Definition

Carbon accounting is a necessary step for companies that aim to manage, align, and control their emissions. It refers to the processes required to measure the amount of carbon emitted, avoided, or removed by an entity (e.g., an asset or business) over time. It allows companies or entities to monitor and report these emissions and measure their climate impact.

Why are carbon emissions key indicators?

Given the net zero goal established in the Paris Agreement, companies need to consider their greenhouse gas (GHG) emissions. Carbon dioxide (CO2), and other GHGs resulting from human activities, play a significant role as primary contributors to climate change. Therefore, carbon equivalent has been identified as a key indicator given its substantial impact on elevating global surface temperatures. It also plays a major role in evaluating the consequences of both climate change and dependency on fossil fuels.

A key step in the decarbonization pathway, carbon accounting enables stakeholders to assess their business’s carbon footprint. Likewise, it allows them to monitor the warming impact in correlation with these GHG emissions. Carbon accounting helps identify the sources of a business’s emissions and contributes to a more informed approach to managing and reducing environmental impact. This explains why regulations such as the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy identify carbon emissions as key performance indicators.

Classifying carbon emissions

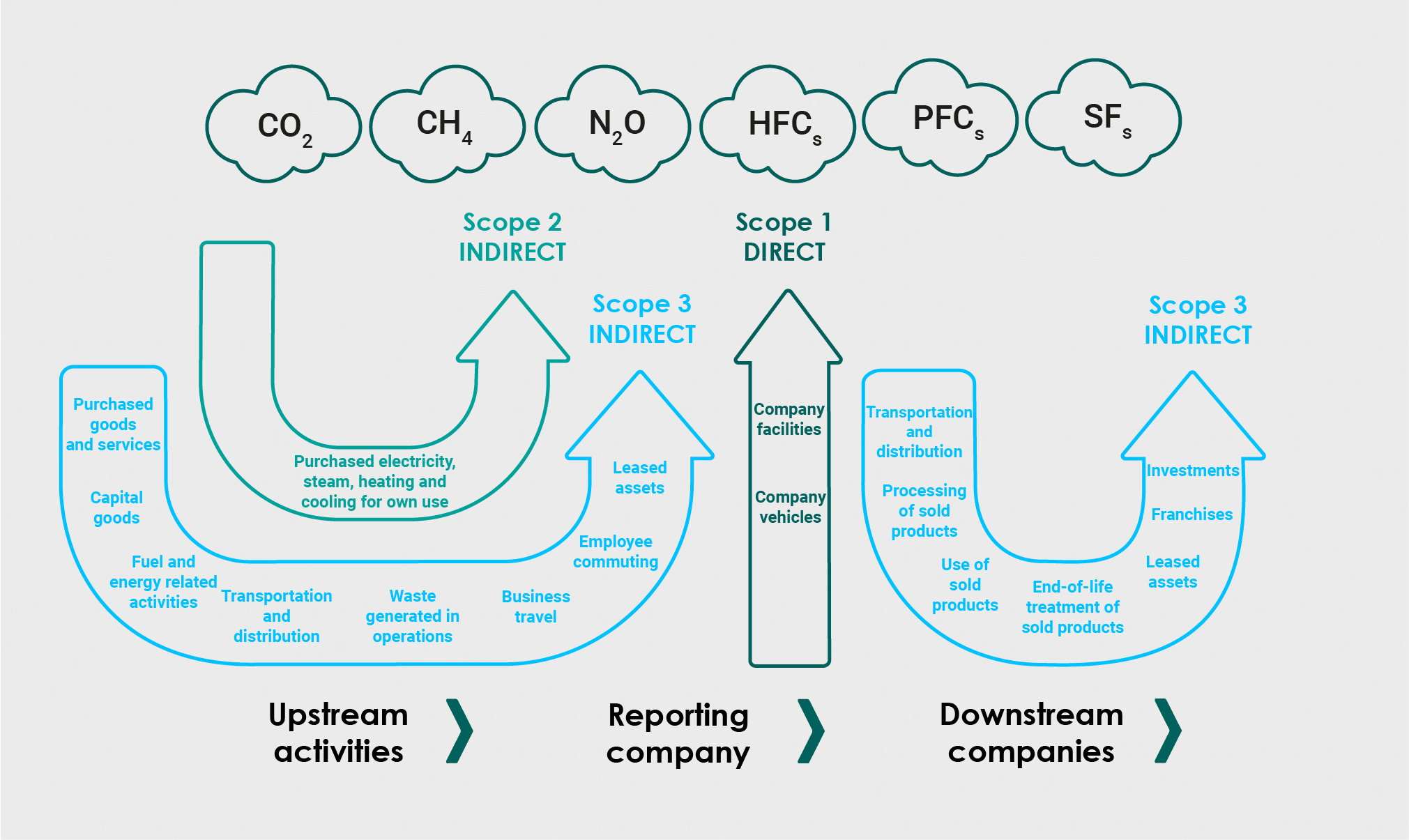

Several methodologies make monitoring GHG emissions possible. The GHG Protocol sets comprehensive and standardized frameworks that organizations, states, and companies can use to measure and manage carbon emissions. The GHG Protocol establishes three scopes to classify emissions, each addressing different sources:

- Scope 1: direct GHG emissions from sources owned or controlled by the entity (e.g., boilers, furnaces, vehicles, refrigerants, etc).

- Scope 2: GHG emissions from the production of electricity, steam, heat, and cooling purchased or acquired and consumed by the entity.

- Scope 3: also called “value chain emissions.” It includes all other indirect emissions that occur in an entity’s value chain as a result of its activities. There are 15 emission categories, including purchased goods and services, business travel, employee commuting, waste disposal, use of sold products, transportation and distribution, and investments.

Understanding scopes is vital to lowering carbon emissions and increasing your assets’ value. To dive deep into the scope’s role, take a look at our article on the subject here.

Implementing a carbon pathway

Temperature alignment assessment

After setting a goal for GHG emissions reduction, a temperature alignment assessment to achieve this reduction is to be established. This assessment quantifies the gap between portfolio climate performance and one of the different decarbonization trajectories that exist.

This process is complex and requires multiple data sources. Usually, this involves four different steps:

- Measuring current climate performance.

- Choosing a baseline scenario for the low-carbon transition.

- Decomposing this scenario into low-carbon trajectories by sector and then…by asset.

- Comparing the results obtained in steps 1 and 3.

Current approaches within the real estate sector

An effective data collection helps measure a company’s greenhouse gas emissions. Once a portfolio’s carbon footprint is assessed, companies can pursue net zero goals through efficient decarbonization strategies. Implementing a decarbonization trajectory or carbon pathway entails data collection, carbon accounting methodologies, and reporting.

However, it is a long-term endeavor that involves different methodologies and approaches. No common framework exists, hence the need to remember that depending on who is reporting and the objective, the different sources of emissions won’t be reported in the same scope. Depending on the risks, objectives, and structures, each company will need to abide by a specific approach:

- A Corporate Approach (the reporting entity is the company) focuses on the entity conducting the reporting, for instance, in the context of companies required to report on sustainable development.

- The Whole-building approach, or “portfolio approach” (where the reporting entity is the fund(s)), for instance, in the case of a company wanting to track emissions from a fund and/or align its assets with a net-zero trajectory.

Read more: Deepki’s opinion piece on Carbon accounting in real estate.

This is where tools like the Carbon Risk Real Estate Monitor (CRREM) come into play. The CREEM, Deepki’s partner, helps companies in the real estate sector to centralize data on their real estate assets to assess their environmental impact and limit the ESG risks associated with their activities.

Once the company chooses an adequate approach, it must prepare for a transition strategy. This goes through three levers: optimizing energy consumption, retrofitting, and improving the energy mix by integrating renewable energy.

Taking it to the next level

It’s not just about identifying and collecting data to reduce carbon emissions, the real difficulty lies in ensuring a comprehensive survey of total emissions from assets within funds. This is why you need a clear plan for reductions to successfully achieve your goals.

Deepki can help you implement an efficient decarbonization strategy to reach net zero and start maximizing the value of your assets. Deepki aims to thoroughly assist all stakeholders in their reporting and decarbonization journey. In this white paper, you will find out about Deepki’s transparent approach to carbon accounting for real estate entities.