During the 2024 Expo Real, Deepki convened a panel of industry experts to discuss how real estate owners and investors can elevate their ESG strategies by leveraging data-driven insights to inform retrofitting decisions.

The goal was to explore how technology can empower real estate professionals to harness the full potential of their data, enabling them to make informed decisions that drive environmental performance and unlock a range of benefits, from reduced operational costs to enhanced asset value and improved access to capital.

The two-part session began with an insightful presentation by Philippe Parlange, Deepki’s Chief Client Officer, who outlined the challenges of decarbonizing the real estate sector. This was followed by a panel discussion hosted by Raphaël Sedlitzky, Deepki’s Head of Client Delivery, DACH, featuring experts from Catella, HIH Invest, Manova Partners, and Real I.S. Group. Panelists shared their experiences assessing the ROI of retrofitting investments and developing strategies to achieve net-zero goals.

This blog recaptures the critical insights from this engaging discussion, aiming to inspire real estate professionals to up their ESG game and accelerate the journey toward a sustainable future.

The lay of the challenging land: introduction by Philippe Parlange

The imperative to decarbonize the real estate sector is undeniable. Yet, the path to net zero is fraught with challenges.

Regarding the criticality of decarbonization, the spotlight is on the real estate industry, as regulators and investors demand transparency. Real estate companies feel the heat to disclose their environmental impact and outline concrete plans for a greener future. As the pressure mounts, it’s clear that a strategic approach is needed to navigate this evolving landscape. Companies must carefully plan and prioritize their decarbonization efforts to avoid wasteful investments and ensure efficient resource allocation, maximizing impact.

Secondly, we need to consider that the very scale of the task is daunting. It’s not new that real estate portfolios are vast and diverse. This has almost always been the case. They encompass a myriad of asset types and tenures to consider when assessing, planning, and deploying a decarbonization strategy. With numerous stakeholders involved, including investors, asset managers, property managers, engineers, and auditors, streamlined processes and effective communication are crucial for successful decarbonization efforts.

We need to address resource scarcity at several levels. Building retrofitting requires significant capital investment, and even though the industry is optimistic about the market bouncing back, it’s still increasingly more challenging to get financed. Moreover, ESG-savvy talent is not just around the corner. There’s a significant focus on upskilling and reskilling the existing real estate workforce through continuous learning, certifications, and professional accreditations to yield more immediate and impactful results. Finally, there’s scarcity in equipment manufacturing as a big part of the industry is rushing to address decarbonization simultaneously. To maximize impact, careful prioritization of investments and actions is necessary to overcome these resource constraints.

A study conducted by Deepki in 2024 involving senior European commercial real estate asset managers overseeing $240 billion in assets reveals a looming threat. Nine out of ten respondents anticipate that at least 20% of their portfolios will become stranded assets within the next three years due to energy inefficiency. While the sector recognizes the urgent need for investment, time constraints and a shortage of skilled professionals pose significant obstacles to achieving energy sustainability goals.

2024 European Retrofitting Report

A survey of 253 director-level/C-suite individuals working for pension funds, insurance asset managers, fund managers, banks and institutional investors in the UK, France, Germany, Spain and Italy who are actively involved in managing the commercial real estate portfolio or the running of a real estate investment fund/portfolio.

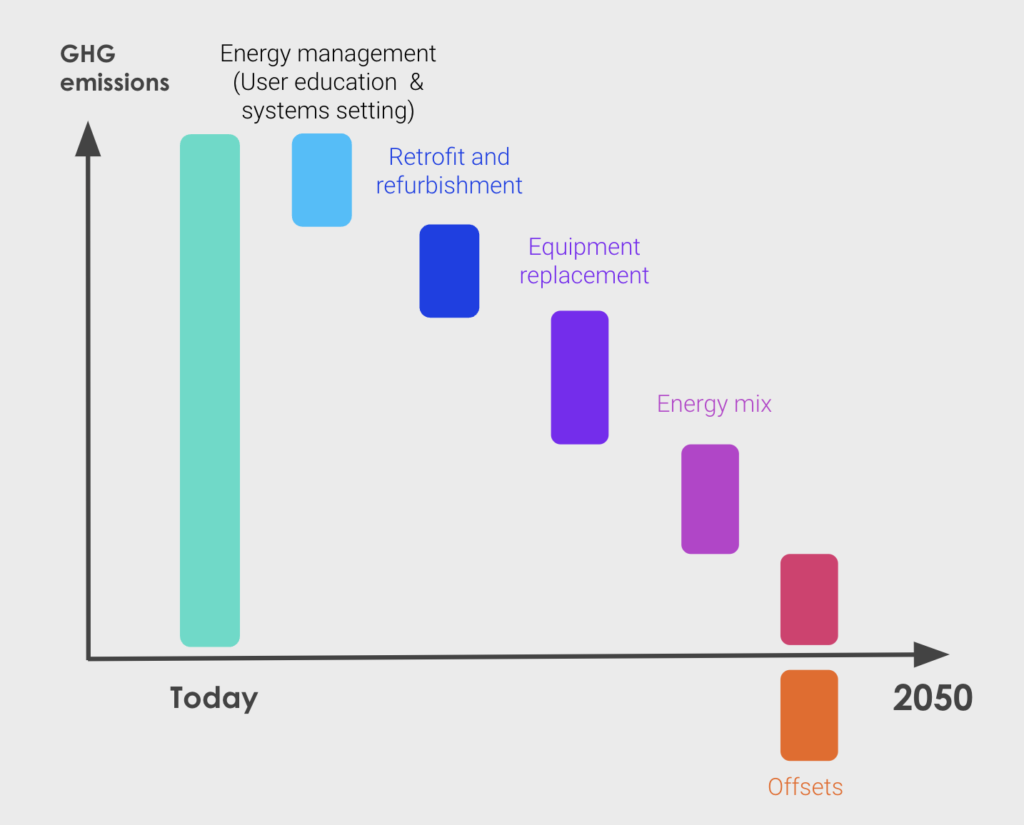

Access the reportTo navigate these challenges, a strategic approach is essential. Traditional bottom-up approaches, which involve assessing individual assets, can be time-consuming and inefficient. A more effective strategy is to combine top-down and bottom-up methodologies. It’s by initially analyzing the portfolio at a high level that it’s possible to identify the most impactful opportunities and allocate resources accordingly.

The approach proposal

The criticality of decarbonization has accelerated the market, and to achieve this daunting mission, prioritization is not negotiable. Through assessing the experiences of its clients, Deepki has identified two significant industry needs to succeed: a critical shift in processes and decarbonization planning, as well as new tools and expertise. Let’s dig further into these.

A shift in the approach

Sustainability isn’t merely about collecting new data; it has become a fundamental shift in how the real estate industry operates. It imperatively demands a new mindset, new processes, and the mobilization of human resources. Historically, the real estate industry has taken a bottom-up approach to ESG. This involves conducting energy audits at the asset level, analyzing each property individually, and proposing CapEx plans. These plans are then consolidated at the portfolio level.

Deepki proposes a hybrid top-down/bottom-up approach, starting with a high-level portfolio analysis to identify decarbonisation opportunities and simulate potential impacts. This will enable asset and action planning and prioritization. Only then are detailed physical assessments conducted at the asset level.

Focus on new tools

Decarbonization planning can be complex. To streamline this process, organizations need a centralized platform for the vast amount of data that provides tools to assess the impact of different actions on your entire portfolio. These tools utilize a catalog of actions, each with a defined CapEx, allowing you to make informed decisions.

A platform that centralizes your data, including decarbonization planning tools that leverage a catalog of actions with associated CapEx. This way, you can perform different actions in each asset and dimension their impact on your entire portfolio.

However, this needs to be combined with the ability to simulate the impact of these actions from a CO2 savings perspective on each asset. Deepki proposes an AI-powered physical thermal simulation model that allows you to input different asset characteristics into the model, generating an action plan with associated CO2 savings. For instance, if you are building a plan with an action that changes the insulation, the model will simulate this impact in terms of energy consumption and CO2 emissions, providing you with data-driven insights to guide your decisions.

The goal is to find the right balance between having a high-level view (portfolio) and the model’s ability to process other types of more specific input, such as asset geometry, to refine the estimation of CO2 savings.

But this is only the beginning. Planning at the portfolio level is one thing, even with a detailed action plan at the asset level. Later, the plans will need refinement, potentially validating the action’s implementation through asset visits performed by engineering firms. Diligent tracking must take place throughout this process to achieve goals.

The art of implementation

Tangibilizing new processes and tools is crucial to grasp the impact they can have. During the session’s panel, the conversation explored the practical application of these concepts and how diverse industry players tackle these challenges in real-world scenarios to accelerate the journey to net zero. The panel featured Shauna Mehl, Head of ESG at Catella Group; Ana Herbert, Senior Manager – ESG Technical Asset Manager at Manova/Macquarie; Iris Hagdorn, Head of ESG at HIH, and David Klingberg, Director at Technical Asset Management. Below are some key takeaways.

1. Integrating ESG into core business strategies

To drive sustainable growth, ESG considerations must be seamlessly woven into core business processes rather than treated as an isolated initiative. This means integrating decarbonization plans into annual budgets and long-term investment strategies to maximize the overall impact of sustainability initiatives.

2. Leveraging technology for accelerated decarbonization

Centralized platforms like Deepki’s offer invaluable tools to expedite decarbonization efforts. These platforms provide a comprehensive catalog of decarbonization actions and enable organizations to simulate the impact of these actions on individual assets. Organizations can make data-driven decisions and optimize their decarbonization strategies by harnessing the power of physical and thermal simulation models.

3. Fostering collaboration for sustainable success

Efficient communication and collaboration are indispensable for the successful implementation of decarbonization initiatives. Data transparency and a shared understanding of goals and strategies foster a collaborative environment that drives innovation and accelerates progress.

The panelists emphasized the critical role of high-quality data in informed decision-making, advocating for the widespread adoption of smart meters.

Read more: The role of stakeholders in ensuring data quality in real estate.

4. Realizing the long-term value of decarbonization

While quantifying immediate monetary returns on investment can be challenging at this stage, panelists emphasized decarbonization efforts’ significant long-term value-creation potential. Reduced energy costs, lower carbon taxes, and improved asset valuations are key long-term benefits. Short-term gains, such as reductions in energy consumption and related taxes, can be realized through strategic interventions.

5. Overall, prioritizing decarbonization efforts

Given resource constraints, prioritizing decarbonization initiatives is crucial. A balanced approach that combines a portfolio-level perspective with asset-specific analyses is recommended. Factors such as equipment lifecycle, regulatory requirements, and available capital should be considered when prioritizing actions. A clear roadmap is vital to guide the implementation of decarbonization strategies and ensure long-term success.

Deepki’s platform was positioned as a critical solution for integrating ESG considerations into core business processes and fostering stakeholder collaboration, ultimately accelerating clients’ decarbonization efforts and their journey to net-zero goals.

WHITE PAPER

Real estate’s ESG imperative: from challenge to opportunity

Download Deepki’s white paper to learn more about the current state of ESG in the real estate sector. It will help anticipate your next move by acknowledging the key trends to watch. Additionally, it will help understand how decisive action when embracing transparency, collaboration, and engagement throughout the value chain can go a long way.