What is resilience?

Resilience is the capacity to plan for, respond to, and recover from challenges. In the context of real estate, and its relationship with climate change, this extends to an asset’s ability to adapt to transition in a fair and sustainable way. As climate change influences weather patterns around the world, environmental and social challenges are increasing in frequency, scale, and cost. While it has been established that the continued use of fossil fuels will result in further warming of the planet, and significant environmental, economic, and social consequences, the exact timing and severity of these effects are difficult to predict. Nevertheless, these risks represent an imminent threat, and are expected to affect organizations in most economic sectors. These challenges do, however, create significant opportunities for organizations committed to climate resilience, adaptive solutions, and defining pathways to Net Zero.

Climate risk falls into three primary categories:

- Transition Risks occur during the shift towards a low carbon economy, where organizations may encounter significant policy, legal, technological and market changes to mitigate risk and undergo required adaptations. Real Estate owners / Asset managers face varying levels of financial and reputational risk depending on the nature and urgency of these changes.

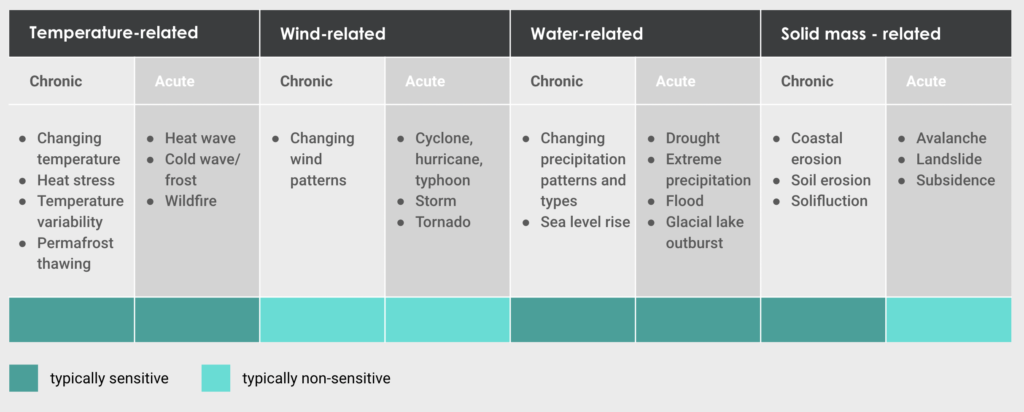

- The Physical Risks that arise from climate change may be acute (driven by events) or chronic (long-term shifts in climate patterns). These events can impact organizations financially, such as direct damage to assets or indirect damage to supply chains. The financial value of a building or any real estate asset may be impacted by water availability, sourcing and quality, food security, and acute weather changes affecting land, operations, supply chains and safety.

- Social Risks are limited to those resulting from or intensified by transition or physical climate risk factors. Social risk factors include shocks and stressors such as inequity, labour market disruption, building shortages, casualties and fatalities during extreme events.

Read more: Open data: changing the Real Estate game

Regulations are catching up

The threats presented by climate change to businesses and financial markets are already a reality. To safeguard against risk and prepare for future changes, real estate investors need to better understand how to identify and evaluate trends, prepare for disruptions and changing environments, and build resilience over time.

In 2017, The Task Force on Climate-related Financial Disclosures (TCFD) released a report setting out recommendations for helping businesses disclose climate-related financial information. The report recommends that companies communicate governance, strategy, risk management, metrics, and targets with respect to climate-related risks and opportunities.

The EU Taxonomy, released in 2020, includes a technical document developed to provide clarity to corporate and investment companies on the ‘greenness’ of different activities and drive funding to where it is most needed. The taxonomy will enable market participants to invest in truly sustainable opportunities and circumvent attempts at greenwashing. The six objectives outlined in the taxonomy are: climate change mitigation, climate change adaptation, sustainable use and protection of water and marine resources, transition to a circular economy, waste prevention and recycling, pollution prevention and control, and protection of healthy ecosystems.

Read more: SFDR regulation: improving the ESG traceability of your real estate assets

Market trends in real estate and infrastructure

The warming of the planet, caused by greenhouse gas emissions, poses a serious threat to the global economy, and will directly impact the real estate industry. Without implementing a robust resilience strategy, real estate investors and asset managers remain exposed to significant and unforeseeable climate risk.

The real estate industry has seen a significant increase in demand for greater guidance, transparency, and regulation for climate-related financial disclosures, as well as unprecedented support for action to tackle climate change.

In October 2021, the UK government announced that it would become mandatory for Britain’s largest businesses to disclose their climate-related financial information, in line with TCFD recommendations, by 2022. What started as elective disclosure recommendations is now part of regulatory frameworks within the European Union, Singapore, Canada, Japan and South Africa.

The EU Taxonomy, which forms the basis for the Sustainable Finance Action Plan, will support new regulations, requiring investment companies to disclose how green their strategies are with a common framework from 2021.

The availability of comprehensive risk management information to investors and asset managers creates new possibilities for effective resilience planning and implementation. It is essential, now more than ever, that real estate businesses not only understand these risks, but also recognize and seize opportunities to create a stronger and more resilient global economy.