In recent years, rising interest and demand from real estate investors and consumers have brought various initiatives and regulations promoting sustainable compliance within the industry to the global forefront. Real estate players are increasingly adopting sustainable practices to safeguard and increase their portfolio value worldwide.

Under Biden’s administration, climate change mitigation and environmental standards went under increased scrutiny. There has also been a significant focus on how companies ensure responsible management, transparency, and sustainable decision-making in their governance structures.

However, while the EU has established a more uniform regulatory landscape, the U.S. still lacks a comprehensive national approach to drive regulatory sustainable adoption. From key federal regulations — mandatory and non-mandatory — to voluntary frameworks and state-level policies, this blog aims to provide a comprehensive overview of the state of these initiatives.

Key federal regulations & initiatives

In the European Union, standardized directives like the Corporate Sustainability Reporting Directive and the Sustainable Finance Disclosure Regulation ensure that all EU countries follow the same sustainability disclosure rules. It offers regulatory transparency for real estate owners and investors. Still, some member states can voluntarily choose to implement stricter national regulations.

On the other hand, U.S. regulation is overall influenced by a federalist system. It means individual states have considerable autonomy to set their own regulations. As a result, these standards still vary widely from state to state. For instance, California’s active climate goals contrast with more lenient regulations in states like Texas. This inconsistency creates challenges for companies operating nationwide.

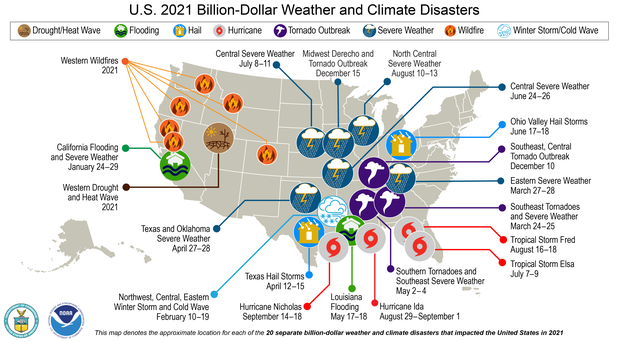

Source: National Oceanic and Atmospheric Administration.

However, the urgency to address climate change has never been more critical, as climate-related hazards increasingly impact the country’s economy. In 2023, the U.S. broke an unsettling record, experiencing 28 weather and climate disasters. According to the National Oceanic and Atmospheric Administration, this surpassed the previous record of 2020 for a total cost of $92.9 billion. This figure does not yet account for the anticipated economic impact of the recent Hurricane Milton.

Joe Biden’s administration progressed significantly in supporting decarbonization efforts over the last few years. Notably, the Inflation Reduction Act (IRA) from 2022, one of the most significant investments in the American economy, energy security, and climate legislation in U.S. history, has fostered a growing federal commitment to sustainability.

Securities and Exchange Commission

The Securities and Exchange Commission (SEC) plays a pivotal role in sustainable and non-financial reporting. Since its founding in 1934, the SEC’s mission has primarily focused on financial risks. However, it has shifted towards broader sustainability disclosure. It now requires publicly traded companies to disclose specific sustainability-related information material to investment decisions.

In March 2022, the SEC introduced the Sustainable Disclosure Regulations, proposing rules to address climate-related risk management. These rules require the disclosure of GHG emissions across the supply chain, reporting on how companies manage such risks, and disclosing the financial impacts of severe weather events and other natural conditions in audited financial statements.

Additionally, the SEC has also increased scrutiny of sustainable-labeled investment funds, ensuring they meet their stated goals and do not engage in greenwashing (making false or misleading claims about environmental benefits). Recently, it approved a final rule targeting greenwashing in investment funds.

US Federal Insurance Office

The Federal Insurance Office (FIO) is a division of the U.S. Department of the Treasury. Its primary role is to monitor the insurance industry and provide oversight on issues that have national or international relevance, particularly those that may impact the financial system’s stability.

The insurance sector becomes increasingly exposed to risks due to climate change. Therefore, the FIO plays a crucial role in assessing how these risks affect the industry. It works alongside other federal agencies to ensure insurance providers respond to these increasing risks.

For instance, the FIO proposed the US Federal Supplier Climate Risks and Resilience Rule to enhance the climate resilience of federal supply chains. Under this rule, major federal contractors must assess, disclose, and mitigate their greenhouse gas emissions and climate-related risks to their operations, products, and services.

The National Building Performance Standards

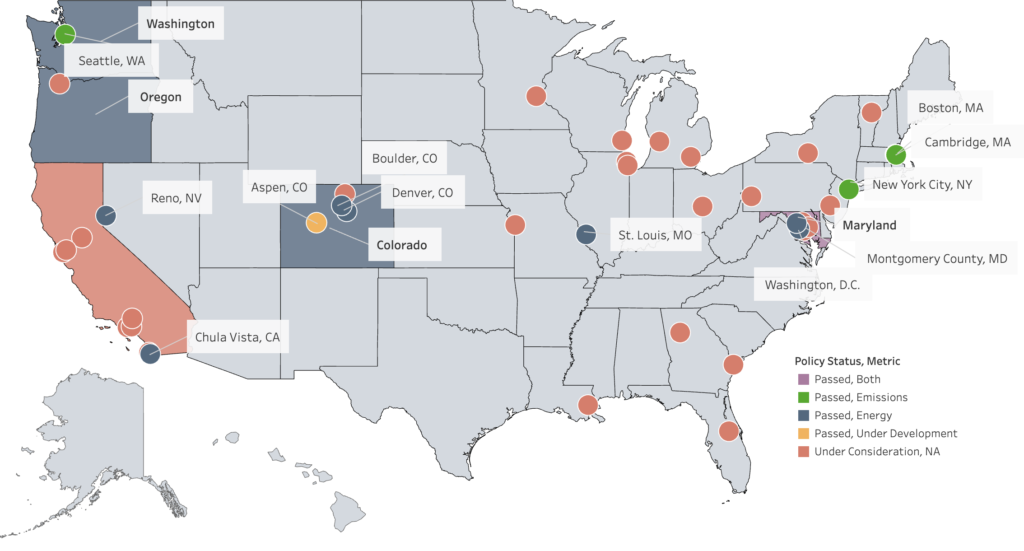

Building Performance Standards (BPS) are primarily state-level and local initiatives. However, there has been increasing federal support for these initiatives, especially under Biden’s administration, which launched the National BPS coalition. This coalition gathers a nationwide group of state and local governments. They are committed to inclusively designing and implementing building performance policies and programs in their jurisdictions. By the end of 2023, 12 jurisdictions, including New York, Washington, and DC, had passed BPS laws.

Overall, the Building Performance Standards (BPS) policies and laws aimed at reducing the carbon impact of the built environment. To achieve that, they require existing buildings to meet energy and greenhouse gas emissions-based performance targets. Widely practiced across the U.S., these standards enforce continuous improvement through reporting, verification, and sometimes third-party validation.

Source: State and Local Building Performance Standards

Department of Labor

The Department of Labor (DOL) is critical in regulating financial advisors and retirement plans. Since Obama’s administration (2009-2017), the DOL has started to address sustainable factors regarding retirement investing. During Trump’s presidency (2017-2021), the administration prioritized mainly economic needs over environmental concerns. Later, Biden’s proposal through the DOL aimed to make financial returns and sustainable factors equivalent. For instance, the Biden administration’s DOL rule encourages financial advisors to use sustainable factors to mitigate risks and identify investment opportunities.

The DOL’s legislation is part of a broader federal effort to integrate sustainable considerations into the U.S. financial system. It aligns with other federal initiatives, such as the SEC’s mandatory Climate Risk Disclosures and the FIO’s focus on climate-related risks, to implement effective sustainable measures.

Voluntary initiatives and regulations

Sustainable reporting in the U.S. is still largely voluntary, although the SEC has worked on stricter disclosure rules. Companies can follow voluntary frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) or the Global Reporting Initiative (GRI). However, no federal mandate requires uniform reporting, leaving an important part of reporting up to companies’ will.

The Sustainability Accounting Standards Board (SASB) was founded in 2011 to create consistent sustainability and finance guidelines for businesses and investors. It serves as a guidance framework and provides industry-specific standards that help companies disclose material and sustainability information to investors.

While not mandatory, SASB’s guidelines are increasingly recognized and adopted by U.S. companies aiming to meet investor demands for sustainable data that can inform investment decisions. It identifies sustainability issues that might impact financial performance and value for companies in 77 industries. This includes the real estate sector, serving as the basis for evaluating a company’s activities during an audit.

Widely used by U.S. companies, the Global Reporting Initiative (GRI) is the first and most widely adopted global standard for sustainability reporting. The GRI’s voluntary disclosures cover various topics deemed relevant to the organization and all related elements of the management approach. The reporting principles cover stakeholder inclusion, sustainability, and integrity and provide a structured way for organizations to report information about themselves and their impacts.

The Task Force on Climate-Related Financial Disclosures (TCFD) is an international standard focused on climate-related financial risk, which U.S. firms increasingly adopt. TCFD was established by the Financial Stability Board (FSB) in 2015 to promote more effective climate-related disclosures. It focuses on the financial impacts of climate-related risks and opportunities of an organization.

The Carbon Disclosure Project (CDP) is a voluntary disclosure framework for reporting Greenhouse Gas emissions and climate-related information. It provides a standardized framework for real estate companies to report carbon emissions, energy consumption, water management, and climate risk. This level of transparency additionally helps real estate companies to align with investor demands for reliable sustainable data.

LEED (Leadership in Energy and Environmental Design) rating system for new construction, developed by the U.S. Green Building Council (USGBC) is one of the world’s most widely recognized certification systems for green buildings. USGBC has published criteria for improving the environmental performance of buildings through LEED. It has now gone from strength to strength, including rating systems for existing buildings, interiors, and neighborhoods.

ENERGY STAR is a voluntary program initiated by the U.S. Environmental Protection Agency (EPA) to promote energy efficiency in residential and commercial buildings, among other products. The program aims to help consumers and businesses reduce greenhouse gas emissions by identifying energy-efficient products and practices. Under the ENERGY STAR program, certified homes and apartments are verified to meet strict guidelines for energy-efficient construction set by the U.S. EPA.

State-level initiatives

States and local governments are at the forefront of implementing sustainable policies and programs, often ahead of federal initiatives. Some states have resisted these initiatives, particularly those related to climate change, revealing a growing divide in this adoption across the country. However, others, like California and New York, are proactive in promoting sustainability-related initiatives. They have ultimately led with robust standards on energy conservation, renewable energy, and emissions reductions. They implement initiatives and frameworks that incentivize sustainable practices to promote sustainability.

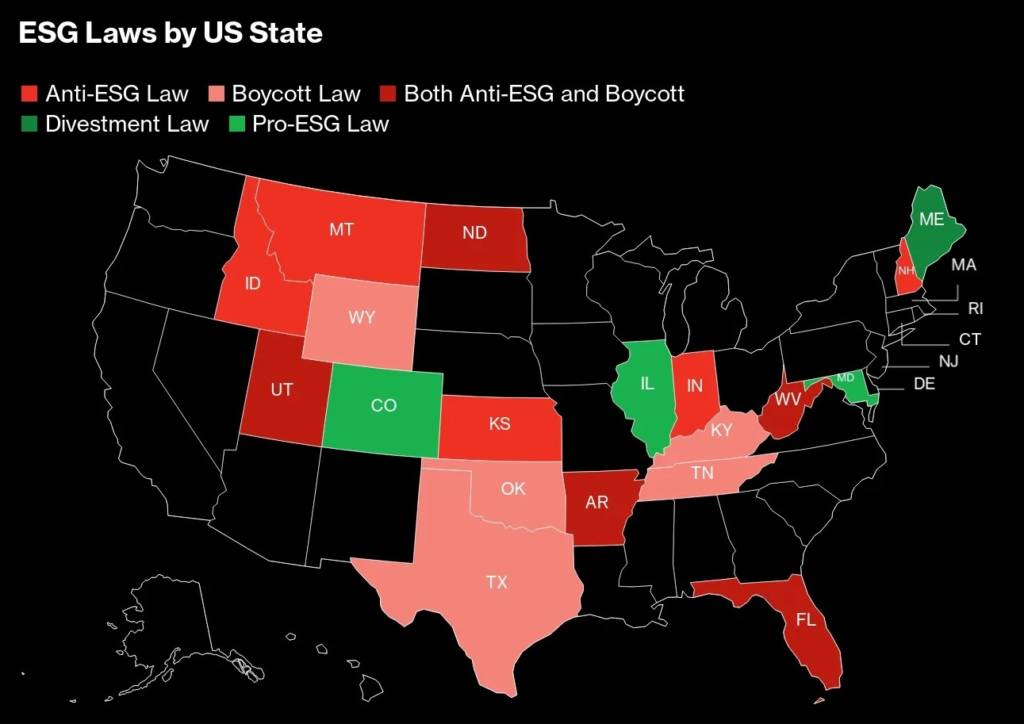

Source: BloombergNEF, State Legislature

States actively implementing sustainable practices

California has some of the most stringent environmental regulations in the U.S. The state’s Greenhouse Gas Emissions Reporting Program mandates corporate disclosures, turning the state into a leader in renewable energy and climate change legislation. The California Secretary of State Office passed the Climate Corporate Data Accountability Act in September 2023. This act requires large corporations to report their Greenhouse Gas Emissions by 2026.

New York State has a robust set of sustainability-focused initiatives. This includes the Climate Leadership and Community Protection Act and climate-risk disclosure obligations for financial institutions under the state’s Department of Financial Services.

States’ reluctance to adopt sustainable practices

Where the European Union’s political environment is more aligned in support of sustainable principles, with sustainability deeply embedded in the European Green Deal and climate action plans, these initiatives in the U.S. face political resistance. Some states and federal lawmakers oppose the idea of government-mandated sustainable practices. The politicization of these issues has led to slower regulatory progress at the federal level. Several states have introduced legislation to push back against the influence of sustainability in investment decisions.

For instance, Texas enacted laws prohibiting state pension funds from doing business with financial institutions that divest from oil and gas companies. This signals strong opposition to policies that are viewed as harmful to the state’s key industries. The state has also pushed back against sustainable investing practices, which are seen by the state as undermining the fossil fuel sector.

Similarly, Florida has introduced measures that restrict the inclusion of sustainable factors in investment decisions for state pension funds. The state has also passed legislation targeting companies promoting what the state considers “woke” policies.

To go deeper: Anti-ESG Crusade in US Sweeps 15 States With More Laws in Works

Significant progress has been made in the U.S, but the regulatory framework remains fragmented, with decentralized enforcement and penalties less stringent for non-compliance than those in the EU.

The EU’s regulatory model also incorporates both financial and double materiality. This approach holds companies accountable for how environmental and social factors affect financial performance and how activities impact society and the environment. In contrast, the U.S. federal approach focuses on financial materiality, requiring companies to disclose mainly climate-related risks that may influence their financial performance.

WHITE PAPER

Empowering a climate-resilient real estate

Rising sea levels, intensified storms, and other climate-related events are no longer distant threats. They are present-day realities that significantly impact the industry’s bottom line. Therefore, the sector’s professionals must adopt a comprehensive, climate-resilient approach to mitigate these risks and secure a sustainable and profitable future. Get insights into practical strategies for building resilience!