The real estate landscape faces rapid climate change, and adaptation to chronic and acute hazards is a priority. A BBP report from 2022 highlighted that climate hazards (river and coastal flooding, sea level rise, hurricanes or typhoons, fires, and extreme heat) are estimated to threaten at least one-third of real estate assets globally. The industry must understand the urgency of addressing climate change by adapting and implementing strong resiliency. Adaptation to climate change aspires to cope with the adverse impacts that are already underway and is crucial for building resilience to current and future climate-related challenges.

This article explains why the real estate industry must urgently address adaptation. Climate risks are becoming increasingly frequent and more costly for real estate owners. This article further explores how adaptation strategies can be implemented by assessing exposure and vulnerability to climate risks, aiming to enhance resiliency and protect asset value.

The insufficient pace of climate adaptation

Overall, there is an important delay in implementing adaptation, compared to integrating climate mitigations within companies’ overall strategies, a topic for which the real estate industry is more mature today. Reports show that only a few companies have adopted adaptation initiatives. Stakeholders need help to take action due to various challenges. The absence of a standardized framework for assessing the adaptation of assets to climate change makes it challenging to quantify the associated risks. Therefore, real estate asset owners still grapple with solutions to comprehend climate models. The entire value chain is still in need of expertise to interpret climatic data, perform on-site vulnerability investigations, and plan effective adaptation measures. Additionally, financial constraints and uncertainty about adaptation measures add to the difficulty of implementing effective adaptation plans.

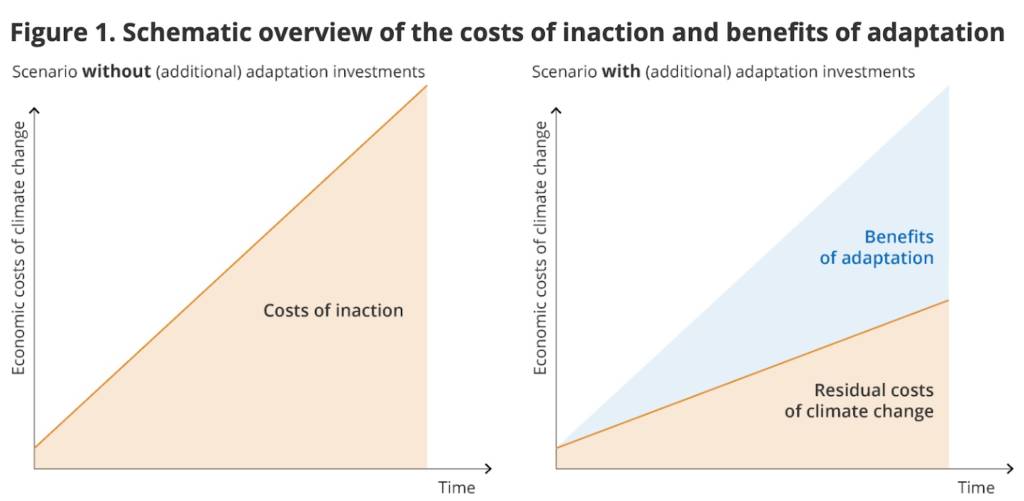

The cost of inaction on the industry

Resilience is the capacity to plan for, respond to, and recover from challenges. In the context of real estate and its relationship with climate change, this translates into an asset’s ability to be less adversely affected by a given climate hazard and to recover more easily from its effects.

Real estate companies that do not properly implement adaptation measures as a part of their strategic resilience planning face several economic consequences, such as property damages and losses, increased operating costs, and regulatory risks. For instance, an EDHEC report stated that some investors in infrastructure could lose more than half of their portfolio to physical climate risks by 2050. As a matter of fact, this delay in implementing efficient adaptation actions eventually leads to a high cost of inaction and generates non-monetary impacts, such as damage to communities and ecosystems.

Source: Further developed from Metroeconomica Limited (2004) and Valverde et al. (2022).

How to start implementing strong adaptation strategies

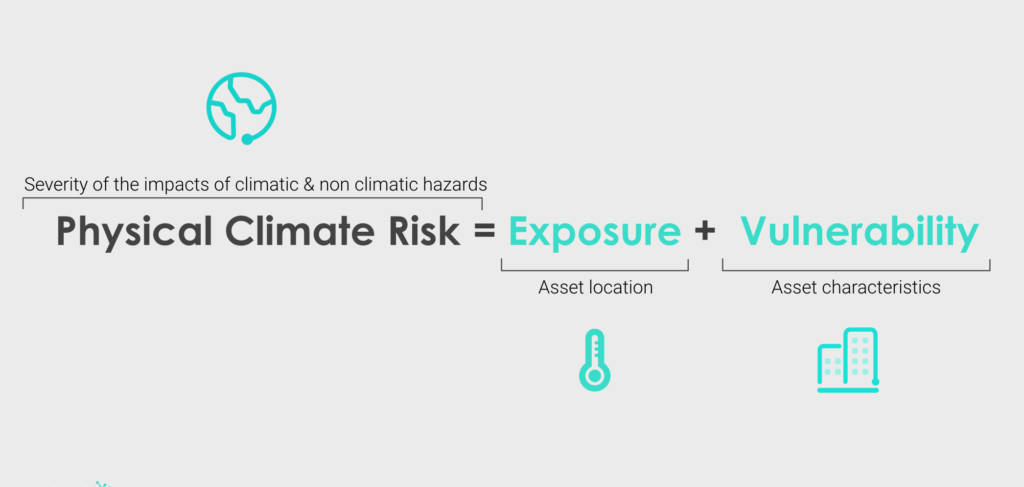

The real estate industry is a vulnerable sector, and properties are exposed to physical climate risks that pose significant threats for real estate stakeholders, such as decreased asset value and profitability loss. Adaptation requires proactive planning. Real estate owners and asset managers need to assess climate risks to implement long-term adaptation strategies efficiently and to ensure their assets’ resiliency for better value on the market.

Strengthening resilience by assessing exposure and vulnerability to climate risks

Implementing strong risk management practices and integrating future climate projections and adaptability planning is crucial. Real estate players must consider existing and emerging physical risks to determine which part of their portfolio is the most likely to be impacted.

The first step in assessing physical risk is to identify potential risks and evaluate the likelihood of their exposure, based on the geographic location of the asset. Companies can refine the exposure analysis to specific physical risks by integrating their assets’ characteristics. This analysis identifies the most vulnerable assets, enabling the prioritization of actions based on both exposure and vulnerability assessments.

This vulnerability assessment allows stakeholders to understand the link between the characteristics of a property and its capacity to respond or adapt. The identification of asset vulnerability helps implement relevant strategies to adapt assets to climate change adverse impacts. For instance, real estate players can categorize them into groups based on their vulnerability to specific climate-related hazards, easing the implementation of resilience-building measures. This comprehensive approach helps decision-makers to prioritize actions, allocate resources effectively, and comply with disclosure requirements.

Climate risk: considerations to evaluate your resilience level.

Compliance for better climate adaptation

Regulations play a crucial role in driving adaptation, and there is an urgent need for the existing policy implications to align and help implement effective adaptation. Different initiatives already provide frameworks to guide stakeholders in assessing and disclosing climate-related risks. They emphasize the need for real estate owners to understand better transition and physical risks.

The EU Taxonomy is designed to understand the sustainability of activities and assets. Adopted in 2020, it aims to reduce carbon emissions by 50% by 2030 and achieve carbon neutrality by 2050. Among 6 different environmental objectives, the EU Taxonomy particularly encompasses climate change adaptation as a fundamental environmental objective. This initiative helps the real estate industry intelligently analyze climate risks, be proactive, better prepare for adaptation, and preserve the value and safety of their assets.

Read more: Understanding the EU Green Taxonomy in 7 questions.

Other initiatives and regulations to help companies start implementing adaptation plans:

TCFD (Task Force on Climate-Related Financial Disclosures) recommends disclosing information on both physical and transition risks. It encourages real estate companies to conduct scenario analysis to assess the resilience of their portfolios under different climate-related scenarios.

CSRD (Corporate Social Responsibility and Sustainability) provides a framework for integrating climate adaptation considerations into real estate companies’ decision-making processes, fostering resilience, sustainability, and long-term value creation.

SFDR (Sustainable Finance Disclosure Regulation) helps integrate climate adaptation measures into real estate investment decision-making processes, promoting transparency, accountability, and sustainability within the sector.

Deepki’s ebook

Understanding and applying ESG standards and reporting frameworks can be complex. This guide will help you have a vision and awareness of how the regulatory landscape might evolve or trend.

Access your free copyEfficiently addressing climate change requires the collaboration of different stakeholders, from governments and local authorities to industry players. Transparent disclosure of climate-related risks and adaptation efforts is essential for building trust and value. Moreover, coordination with industry players can facilitate knowledge sharing and collective action toward climate resilience. It also helps build standardized approaches leading to best practices for adaptation reporting and disclosure.

Facing real estate climate adaptation challenges with Deepki

Prioritizing long-term adaptation is essential for safeguarding real estate assets and avoiding the costs of inaction. However, real estate players may still encounter challenges in identifying vulnerabilities and implementing effective adaptation measures.

Turning climate models into actionable business decisions can be intricate. Climate change threats are unprecedented; therefore, predictions need to be treated with caution. Moreover, reliance on voluntary cooperation, complexity of adaptation measures, limited data, and unpredictable outcomes can increase hesitancy.

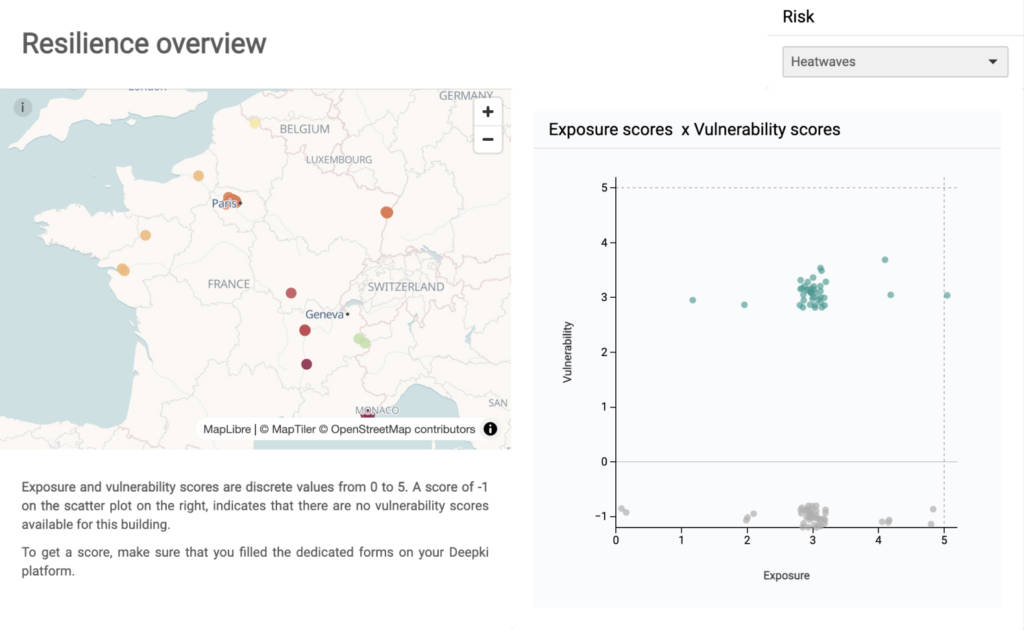

Deepki’s new Climate Resilience feature helps simplify the assessment of real estate assets’ exposure and vulnerability to climate change and disclosing critical risk information. This is necessary to unlock access to capital, ultimately protect asset value, and ensure long-term financial success.

For advanced exposure and vulnerability insights, read our blog on Deepki’s Climate Resilience feature.

Climate resilience panel in the Deepki Platform.

By integrating the latest CMIP6 (Coupled Model Intercomparison Project) climatic data within its end-to-end EGS SaaS, Deepki enables asset and fund owners to evaluate their portfolio’s exposure with the latest state-of-the-art climatic data projections. Wherever in the world their asset locations are, exposure to climate risks such as clay subsidence, dry days, coastal and riverine floods, heatwaves, wildfires, earthquakes, and precipitations can be measured most accurately. By factoring in asset vulnerability, asset and risk managers can therefore prioritize further investigation to plan adaptation measures necessary to build the portfolio’s resilience and long-term success.

WEBINAR

Don’t miss out on catching Deepki new features in action

Start assessing both climate exposure and vulnerability to build effective adaptation strategies and protect asset value! Access the replay of our dedicated webinar and discover Deepki’s new feature on climate resilience!