A collaboration by Hélène Lecointre and Kahina Hamouche.

In today’s real estate landscape, ESG data has become highly valuable for stakeholders. Collecting data is essential for audits, regulatory compliance, and investment decisions, ultimately enhancing their portfolio value and the credibility of their decision-making. Yet, the lack of transparency in ESG data poses a serious threat to the industry. Difficulty in understanding the origin of data and the methodology behind estimated energy consumption and emissions could result in reporting failures and undermine portfolio value.

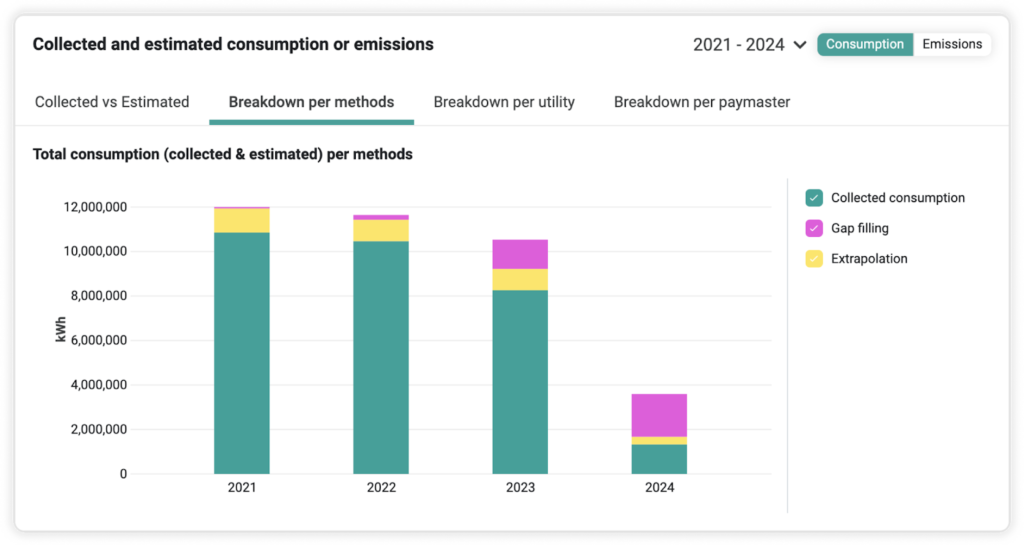

To address this urgent matter, Deepki leverages AI and Machine Learning to fill these gaps through powerful estimations. Additionally, our latest feature, Deepki’s new data visualization, is designed to help gain transparency on how your data estimations have been calculated at the asset and entity level. This visualization will allow you to identify the specific methodologies used to estimate missing data, providing a granular analysis of collected and estimated data.

The increasing need to collect and disclose reliable ESG data

However, meeting this challenge requires stakeholders to ensure their data is reliable, traceable, and actionable. Addressing the lack of transparency that comes with ESG data efficiently and promptly is crucial. Stakeholders currently face missing data due to various issues, such as lack of tenant collaboration, privacy concerns, and lost consumption history. The multitude of solutions and sources adds to the complexity of the process. Ensuring that the available data is accurate and helpful for decision-making remains a critical hurdle.

Read more on Greenwashing in ESG reporting: risks, consequences, and strategies for transparency

Collecting and managing your ESG data is a complex task, encompassing different challenges. According to the ESG Global Survey, directed by BNP Paribas in 2023, the top 3 challenges when collecting and using ESG data for asset owners and managers are:

- Risk for poor quality of analytics for ESG data (46%).

- Cost of ESG data (40%).

- Inconsistency between ESG data providers (40%).

Regarding ESG data management, 47% of companies specified using spreadsheets, leading to inefficiencies and errors, ultimately compromising the accuracy of their data. Overall, the survey also shows that an impressive 71% of asset owners and managers identified incomplete and inconsistent data as a significant barrier to greater adoption of ESG strategies.

Deepki’s AI-powered estimations help you fill data gaps

To address the issue of incomplete and inconsistent data, the Deepki Platform offers data enhancement capabilities tailored to the specific needs of real estate professionals. By using the Deepki Plaftorm, you can benefit from different methodology to fill the data gaps:

Gap-filling

The gap-filling methodology is performed at a high level of granularity, more specifically at the meter level. Missing data estimations are conducted for individual meters, providing precise insights. The primary source for these calculations is the available historical consumption data. The gap-filling effectively predicts missing data by analyzing historical patterns and behaviors of data consumption.

Extrapolation

Another approach to estimating missing data involves projecting trends from existing data and identifying areas lacking information. This extrapolation model can reflect the specific consumption patterns of individual tenants or areas within a building. Using comparable data from similar sources makes the estimations reliable and relevant to the specific environment.

Indexing

Finally, the indexing methodology provides estimates at the asset level. By comparing the buildings to other similar asset classes located in the same geography, accurate estimations can be generated when actual data is missing. These reference values are based on energy consumption data from over 400k real estate assets owned or occupied by our customers and automatically collected on the Deepki Platform.

Data collection & estimation: a visual interactive guide.

Bring transparency on your estimated data to your stakeholders

Establishing trust in your ESG indicators begins with ensuring transparency in these enhancements. With our new data visualization, provide clear visibility to your stakeholders on the source and calculation behind your collected and estimated data:

- Visualize the split between collected and estimated data to understand how your consumption and emission indicators have been calculated.

- Track the progress of your data completion over the years and witness the improvement of the quality and reliability of your data.

- Identify the methodology used to estimate your missing data at the meter or asset level, with a breakdown per method.

- Get a granular analysis of collected and estimated data broken down by indicator, fluid type, and billing entity.

Data visualization on the Deepki Platform.

Improving data reliability is essential to maximize the impact of your actions and track the decarbonization of your portfolio more effectively. Deepki’s new data visualization can help you gain trust and confidence in your energy consumption and emission data when disclosing it to your key stakeholders, fostering stronger relationships.

Reliable and transparent data will allow you to take action and make informed decisions that support decarbonization targets, ultimately protecting asset valuation in the long term. Lastly, this feature helps optimize compliance and regulatory reporting, key elements for implementing an effective ESG strategy.

WEBINAR

Don’t miss out on catching these features in action!

Want to learn how Deepki’s AI-powered estimations help you bridge data gaps? Watch the replay of our dedicated webinar to discover our new feature in action!