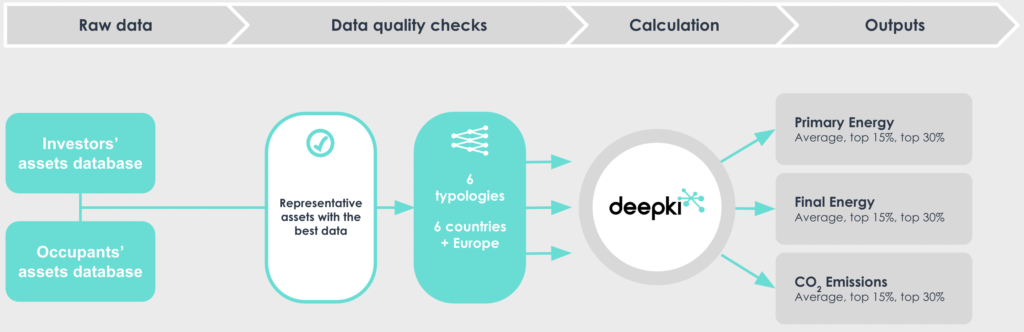

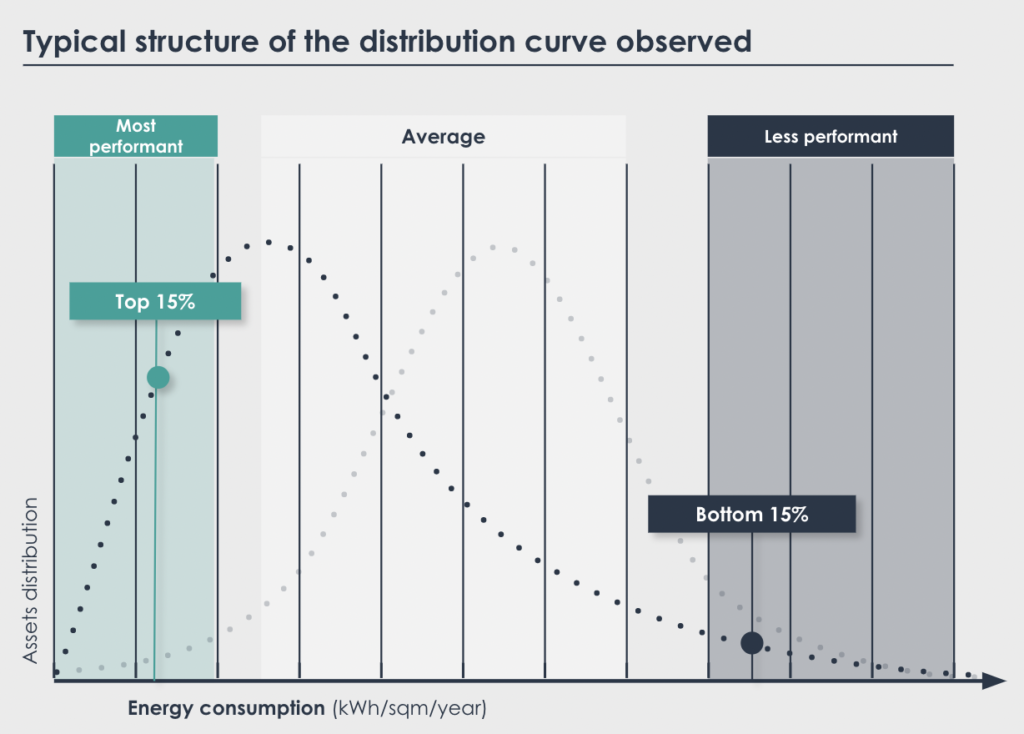

A lot of action plans have been orchestrated to fulfill the commitment the EU made to become the first continent to reach carbon neutrality by 2050. The goal of reducing greenhouse gasses and energy consumption altogether means that major real estate players must face the challenges by adopting clear strategies and action plans. The time has come to face the truth: in real estate, regulatory compliance is vital for achieving alignment, and solid frameworks are needed for successful outcomes. In order to help real estate players better understand the energy consumption of their portfolios and meet the challenges of the EU Taxonomy & SFDR, Deepki’s ESG Index was launched. This will be one of the first European indexes that measure the sector’s sustainability performance through primary energy consumption. It is accessible online, providing the top 15% and top 30% performance in primary energy consumption for each asset type categorized by country.

What is Deepki’s ESG index?

As an asset manager, you want to know how well your portfolio is performing as well as monitor its alignment to taxonomy standards (top 15%). High ESG rankings in response to the EU Taxonomy mean higher and safer asset value in the long run. As of right now, the only way to consult the industry standards in relation to ESG scores is to create one’s own benchmark which requires time without the certainty of the data being precise enough for a comparison. Deepki’s ESG Index helps reach a consensus on ESG standards by using actual data that enables an accurate market comparison. Through the affiliation of multiple partnerships, and backed by its extensive database Deepki’s ESG Index will ensure the data published in the benchmark is a dependable touchstone for real estate players.

The need for quality data

Reliable data is the first step toward making smart and informed decisions. The Deepki Platform already allows customers to have ESG performance predictions based on different scenarios and selected trajectories. The ESG Index will further assist managers in better understanding which assets to prioritize in order to meet the ESG standards categorized by country. This ensures that managers can properly monitor assets, mitigate actions accordingly, and prevent them from becoming stranded or losing market value.

By automatically collecting actual data from more than 400 000 assets in 41 countries, Deepki is able to share in-depth insights into the real estate sector’s energy performance, by asset type (offices, retail, residential, logistics, healthcare, etc.) and location. Published and updated annually, this index will display a true reflection of the European market, taking into consideration the constantly evolving ESG market standards.

The ESG Index calculates annual performance statistics based on real data collected by Deepki. Thanks to Deepki’s ability to collect real data, the ESG Index is based on an in-depth knowledge of the characteristics of the buildings analyzed and then guarantees both the completeness of the data and the representativeness of the sample. Combined with Deepki’s industry expertise, it aims to provide you with the most accurate measure of information, so that you no longer need to guess – you can be sure of your position in the total market average.

1. Real Data

What makes Deepki’s ESG Index an important tool is the quality of real data that is used for the creation of a very precise benchmark. Until now, market benchmarks have been based on declarative data, resulting in potentially incomplete or biased data. Since the Deepki platform automatically collects actual data through 1000 connectors with water, energy, and metering providers around the world, data is no longer limited only to what’s declared, so, the scope of the data the index becomes more precise. It is also important to consider that the total data collected encompasses over 400 000 assets in 41 different countries (and counting) meaning that Deepki’s ESG Index is not only precise in the realm of data but is also comprehensive, and thus can be used as an actual analytic tool for further improvement in energy performance.

A benchmark for the entire sector

To achieve the goal of carbon neutrality explained above, the ESG index will provide a benchmark for the entire sector. The Taxonomy will consider the top 30% as ‘not doing significant harm,’ while it will consider the top 15% of market performers as ‘contributing substantially. For example, it shows that:

- the top 15% of the retail building market in France consumes 84 kWhFE/m2

- the top 30% of the office building market in the UK consumes 129 kWhFE/m2

- the average German healthcare building market consumes 179 kWhFE/m2

- the top 15% of the logistics building market in Europe consumes 26 kWhFE/m2

As mentioned above, complying with the EU Taxonomy, the SFDR and the Tertiary Decree is difficult when there’s a lack of consensus around what is considered a sustainable investment in relation to competitors in the real estate market. Deepki’s contribution hopes that, by providing a precise index through trusted data that is collected from some of the biggest players in the industry, a reliable benchmark can aid to ensure quality control and proper results.

2. Primary, Final Energy Consumption, and CO₂ Emissions

Deepki’s ESG index is currently only measuring the performance of assets in terms of primary energy consumption (kWhPE/m²/year). Here are some important definitions one must keep in mind when considering the usage of an energy market benchmark:

- Final Energy: refers to the energy consumed as it is charged (on an electricity bill for example)

- Primary Energy: refers to the total energy consumption. In other words, primary consumption encompasses the energy used to create the energy consumed in the final stages – for example, the usage of heating systems versus the usage of energy needed to create heat. As of right now, primary energy was chosen as the quantifying measure of an asset’s performance by the EU commission.

- CO₂ emissions: refers to the assessment of the energy-related carbon footprint, both for direct combustion and indirect use of energy of each building. Based on the consumption of each asset and its energy mix, it is possible to determine the associated equivalent CO₂ emissions using an official database of emission factors.

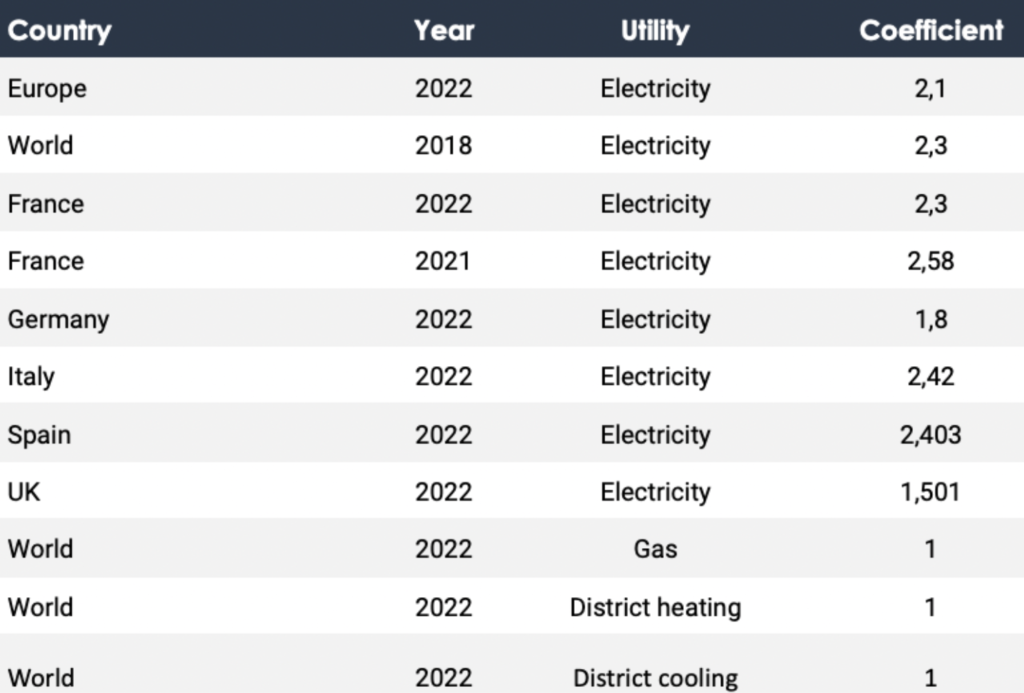

Let’s compare two offices, one in Germany and one in France. The office in France consumes on average 151kWh/m2 of final energy, and the one in Germany consumes 132kWhFE/m2. Looking at primary energy, and because the coefficient of conversion of electricity is 1.8 for Germany and 2.3 for France, we end up with a consumption of primary energy of 265 kWhPE/m2 for the office in France and 172 kWh/PE for the office in Germany. Eventually, as the electrical mix is more carbonized in Germany, looking at CO₂ emissions, the office in France emits much less than the one in Germany: 17kgCO₂eq/m2 for the office in France versus 32kgCO₂eq/m2 for the office in Germany (considering scope1 and 2 only, with a location-based approach).

The goal of the EU Taxonomy is to help investors analyze their performance in reaching the climate objectives, thus considering primary energy is useful – as we have a harmonized unit between countries – but they still need to be analyzed in the light of each country’s energy mix. A market benchmark allows for the energy differences to be translated into a single unit that measures performance taking into consideration the type of energy consumed. Examining the type of energy that is being consumed allows for a more precise market index, to help distinguish between companies that are contributing substantially to the market’s ESG performance and those that are contributing less.

Considering the factors that play a bigger or smaller role in measuring company compliance allows the EU Taxonomy to pressure major market players into considering whether their activities lead to climate neutrality. Deepki’s ESG Index carefully takes into consideration the different energy coefficients used per country, automatically displaying the data relevant to the primary energy. In this way, real estate players not only get an accurate representation of market standards but also that the data presented interlocks with the countries’ own energy measures. Therefore, by creating an ESG Index that standardizes the market’s energy consumption to have a tangible measurement, Deepki is helping major players understand their progress by allowing them to compare to other players in the real estate industry, and potentially allowing companies to learn from their peers to motivate better uses of energy across the sector as a whole.

Who is it for?

To ensure that stakeholders comply appropriately, the Deputy Director-General of the European Commission has announced in a letter the date change for the regulation taxonomies (RT’s) under the SFDR (Sustainable Finance Disclosure Regulation), stating:

Due to the length of technical detail of those 13 regulatory technical standards, the time of the submissions to the Commission, and to facilitate the smooth implementation of the delegated act by product manufacturers, financial advisers, and supervisors, we would defer the date of application of the delegated act to January 2023.

Matthew Baldwin

Since the stakes are high, and – technically – the demand can be quite challenging, it is pertinent for major real estate players to emphasize good practices in energy consumption. Companies are now obligated by law to publish a statement on their website regarding their current impact and action plans, and the new transparency requirements can – and do – affect funds’ investments and portfolio value. If certain products are not promoting ESG requirements or are not reflective of sustainable investments, the regulations in place bind companies to disclose statements of the like: “the investment underlying [this financial product] does not take into account the EU criteria for environmentally sustainable economic activities”.

Such a statement could result in a negative impact on asset values, and contrarily, those complying could increase their investment efficiency as their product would become enticing by government standards. An article from worldbank.org observed that investment behavior in response to ESG reporting shows that companies who underinvest can raise their debt relative to total assets by 8.7% by being ESG transparent! These studies prove the increased importance of ESG topics in all investment sectors, which should motivate investors to evaluate factors they may not have contemplated until now.

Considering that in recent years environmental factors have become an increasingly important standard to keep in mind for investment portfolios, not complying is to risk the accumulation of stranded assets that can devalue a portfolio, potentially turning what should have been a sound investment into a liability. Thanks to certain regulations such as SFDR and the EU taxonomy, real estate players are beginning to feel the obligations related to the evaluation of important ESG factors.

The need for a standardized benchmark

What’s lacking is a clear consensus on what energy performance should look like to succeed in achieving net zero. As of right now, Europe has no market comparison based on non-declarative data that allows companies to benchmark their CO₂ emissions and energy consumption in a simple way. Moreover, since the goal of reducing overall greenhouse gasses is in constant upwards evolution, it becomes increasingly difficult to accurately assess whether an asset’s value is improving in correlation to the market. Being transparent is no longer the sole indication of an asset’s success – an alternative indicator has become in high demand to ensure ESG compatibility within the existing requirements, and overall standing within market standards. It is for this reason that Deepki has published its “ESG index”, a European benchmark with a stable and robust methodology that measures the primary energy performance of real estate actors.

In light of the SFDR and the EU Taxonomy, there was increasing demand from the market for a reliable, standardized benchmark at a European level. Deepki’s Index will serve as a common standard against which we can compare ourselves.

Primonial

This will provide owners’ and asset managers’ portfolios with a clearer understanding of the sector’s environmental performance, and a reference against which they can measure their own assets. There is still room to improve the capabilities of the index to include other measures in the future, but as of right now the priority is to provide interpretable values for those invested in the sector.

Next Steps for Deepki’s ESG index

Deepki has made its ESG index freely accessible to help the market build a harmonized framework at the European scale. With this first publication, Deepki aims to gather feedback and expertise through discussions with all European real estate players. The index methodology was developed with the criteria of the European taxonomy to help the market achieve the net zero emissions target. Furthermore, Deepki has the intention of expanding soon into final energy and CO₂ so as to produce better representations of asset performance of energy typology. The index will be an annual publication to track the industry’s performance with the most accurate values through the work of our data scientists.

Allianz Real Estate sees index initiatives as an opportunity to have harmonized Taxonomy alignment values for all countries in which we operate and for which we suffer from a lack of reliable benchmarks.

Allianz Real Estate West Europe

It’s important to have as much investment at a government level as on a company level to ensure the proper advancement to net zero. Deepki’s ESG Index allows for a thorough understanding of the general progress of the market for every country, aiding all those concerned with the compliance of the EU Taxonomy.

Being transparent is a responsibility that leads to investment efficiency gains. Moreover, total ESG transparency allows for the evolution of proper benchmarks that in turn help give more precise presentations of industry standards and progress so that the proper measures (whether they be managing expectations or promoting the use of better energy sources) can be applied on both an investment and managerial level.

WEBSITE

Leverage the 2024 ESG Index results

Visit the ESG Index website to easily access a wide range of indicators that cater to your specific needs. Whether you’re looking for primary energy data for taxonomic reporting or other key metrics, everything you need is right at your fingertips.