Europe will not meet its climate goals and 2030 / 2050 targets unless financial investments are directed toward sustainable projects and activities.

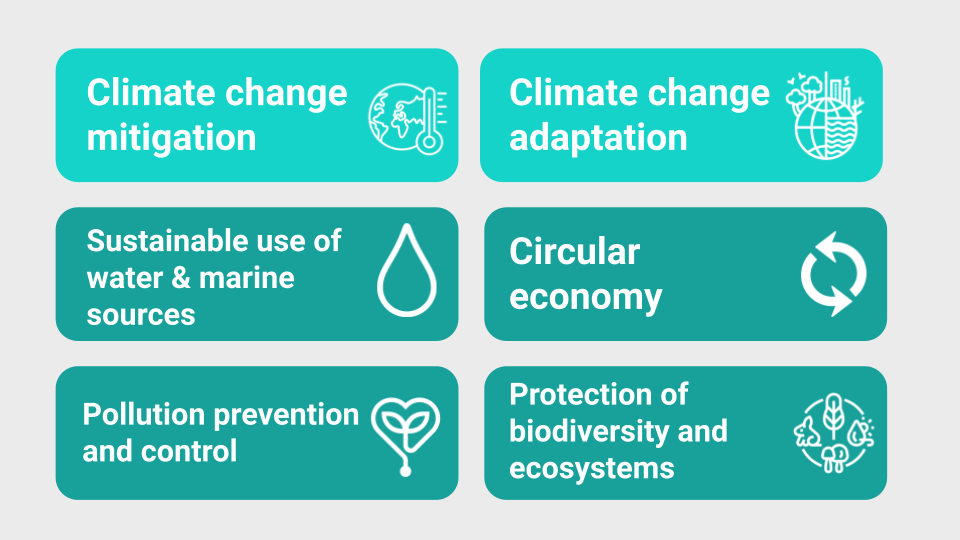

The EU’s Taxonomy Regulation is expected to construct a common language to support the energy transition and help redirect capital flows to renewables and green assets. The first two objectives – climate change mitigation and climate change adaptation – represent the current priorities and as such take center stage for the Commission, member states, local authorities, companies, and so on.

In this article, we place an emphasis on the other four objectives, outlining why these are equally important as the two climate-specific objectives, namely: sustainable use of water and marine sources, transition to a circular economy, pollution prevention and control, and protection and restoration of biodiversity and ecosystems.

The EU Taxonomy Regulation in brief

At over 1000 pages (with more to come), the EU Taxonomy can be daunting – even to the initiated. It is primarily a classification system for economic activities whose definitions and rules determine which economic activities may be marketed as environmentally sustainable. 2022 marks the first year where most European financial institutions and non-financial companies will have to demonstrate the environmental sustainability of their economic activities. And this is a significant step.

See also: Understanding the EU Green Taxonomy in 7 questions

The regulation was created to address greenwashing, where organizations exaggerate their environmental credentials, among so-called eco-friendly investment products. In this regard, it aims to enable market participants to identify and invest in transparent, sustainable assets with more confidence and clarity.

Its pressing timeline, and the expectation that it is a complex and extensive framework, means that it is key to begin aligning with the EU Taxonomy as soon as possible. Reasons to align and the general implications and structure of the regulation have been detailed in a previous article (How do I comply with the EU Taxonomy?) here.

So far, the European Commission (EC) has emphasized and prioritized climate objectives in the Taxonomy, and for good reason. However, this has resulted in limited attention being paid to the remaining four environmental objectives. We will give insights into the implications of these and emphasize the importance and benefits of addressing them sooner rather than later.

The Taxo4

To be deemed green, an activity must substantially contribute to one of six environmental aims and not contradict (“Do No Significant Harm”) the other five.

So far, only the screening criteria for the first two environmental objectives were formalized on June 4th, 2021, and implemented as of 1st January 2022. The reporting is already underway as financial institutions have to comply with the associated criteria from January 1st, 2022, and non-financial companies throughout 2022. In August 2021, then updated on March 30th, 2022, the Technical Working Group published the report which contains the technical screening criteria and the final four environmental objectives (the Taxo4), which will apply as of January 1st, 2023. The initial focus of the EC on climate change mitigation and adaptation objectives is also seen in the EU’s pressing climate policy and targets. Hence, economic activities mitigating and adapting to climate change have been prioritized in the development of the screening criteria for the Taxonomy Regulation.

Objective 3: Water and marine

Safeguarding a healthy and sustainable use of water and marine resources is paramount in climate and weather stabilization, human livelihood, and more.

Objective 4: The transition to a circular economy

The circular economy is a resilient system that gives us the tools to extend the lifecycle of products. One of the principles of this system is to recycle, reuse, repair, refurbish, and share existing materials and products for as long as possible. It’s based on three principles: the elimination of waste and pollution, circulation of products and materials (at their highest value), and the regeneration of nature, which leads to the cutting of greenhouse gas emissions, waste, and pollution.

Objective 5: Pollution prevention

The purpose here is to take urgent measures to prevent the introduction of substances or contaminations across air, water, soil, living organisms, and food resources at levels that trigger harm or adverse change. It includes restoration and remediation of terrestrial ecosystems, soil, buildings, waste management, and de-pollution, and dismantling of end-of-life products.

Objective 6: The protection and restoration of biodiversity and ecosystems

Conserving, restoring, or protecting ecosystem services are fundamental to human and animal welfare.

Overlapping objectives

Even though there are six different objectives, there will be some overlap between them. The Platform suggests that there is an articulation between the non-climate objectives and their impact on each other. For instance, take the objectives of climate change mitigation and pollution prevention and control: these will overlap with economic activities involving the reduction of emissions from fossil fuel combustion. Similar overlaps exist between ecosystems and the use of water and marine resources objectives. For this reason, the transition to net-zero can only be considered as seriously sustainable if it takes a holistic approach, which is the aim of the broad scope of the Taxonomy.

Focus on the real estate sector

Regarding the real estate and buildings sector, the regulation takes into account several activities including construction, renovation, acquisition, and management of buildings. Specific criteria regarding Taxonomy alignment and climate change mitigation and adaptation objectives have been drawn up for these activities.

Within the buildings sector, the aim is to apply clearly defined taxonomy criteria (‘thresholds’) to new buildings, renovation measures, and the acquisition and ownership of buildings. It will also be particularly important for the commercial real estate market due to the possibility of classifying the building as a portfolio of assets covering green bonds. Moreover, the Taxonomy serves to optimize the contribution of the real estate and buildings sector to Europe’s climate goal. And this would be reached by transforming and retrofitting existing buildings, as well as by building new assets to a net zero carbon standard.

One of the hurdles to overcome is to undermine the ongoing cycle of demolition and construction. Property emissions are a combination of two things. The first is the day-to-day running of a building: energy used to light, heat, or cool homes, offices, and shopping malls. The other type is “embodied” carbon, which refers to emissions tied to the building process, maintenance, and any kind of demolition. In addition, real estate companies will be required to meet ambitious goals regarding water consumption, as well as pollution goals.

According to the Platform on Sustainable Finance report, the main goal is for new buildings and renovations to contribute to the circular economy. This is why real estate players should be concerned mainly with Objective 1 (Climate change mitigation) and Objective 2 (Climate change adaptation) as well as Objective 4 (Circular Economy).

The first criteria drawn up by the working group (which will need to be formally adopted through a Delegated act) include:

For the construction of new buildings and renovation of existing buildings:

- 90% of construction and demolition waste re-used or recycled;

- 50% of re-used, recycled, or responsibly-sourced renewable materials;

- Compulsory life cycle assessment of the environmental impact of the entire building (construction) or the renovation work (renovation);

- Construction designs and techniques supporting circularity.

For the renovation of existing buildings:

- 50% of the original building is retained.

See also: The goal of reducing GHG emissions: understanding carbon pathways

Deepki’s role is to help you disclose your green investments

Due to the various expected overlaps i.e. interrelations between the six different objectives, Deepki recommends gaining an overview of objectives relevant to your business. This will avoid unnecessary extra work and create a more efficient alignment process and give immediate insight into topics that are covered by multiple objectives at the same time. Comparable and reliable data is paramount to achieving green investment goals. This can be done through our centralized platform, Deepki Ready, which is able to collect, aggregate, and exploit your data as quickly as possible in order to increase efficiency and uses this information to choose which objectives are most applicable according to your portfolio.

The regulation extended to natural gas and nuclear energy

On July 6th, 2022, in a plenary vote, the European Parliament (EP) did not reject the EC’s proposal to include fossil gas and nuclear power under the taxonomy. The so-called Taxonomy Complimentary Climate Delegated Act (CDA) stipulates that nuclear power and fossil gas can be labeled green investments and is expected to come into force on January 1, 2023. Despite concerns raised by environmental groups, policymakers maintain such energy sources have a role to play in the transition and the EU climate and environmental objectives and may still need investment now.

The Taxonomy has been used to form the basis of the EU Green Bonds Standard and will likely be used as a guide more broadly. As we embark on this Taxonomy journey, the focus cannot be on companies to act alone.

As population growth and rising demand for housing mean that the size of the built environment is expanding at a faster rate than efforts to fight climate issues and catalyze CO₂ emissions, the entire real estate and built industry should all be engaged in this process, encouraging accurate corporate transparency.