

ESG REPORTING

Streamline and facilitate ESG reporting processes for EPRA, INREV, TCFD, ESOS and CDP with Deepki Ready

In 4 years, more than 230 mandatory and voluntary ESG reporting provisions emerged to meet the demand for transparency and accountability on ESG matters required by board members, lenders and investors. The increasing number of ESG reporting frameworks makes each reporting season even more challenging for asset and ESG managers, who must calculate and audit numerous extra-financial indicators to meet deadlines.

With Deepki Ready’s new ESG Reporting feature, it is now possible to manage reporting campaigns directly on the platform, significantly reducing the time and costs associated with ESG reports:

- Set timelines and track upcoming deadlines from data collection to final submission,

- Export the right ESG KPIs for specific frameworks like INREV, EPRA, IFRS/TCFD, ESOS, CDP with our robust data collection capabilities,

- Ensure reporting auditability by storing the KPIs and uploading the final dataset in a locked and secure way.

The platform helps to identify which stakeholders to involve, outline critical milestones to be achieved, and keeps campaigns on track, allowing ESG and asset management teams to focus on strategic initiatives rather than operational burdens.

Amid this complex reporting framework landscape, Deepki distinguishes itself with its unique, distinctive offering, combining an end-to-end ESG SaaS platform with tailored advisory services. To improve the quality of ESG reporting, Deepki’s consultants advise customers throughout the entire reporting journey, from campaign preparation to data collection, quality checks, data freezing, and formatting.

EBOOK

Discover

To learn more about ESG reporting processes for INREV, EPRA or IFRS/TCFD, explore our dedicated ebook “Landscape of the principal entity-level ESG standards and reporting frameworks”.

SUPPLIER ACCOUNT MANAGEMENT

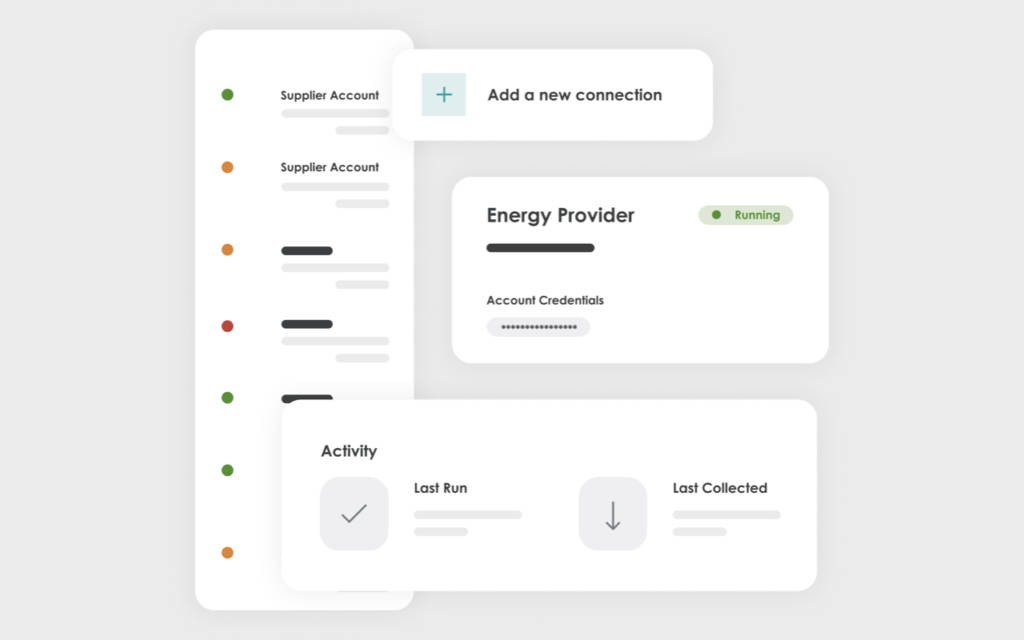

Maintain seamless utility data collection and access the most up-to-date data

The challenge of collecting reliable data remains a significant barrier for asset owners pursuing an ESG investment strategy. This highlights the difficulty of managing multiple assets across various countries, dealing with numerous energy providers, and the added work for property managers to identify data discrepancy causes.

To address this critical issue, Deepki has developed the Supplier Account Management module to securely facilitate automated data collection within its platform, enabling property managers or other stakeholders in charge of collecting utility data to:

- Establish automated connections with a list of 1000+ energy providers,

- Monitor connector status to quickly address any data collection issues with a specific supplier.

Deepki Ready: an ESG SaaS platform built for real estate

Drawing on client feedback, industry insights, and specialist expertise, Deepki develops powerful capabilities that transform data into actionable insights, unlocking opportunities for significant impact.

WEBINAR

Don’t miss out on catching these features in action!

If you missed our dedicated webinar on March 21st, you can still access the replay! Learn more about our latest product releases included in our Deepki Ready platform. Dive into the insights from our community’s best practices and get your questions answered!