Reducing carbon emissions is a primary goal included in environmental strategies for all businesses and organizations. In order to do this effectively, an in-depth understanding of GHG emissions and its complexities is vital.

Globally, the real estate sector accounts for 38% of CO2 emissions: 28% from building operations and 10% from building materials and construction.

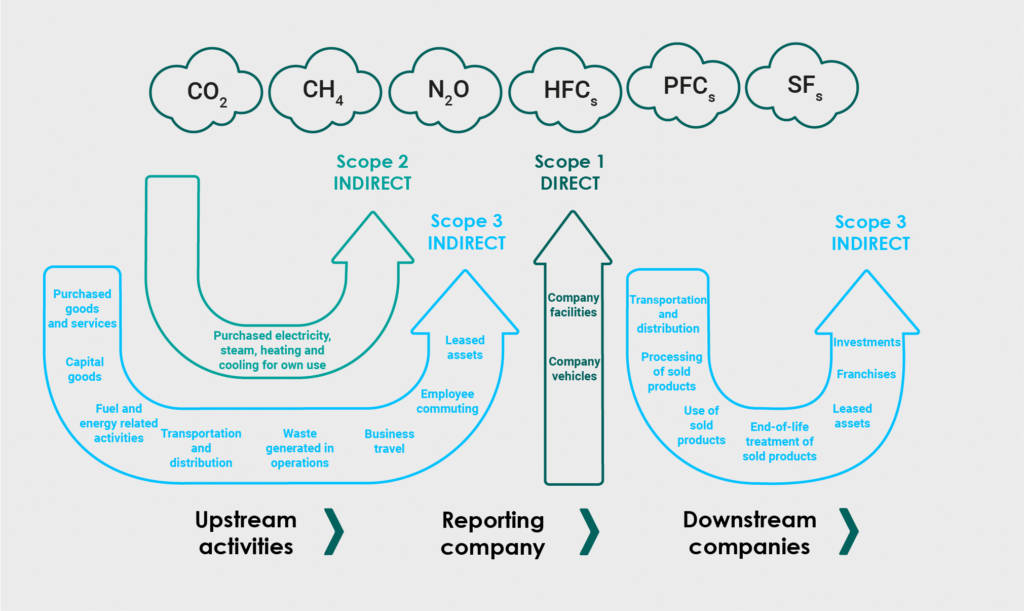

Born from the partnership of the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD), the GHG Protocol classifies emissions according to three distinct categories or ‘scopes’:

- Scope 1 refers to direct GHG emissions from sources owned or controlled by the entity: boilers, furnaces, vehicles, etc. Refrigerants

- Scope 2 includes GHG emissions from the production of electricity, steam, heat and cooling purchased or acquired and consumed by the entity

- Scope 3, also called ‘value chain emissions’, includes all other indirect emissions that occur in an entity’s value chain as a result of its activities. There are 15 emission factors, including purchased goods and services, business travel, employee commuting, waste disposal, use of sold products, transportation and distribution and investments.

According to the GHG Corporate Protocol, Scope 3 emissions quantification is recommended but not mandatory. These types of emissions often represent an organization’s biggest greenhouse gas share and overlooking them means missing out on a significant opportunity for environmental improvement and cost reduction.

The benefits of tracking Scope 3 for investors

Having a clearer view of the overall impact of your activity will make it easier to spot the most effective improvements to be made. A solid Scope 3 strategy will help with identifying and achieving critical reductions in the areas of your organization’s value chain that produce the most emissions, also known as ‘hot spots’. Understanding where these areas are and where you are most vulnerable to future risks is essential for increasing the resilience of your portfolio. Further tackling Scope 3 emissions requires a clear understanding, governance and oversight of your full value chain.

As companies and governments are increasingly required to be not only transparent but also prove their commitment to improving climate impact, addressing Scope 3 emissions enables organizations to answer to growing demands for reporting by investors, partners and tenants alike. In order to achieve this goal, these organizations need to have precise information to make complex fact-based decisions.

Although addressing Scope 3 emissions is not a requirement, committing to this framework is a clear differentiating factor when it comes to actually walking the talk. A well implemented and strong Scope 3 strategy can help boost performance in rankings regarding sustainability indices.

It can be seen as an opportunity to stand out, demonstrate leadership, and promote innovation in forging a path forward.

What are the main challenges?

Scope 3 emissions are the most important and the most challenging emissions to manage as they are beyond an organization’s direct control but still under their responsibility. The challenges and opportunities lie in implementing emissions-reduction initiatives that result in improvements and impact through collaboration.

However, a few setbacks can be expected along the way.

In regions where the company or its value chain operate, not complying with GHG emissions-reduction regulations, either applicable or pending, could expose the organization to higher financial costs in the short run and legal penalties in the – not so– long run.

Read more: SFDR regulation: improving the ESG traceability of your real estate assets

The larger and more complex the organization is, the more diverse the emissions sources are. Making an impact requires dealing with several competing cultural, legislative and practical variables. Additionally, this may require a trade-off between priorities: from modern slavery to waste or climate change, there are a lot of issues to address in value chains.

The most complicated aspect in assessing value chain emissions is the data collection process itself. It often depends on a wide variety of stakeholders, many of whom may not manage their own data or calculate a footprint. Even if they do, the reliability and format of the data can be subject to question as disparities in reported emissions may arise from variations in methodology – in data used to calculate inventory and in reporting of intensity ratios or performance metrics.

Deepki’s recommended three best practices

If applying this framework seems like a daunting task, a few best practices can help manage the process:

- Organizations usually put a screening approach in place, but when value chain emissions represent at least 40% of total GHG emissions, more detailed inventory methods are preferred and an actual Scope 3 target should be defined.

- Organizations can choose to set multiple, category-specific targets or a single target covering all relevant Scope 3 categories. These can be set as absolute emissions or emission intensity targets.

- The Scope 3 target limit should cover at least two-thirds of total Scope 3 emissions. Should you need more information, we recommend you to consult the Science Based Target Manual

The most crucial step in undertaking Scope 3 reporting is the screening process or the assessment to identify the categories that are most relevant to the reporting entity. The relevance of each of the fifteen categories depends on the industry.

Zooming in on Real Estate

In the Real Estate sector, the construction, maintenance and ongoing energy consumption of properties make up the majority share of the overall carbon emissions, included in Scope 1 and 2. However, both the waste of energy required to operate a building as well as the energy used to create, maintain and demolish a property should also be taken into account.

The GHG protocol reporting categories regarding real estate, in order of importance, are:

- Category 13 – Downstream leased assets: emissions from the assets leased to other organizations over the reporting year including energy use in leased spaces.

- Category 2 – Capital goods: any capital expenditure related to the company’s activities, excluding operational expenses. A crucial component will be embodied carbon: emissions linked mainly to extraction, manufacturing, transportation, assembly, maintenance, replacement and deconstruction.

- Category 1 – Purchased Goods and Services: mainly spendings on facilities management, contractors, lawyers and consultants.

- Category 3 – Fuel-and-Energy Related Activities (not included in Scopes 1 and 2): including the well-to-tank transmission and distribution losses from fuels and electricity purchased.

- Category 5 – Waste Generated in Operations: treatment and disposal of solid and water waste by third-parties such as waste collection providers.

While Scope 3 emissions are very important, they are often the most demanding emissions to tackle. Most companies have been focusing on reducing emissions under their direct operational control (Scope 1) and from the purchase of their energy mix (Scope 2). Addressing Scope 3 emissions wouldn’t only help preserve the fast shrinking global carbon budget and have a direct effect on climate change, it can also mitigate risks within value chains, accelerate innovation and collaboration as well as strengthen an organization’s reputation.