The dynamic nature of the UK and EU regulatory landscape poses real challenges for UK real estate actors. Understanding the implications of these key developments is essential to avoid getting lost in a regulatory maze.

In this blog, we look at the latest updates that are keeping everyone busy, from UK policymakers, to the wider financial sector: the UK Sustainability Disclosure Requirements. We will explore what the SDR means for investment firms operating in the country, what challenges they will face, and how it differs from requirements under the EU SFDR.

What is the UK Sustainability Disclosure Requirements?

In a regulatory update on 17 July from co-chairs Nikhil Rathi, CEO of the FCA, and Sam Woods, deputy governor for Prudential Regulation at the Bank of England, the regulator said a policy statement for its green fund labeling regime would be published at the end of 2023 instead of the third quarter as previously signposted. This is the second time the FCA has had to postpone updating its sustainability disclosure rules, which are part of its plan to improve the UK’s sustainable investment framework and stamp out greenwashing.

In its quest for sustainable finance, the FCA is currently developing the UK Sustainability Disclosure Requirements (UK SDR), a proposed set of rules that will govern sustainability disclosure requirements for financial market participants in the United Kingdom.

The UK SDR builds on the FCA’s implementation of the Task Force on Climate-related Financial Disclosures (TCFD), which came into effect in April 2022, and the FCA’s Dear Chair Letter of July 2021. The letter addressed concerns about greenwashing, warned firms against overstating the sustainable features of their products and services, and provided guidance on mitigating these issues.

Before delving into the details of the new requirements, let’s start with a quick overview of the FCA and its role.

What is the FCA?

The Financial Conduct Authority (FCA) is the UK’s financial regulatory body. It operates independently of the UK Government and regulates the financial services industry in the UK as per the Financial Services and Markets Act 2000 (FSMA). Its role entails protecting consumers, promoting competition between financial service providers, and maintaining stability within the industry.

Who will the UK Sustainability Disclosure Requirements apply to?

The regulation will apply to

- Firms managing investment products for retail investors. The firms and their products will be subject to the new UK SDR rules. This will include wealth, fund, and asset managers.

- Distributors of investment products that fall within the scope of the UK SDR. This will include financial advisors and platforms. Requirements include displaying labels clearly alongside consumer-facing disclosures.

- FCA-regulated firms will be subject to the new anti-greenwashing rule. It requires that information provided to customers is clear and not misleading. Customers must also be linked directly to any sustainability claims.

For now, the UK SDR will only apply to financial products and firms within the UK, though the FCA has stated that it may seek to extend the scope of the rules to a larger scope at a later date.

Therefore, the UK SDR only applies to UK-based companies, while the EU SFDR applies to EU-based companies and external entities marketing products in the EU. There will then be a significant number of firms who need to consider the applicability of both the UK and EU requirements.

Learn more on the SFDR regulation: improving the ESG traceability of your real estate assets

What are the key differences between the EU SFDR and the UK SDR?

Currently, the proposed UK SDR and the EU SFDR share some components, including mandating disclosures at product or entity level, as well as pre-contractual and ongoing disclosures. However, there are key differences between the two regulatory regimes, both in approach and scope.

1. Sustainable investment classification and label

At their core, SFDR and SDR are both designed to increase investor trust, combat greenwashing, increase transparency around sustainable finance, and empower investors to make better-informed decisions. However, the mechanisms to achieve those ends differ in key ways.

The SDR will employ three labels: focus, improvers, and impact. These labels do not correspond to the three categories in SFDR (Article 6, Article 8, and Article 9). Most importantly, SDR’s labels are not hierarchical. Instead, they are reflective of consumer preferences:

- Sustainable focus: Funds that mainly have an environmentally or socially sustainable focus. This label suggests a high sustainability standard, particularly as it comes with a minimum threshold of sustainable assets (70%) in which the fund must invest.

- Sustainable improvers: Funds that may not currently be sustainable but aim to make a positive environmental or social impact in the future. This label highlights the concept of “stewardship” and making measurable improvements to underlying ESG performance.

- Sustainable impact: Funds that invest in real-world problems and achieve measurable real-world contributions to ESG outcomes. No minimum sustainable investment is required under this label, which includes products with a specific ESG outcome as an objective.

SFDR classifies funds as Articles 6, 8, or 9, depending on their characteristics. These categories are not labels but represent the level of disclosures the fund must make.

- Article 6: Funds without a sustainability scope.

- Article 8: Funds that promote ESG characteristics.

- Article 9: Funds with sustainable investment as their core objective.

2. Sustainability Disclosures

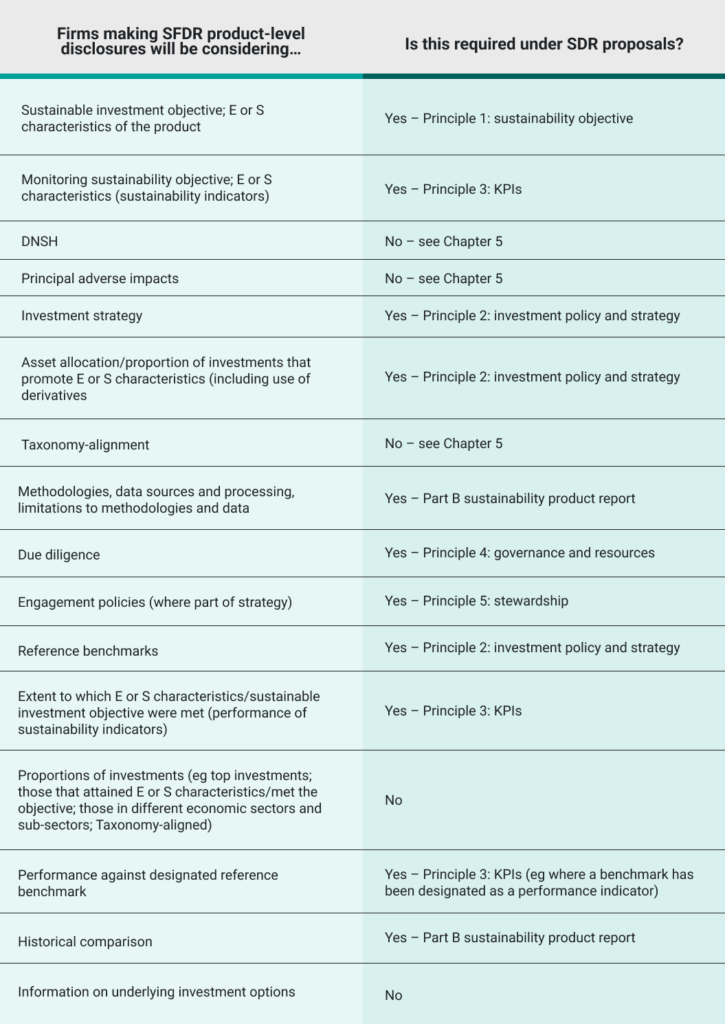

The UK proposal differs from the SFDR in determining whether investments are sustainable:

- The SDR does not contain a “Do No Significant Harm” concept. This could be introduced later, but the FCA considers it too restrictive for the time being.

- The SDR also does not refer to Taxonomy alignment.

- The SDR does not refer to the reporting of Primary Adverse Impact Indicators (PAI).

The FCA conducted high-level mapping on how its approach compares to SFDR requirements in Annex 1 of the Consultation Paper (see below).

When does the UK Sustainability Disclosure Requirements come into effect?

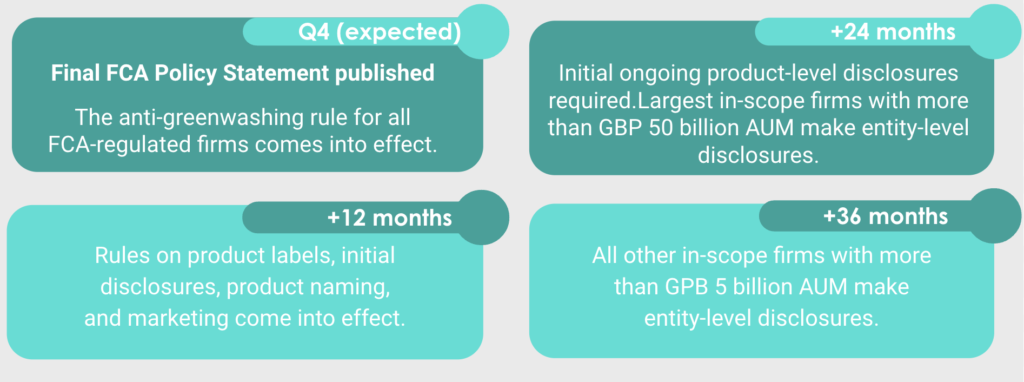

The UK SDR is currently in the final stages of development by the FCA. The publication of the FCA Policy Statement with the finalized rules and guidance is expected in this year’s fourth quarter. Once published, the requirements are expected to be phased in (see timeline below).

The FCA is putting a regulatory framework into the ESG space in the UK through the SDR proposals. However, it should not be considered equivalent to the EU’s Sustainable Finance Disclosure Regulation. Even though the FCA looked at the SFDR as a starting point, the SDR diverged from the SFDR.

Next phase

Currently, a gap exists between the existing ESG requirements in the UK market and what the SDR will ask for. The SDR should lead to setting a high bar in the ESG compliance world and introduce robust standards, which will surely drive changes in the industry.

Overall, the post-Brexit landscape drives some strategic decision-making for green fund managers. The SFDR is the most demanding regime regarding disclosure and compliance but it provides access to European investment capital. However, the SDR has not yet been tested, and time will tell whether it, too, has unintended consequences that will require additional rules.