A collaboration by Hélène Lecointre and Emmanuelle Fasciale.

The ESG reporting landscape continues to grow and become more complex than ever. New research indicates that in the past 10 years, ESG regulations have increased by 155%, with 1,255 ESG regulations introduced worldwide since 2011. ESG is no longer a compliance obligation. It has now evolved into a strategic imperative, as sustainability increasingly plays a key role in fostering economic resilience and investor trust.

To navigate this landscape, real estate companies must have a good understanding of the evolving reporting standards and their nuances. Mandatory reporting frameworks such as SFDR and CSRD impose strict deadlines and guidelines. On the other hand, annual reporting demands ever-greater detail in company disclosures. Adding to this complexity, voluntary standards like GRESB bring additional deadlines and reporting layers. Companies must also ensure the credibility and transparency of their data by adhering to auditable standards, critical to building stakeholder confidence.

The key challenges in ESG reporting include juggling multiple spreadsheets, data sources, and visuals—making it difficult and time-consuming to produce high-quality reports. Therefore, ESG asset and fund managers face increasing pressure to streamline their processes in the face of these demands.

Success in this intricate environment requires robust expertise and resources, along with efficient workflows and processes. Adopting the right tools and organizing reporting campaigns are essential for achieving scalable, effective compliance and unlocking long-term value through ESG initiatives.

Navigate the complex landscape of ESG reporting with Deepki

To better support asset owners in sharing essential information with stakeholders—whether between internal ESG and investment teams or externally with investors and lenders—Deepki’s ESG reporting module now offers new ESG KPI exports. These exports simplify the process of complying with major reporting standards such as CSRD, IFRS/SASB, INREV ESG SDDS, and SECR – on top of the frameworks already supported by the platform since January.

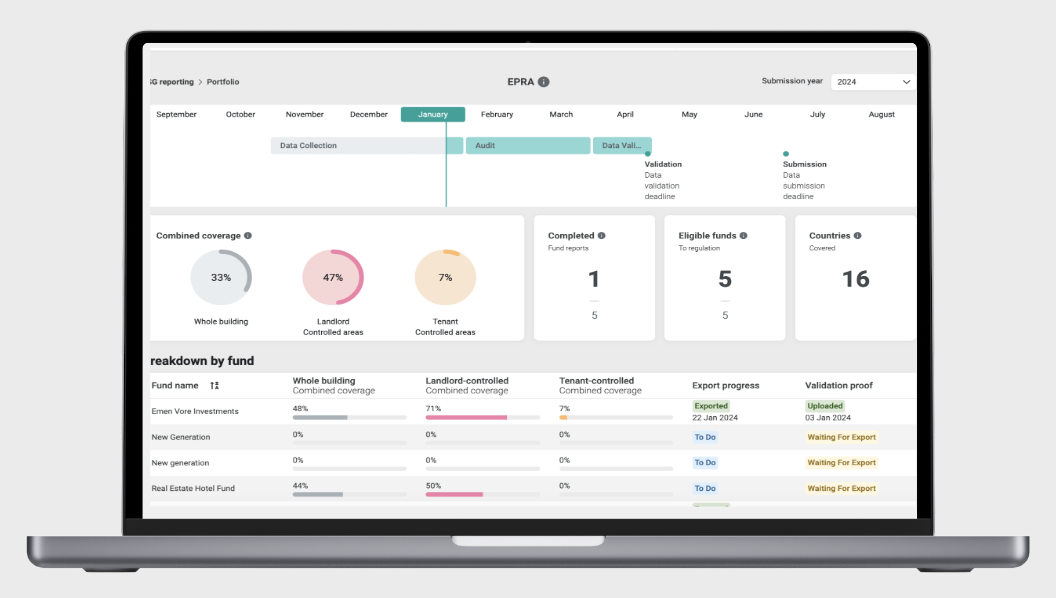

How does it work? With Deepki’s ESG Reporting module, streamline your reporting processes, whether for regulatory compliance, annual reporting, or voluntary ESG disclosures:

- Easily track upcoming deadlines: from data collection to final submission, set reporting timelines to stay on top of critical deadlines.

- Export reliable KPIs: extract energy, carbon, and water KPIs tailored to more than ten reporting frameworks.

- Store KPIs securely and upload your final dataset in a locked format for compliance, ensuring auditability.

ESG reporting module on the Deepki Platform.

A closer look at the INREV ESG SDDS framework

About INREV ESG SDDS

The European Association for Investors in Non-Listed Real Estate Vehicles (INREV) promotes knowledge-sharing in the non-listed real estate industry. In November 2023, INREV revised its guidelines, providing a new reporting template called INREV ESG Standards Data Delivery Sheet (SDDS). It includes 109 ESG KPIs, some mandatory and others optional. 28 of those are required at the vehicle level and cover energy, GHG, water, waste, building certifications, and climate change aspects. Some optional KPIs recall SFDR, GRESB, GRI, TCFD, and other major reporting frameworks.

INREV ESG SDDS disclosure simplified with Deepki

Tracking a wide range of KPIs can be time-consuming and complex for real estate entities reporting to the INREV ESG SDDS framework. Deepki’s ESG reporting module simplifies this process by enabling you to effortlessly export all the required Environmental KPIs for compliance directly through the platform, such as:

- Asset energy consumption

- Asset GHG emissions

- Asset water consumption

- Asset waste production

In the final submission part, the Deepki feature and its appropriate version of the INREV ESG SDDS template can be particularly useful. It eases and ensures submissions have the proper format at the right times.

Get audit-ready to seamlessly meet your reporting requirements

Historically, corporate reporting has been centered on financial data. Today, there has been a growing shift toward non-financial reporting. This has been driven by investors’ and stakeholders’ demands for transparent ESG disclosure, free from greenwashing. As new standards and frameworks emerge, ensuring a smooth audit of your ESG key performance indicators is more critical than ever.

Thanks to its comprehensive set of features, services, and certifications, Deepki enables real estate professionals to navigate reporting and audit periods more confidently by providing audit-ready reports. This label guarantees them, their investors, and auditors good quality data, respecting audit principles.

The Deepki Platform’s latest additions provide a complete view of your reporting campaign timeline and the stakeholders involved, from data collection to the audit and validation phase. Moreover, Deepki’s automated data collection minimizes the risk of error and guarantees auditable data. This way, you can ensure the quality of ESG data you need to report on and export computed KPIs in a few clicks.

Finally, the ESG reporting module helps bring transparency on the progress of your reporting campaigns. During the entire process, you can store the KPIs, upload the final dataset in a locked and secured way, and navigate easily through your history. This ultimately allows you to have a faster audit turnaround.

To streamline real estate players’ reporting processes, Deepki additionally offers dedicated services to support the effective adoption of its solutions. This includes data collection services, project management, and audit preparation. This is supported by the following data quality and security standards under which Deepki is attested: ISAE 3000 type 1, ISO 14064-1, and ISO 27001.

Beyond ESG Reporting: decarbonize your real estate portfolio with Deepki

Reporting plays a foundational role in ensuring transparency and governance in ESG strategies. It enables real estate companies to build trust with stakeholders and demonstrate accountability. But beyond ESG reporting, streamlining these processes empowers companies to save time and focus on actionable priorities, such as decarbonizing portfolios and managing risks effectively.

Deepki’s new capabilities are driven by continuous innovation. Our end-to-end platform, coupled with the expertise of our ESG specialists, enables real estate players to turn complex data into actionable insights in order to take action.

WEBINAR

Take action! Catch Deepki Platform’s latest update in action

Watch the webinar replay and discover our ESG Reporting module. It is designed to facilitate your reporting efforts and get your questions answered by our experts.