The PwC’s Global Investor Survey 2023 revealed that 94% of investors expressed skepticism towards the validity of corporate sustainability reporting, citing unsupported claims. This is based on a comprehensive survey encompassing 345 investors and analysts from 30 countries and territories with 65% of respondents at organizations with total AUM of more than $1 billion. This highlights the need for strong actions to combat greenwashing, a practice that erodes trust in sustainability efforts.

In this article, we delve into the risks, consequences, and transparency strategies surrounding greenwashing, particularly in the context of the European Union’s sustainable finance regulatory framework.

What is ‘greenwashing’ and why is it a concern for real estate?

At the European Commission’s behest, the European Supervisory Authorities (ESAs) defined greenwashing as: a practice where sustainability-related statements, declarations, actions, or communications do not clearly and fairly reflect the underlying sustainability profile of an entity, a financial product, or financial services. Simply put, portfolio greenwashing occurs when investment managers claim a positive environmental impact without managing funds in a manner consistent with such an impact.

Widespread misleading qualities include cherry-picking, omission, language ambiguity, empty claims, and the misleading use of sustainability terminology. Even regulatory documents are not immune to greenwashing risks, and labels and voluntary reporting should not be overlooked. Greenwashing can be unintentional, contributing to investors’ confusion and potential misinformation.

With greenwashing comes greenhushing and greenwishing

Transitioning to the discussion of related phenomena, let’s explore the concepts of greenhushing and greenwishing.

Some companies turn to greenhushing as a way to avoid greenwashing. Greenhushing, or underreporting progress on sustainability initiatives, is not a viable solution in the long term. Failing to communicate about these initiatives is a lost opportunity to demonstrate long-term value creation and risk mitigation.

Greenwishing, also known as unintentional greenwashing, occurs when a company aims to fulfill sustainability goals but lacks the means to do so. Driven by the urge to establish ambitious sustainability targets, companies may commit to objectives beyond their capabilities, be it due to financial, technological, or organizational limitations.

The consequences of greenwashing

Intentional or not, the consequences of greenwashing can be severe. Greenwashing distorts relevant information that a current or prospective investor might require to make informed investment decisions. It can erode investor trust in the market for sustainability-related products. This practice poses a significant threat to the financial system, potentially misleading consumers, investors, and market participants while also carrying reputational risks.

EU strives for sustainability transparency leadership

The regulatory framework for sustainable finance in the European Union offers valuable tools for addressing greenwashing, promoting transparency and ensuring compliance. Key among these are the EU Taxonomy, the Sustainable Finance Disclosure Regulation (SFDR), and the Corporate Sustainability Reporting Directive (CSRD). The CSRD places particular emphasis on double materiality, obliging companies to divulge not only their environmental impact but also how external factors influence their financial performance.

Deepki’s guide

Understanding and applying regulations in daily operations can be tough. This guide will help you develop a solid action plan to meet the European Commission’s requirements.

Read the guideThe SDR’s anti-greenwashing rule

In November 2023, the Financial Conduct Authority (FCA), the regulatory body overseeing financial services firms and markets in the UK, announced the release of its new Sustainability Disclosure Requirements (SDR) for asset managers and investment labels. These rules constitute a comprehensive framework designed to empower investors in evaluating the sustainability credentials of investment products and funds. Central to these measures is an anti-greenwashing rule, applicable to all communications by FCA-authorized firms concerning the environmental or social attributes of financial products or services, set to take effect by the end of May 2024.

Limitations and challenges of the EU regulatory framework

However, limitations arise – partly because the EU has been a front-runner in this sphere which is rapidly evolving. The establishment of regulatory and voluntary standards has addressed issues like insufficient data availability and the lack of standardization. Indeed, the absence of uniform reporting standards has led to a fragmented landscape characterized by a multitude of reporting frameworks, guidelines, and metrics. This lack of harmonization heightens inconsistencies, confusion, and the risk of greenwashing, whether intentional or unintentional. Voluntary adoption of standards enhances credibility but necessitates comprehensive implementation.

Greenwashing or poor data?

The challenges associated with sustainability and greenwashing stem from various data-related issues:

- Lack of standardization: Companies often report sustainability data using different standards and metrics, making it difficult for investors to compare and assess their performance accurately.

- Data quality and reliability: Sustainability data can be incomplete, inconsistent, or unreliable. Companies might omit negative information or engage in selective reporting, emphasizing their positive actions while minimizing negative impacts.

- Scope and materiality: Determining key sustainability factors can be subjective. Companies may prioritize less critical ones for a positive image, neglecting more important issues.

- Limited regulatory oversight: There is limited regulatory oversight and enforcement in sustainability reporting, leading to a lack of accountability for companies engaging in greenwashing practices.

- Complexity of sustainability issues: Sustainability issues are multifaceted and interrelated, making it challenging to capture their full impact accurately.

Greenwashing can occur due to data problems, including misleading metrics, inadequate disclosure, lack of verification, complexity masking, and limited transparency.

Avoiding greenwashing starts with good data

High-quality sustainability data is paramount in mitigating greenwashing risks and enhancing transparency. Establishing data collection, management, and traceability processes ensures the accuracy and reliability of sustainability claims. This starts with establishing a clear process and structure around portfolio-level data collection. It includes what metrics will be collected and guidance to help portfolio companies report accurately.

Firms should also communicate why they are interested in specific sustainability data, its importance to the portfolio company, and how they intend to use it. Collecting this data is more than a “tick-the-box” exercise. Understanding the motivations behind requests is key to improving data quality. With accurate data, firms and portfolio companies can support sustainability claims, communicate effectively, and track progress over time.

Executing all of this starts with collecting high-quality data and extends through the investor’s engagement with portfolio companies and the ability to communicate and track progress over time.

A proven approach to streamline sustainability performance monitoring

The need to improve sustainability data hasn’t been higher: twice more asset owners see unreliable data as a primary barrier to pursuing their ESG strategy. However, collecting reliable environmental data is complex, involving various sources, time-consuming, requiring coordination among numerous stakeholders, demanding specificity for different geographies, and needing financial and human resources. However, Deepki simplifies this process for you. Our platform streamlines sustainability performance management by consolidating data from all assets and energy suppliers into one centralized platform.

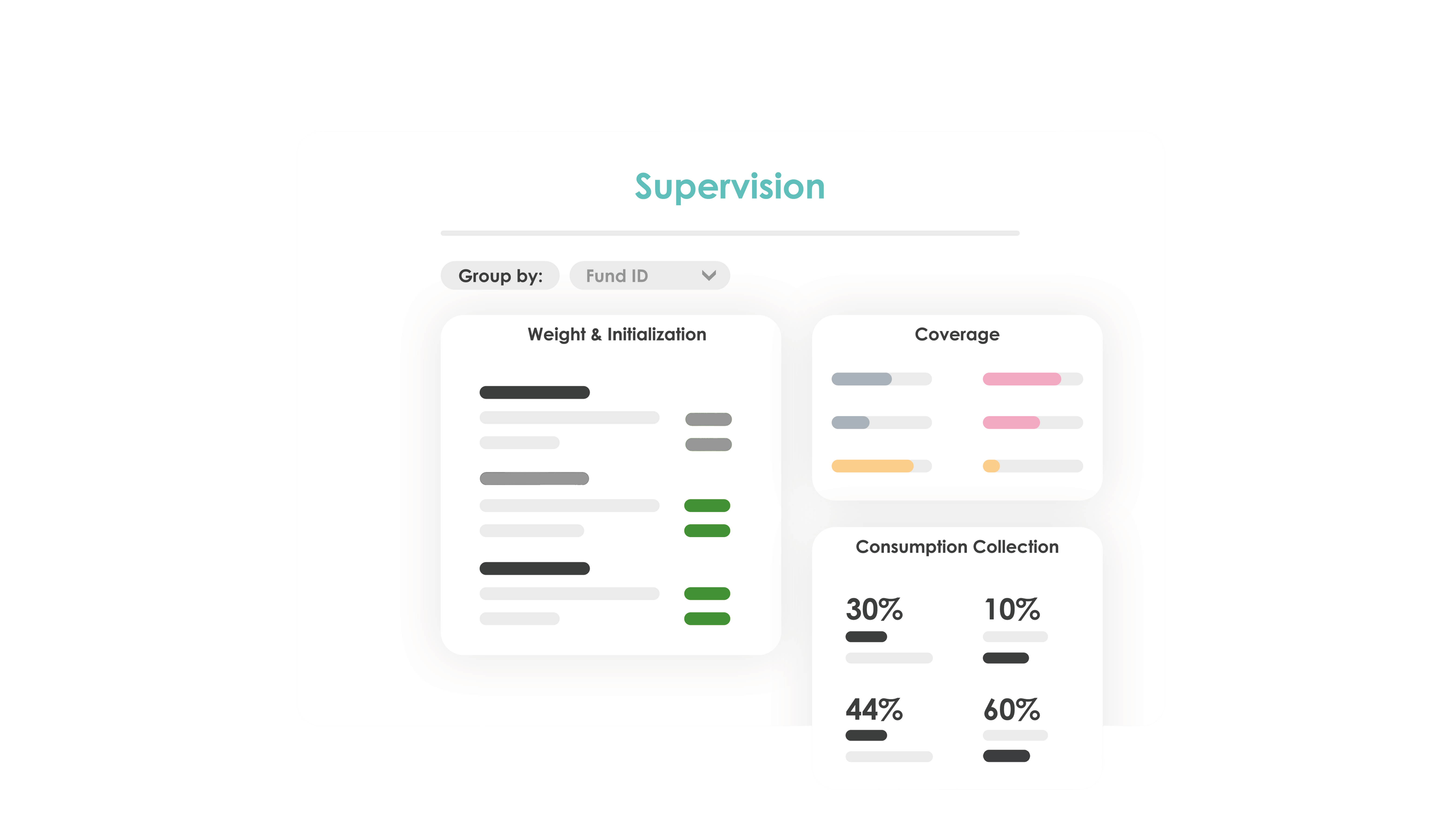

With the Deepki platform, you can:

- Automate data collection of energy consumption with the help of 1,200+ connectors

- Collect other types of sustainability data using forms, for example.

- Monitor data coverage rates to identify data gaps and ensure the integrity of your data, enabling informed decision-making.

Deepki transcends mere data completeness by spotlighting consumption outliers, thereby facilitating a thorough analysis of data coherence, ultimately leading to enhanced transparency.

Overcome missing data with machine learning

Another notable obstacle that can lead to greenwashing persists in the form of limited available sustainability data—a challenge that can be addressed through the use of estimates. Deepki’s actual energy consumption database of +400,000 buildings enables it to run cutting-edge machine learning models, helping to approximate the consumption data of an asset with reference values. When data is occasionally missing at a more granular level, data gaps can also be filled at the meter level or extrapolated based on known consumption of other tenants or meters from the same asset.

Integrated seamlessly into the Deepki platform, these AI-based estimates automatically address data gaps and offer a comprehensive view of overall consumption. Deepki’s approach extends to estimating energy consumption (electricity, gas, district heating, district cooling, propane, and heating oil), instrumental in converting CO2 eq emissions with more accuracy.

Ensuring extensive data coverage and maintaining data quality is essential for achieving high-quality reporting standards and enhancing transparency in sustainability disclosures.

Conclusion

Stakeholders expect the same robustness and reliability for “non-financial” sustainability data as they do for financial data. As investor demand for sustainability-related financial products rises in the European market, so does the risk of greenwashing. This poses a threat of confusion or misinformation for investors. Consequently, issuers must adhere to existing requirements when promoting or offering sustainability-related products.

By embracing robust reporting standards, leveraging high-quality data, and fostering genuine commitment to sustainability goals, businesses can not only mitigate the risks of greenwashing but also foster greater trust and credibility among stakeholders.

WEBINAR REPLAY

How professional ESG reporting can give your portfolio a competitive edge

Explore how Deepki’s ESG Reporting framework, modelled using financial best practices, can ensure data accuracy and foster investor confidence through independent audits.