Extreme weather events and other climate hazards are increasing in frequency and severity across Europe. There has been an unprecedented rise in temperatures since the 1990s. 2020 was even the warmest year on record in Europe. In 2021, heavy rainfall caused widespread flooding and landslides in the Netherlands, Belgium, and Germany, sometimes leading to people’s death. The continent’s 2022 heat wave has turned deadly as France and the U.K. experienced the hottest days on record last summer, causing massive wildfires in the south of France. The August 2021 report made by the Intergovernmental Panel on Climate Change (IPCC) states that human-caused climate change is already affecting many weather patterns causing extreme scenarios around the world, dramatically exposing our current and urgent situation.

The real estate industry is no stranger to what is going on. Climate change is leading to the intensification and multiplication of climatic hazards: buildings are on the front line, and stakeholders will have to take ownership of the resilience of their assets. Urban areas are particularly sensitive to these issues. In Europe, 4 out of 5 people live in urban areas. Well-known regulations such as the Tertiary Eco-Energy Scheme, the European Taxonomy, and the SFDR are becoming increasingly important for prescribing responsibility in the sector.

Given the imminent risks properties face worldwide, are real estate players properly assessing their portfolio’s scenario?

Physical risks & transitional risks: multiple challenges for the real estate sector

Resilience is an increasingly urgent notion, but it can be tricky to define a real estate strategy when we don’t know the real climate risks of tomorrow. Resilience is the capacity to plan for, respond to, and recover from challenges. Climate exposure for different buildings could depend on geographical localization: for example, the amount of sunlight could have an effect on the heating system needed throughout the changing seasons. More sunlight could cause more heat in the summer and overuse of air conditioning. In the context of real estate and its relationship with climate change, this extends to an asset’s ability to adapt to transition in a fair and sustainable way to the climate changes we are continuously experiencing. Climate change, previously a relatively peripheral concern for many real-estate players, has now moved to the top of the agenda.

These physical consequences have brought a sense of urgency to the critical role of real estate leaders in the climate transition. The urge to act is supported by recommendations from the Task Force on Climate-Related Financial Disclosures (TCFD). The Task Force calls on improving the standards for reporting climate-related risks and opportunities. However, many companies either do not report the costs of physical climate change impacts or tend to underestimate them.

The 2050 net zero target as well as the economic, social, and regulatory changes lead the real estate players to decarbonize their assets. Considering resilience factors not only creates new responsibilities for real-estate players to both re-evaluate and “future-proof” their portfolios, but it also brings opportunities to create fresh sources of value. For example, taking into consideration the location of a certain asset and the exposure to sunlight may affect the amount of electricity one would need to maintain such a building – a worthy consideration when assessing the value of an asset. With climate change also comes the geopolitical tensions that have affected the prices of natural goods including gas and electricity. Knowing whether your asset is at risk of being a financial burden is necessary for the maintenance of one’s portfolio

See also: What is resilience?

Into the risks

The risks of climate change can be divided into two types:

- Physical risks relate to the physical impacts of climate change, such as increasingly severe storms, sea-level rise, extreme heat, and wildfires.

- Transitional risks are the broader risks associated with climate change and transitioning to a low-carbon economy, such as regulatory change, resource availability, and reputational and market shifts.

Climate risks will affect all aspects of a building: its structure, uses, accessibility, provision of services, and also the safety, health, and well-being of its occupants. Because of their fixed location and long life span, assets are particularly exposed to both physical and transitional risks associated with climate change.

Main considerations to preserve the value of your assets

Climate risk is currently largely underestimated in the property market. However, the potential cost of not focusing on adaptation and resilience could result in huge financial implications for any industry and real estate is expected to be one of the hardest-hit sectors.

Physical risks can lead to increased insurance premiums, higher capital expenditure, and operational costs, or decreased liquidity and value of buildings. As natural disasters occur, some areas will see their insurance costs increase. Insurers are indeed alarmed by the climbing costs of damage insurance; for example, insurance is limited in certain zones identified as “high risk” (with significant material and financial damage), and insurers are limiting their contracts to compulsory insurance. As a result, some consumers buy policies that don’t provide as much coverage as they need, while others go without insurance. The amount of insurance is likely to increase as well as insurance coverage is likely to decrease in the face of climate change by 2050.

Insurers’ concerns are no longer individual catastrophic events but the interactions between the global climate and human systems. Today, only 35% of the total losses caused by extreme weather and climate-related events across Europe are insured. (EIOPA). In a 2021 report, the European Insurance Regulatory body, EIOPA, has issued some guidance. The institution recommends amongst other things that the insurance entity consider climate change implications in its pricing and underwriting strategy. This could involve:

- Assessing current underwriting and exposure limits in light of the increased potential for adverse underwriting experiences.

- Underwriting actions and risk mitigation activities that could help reduce adverse climate change outcomes and loss exposure.

Alongside the problem of the insurability of property is the risk of asset tangibility. Transitional risks can cause buildings, and even entire metropolitan areas, to become less appealing to investors, tenants, and residents because of these climate change-related events. There’s also the risk of buildings becoming obsolete, leading to write-downs.

Learn more: The growing risk of stranded assets

How to build your climate plan with Deepki

Is your property at risk of losing value? If you own, manage or invest in real estate properties, you should assess the risk of damage caused by extreme weather events, and its potential costs.

The challenge is to be able to assess the impact of these different hazards affecting the real estate market portfolio so that they can be integrated into the economic decision-making mechanism of any portfolio.

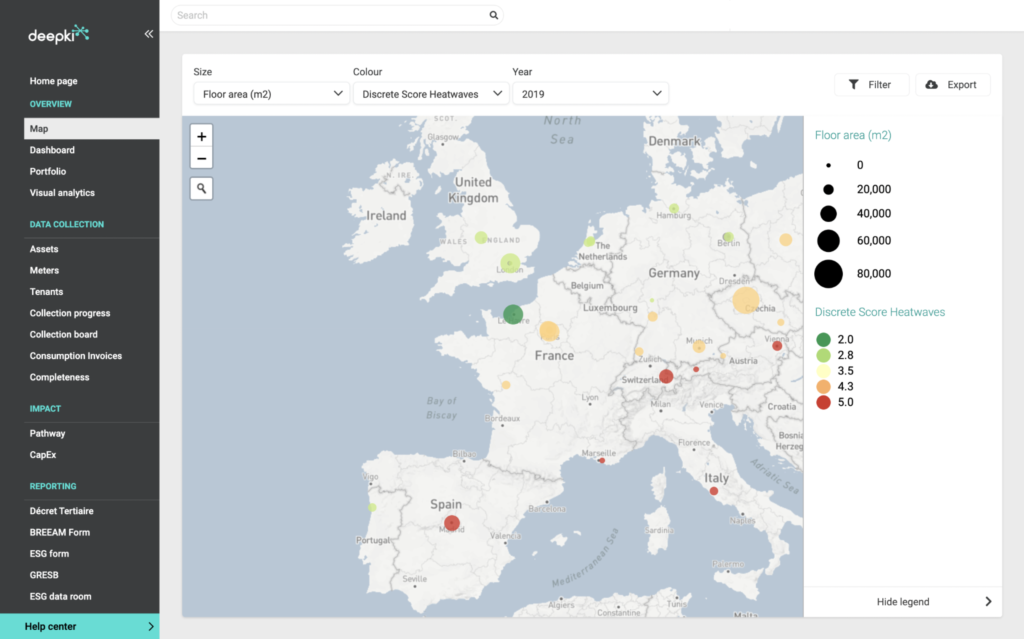

How does one assess with enough precision the climate impact on the portfolio’s value? It all depends mainly on the exposure of your assets to specific risks; such as rising sea levels, rising temperatures, and increased drought. Indeed, not all geographical areas will face the same impact of climate change, and such a measure should be considered when assessing one’s own assets or potential ones. At Deepki, we’ve developed a questionnaire to evaluate each of the different factors that come into place that help assess specific risks and their impact on assets. This way, we can grasp what details could make a big difference in regard to the planning of your investment strategy.

Physical risk exposure can be assessed with open data which plays a big role in completing this information in order to go deeper in the assessment. Open data is important to declare to better assess how different climate exposures can be of risk to a particular asset. Deepki has more than 1000 connectors for water, energy, and metering providers around the world, so that information can be centralized in one place in a structured way: In Deepki Ready – our SaaS platform with a wide range of features that gathers and centralize data consumption information–data is collected in the database and is updated and checked regularly by our team to ensure the most accurate representation of important measures. Thanks to this accurate engineering by Deepki, portfolio and asset managers can map, quantify, and forecast the impact of climate change on an asset’s value. Specifically, Deepki’s platform allows us to determine for each building and portfolio a risk score and thus aids in identifying which buildings/portfolio present high climatic risk.

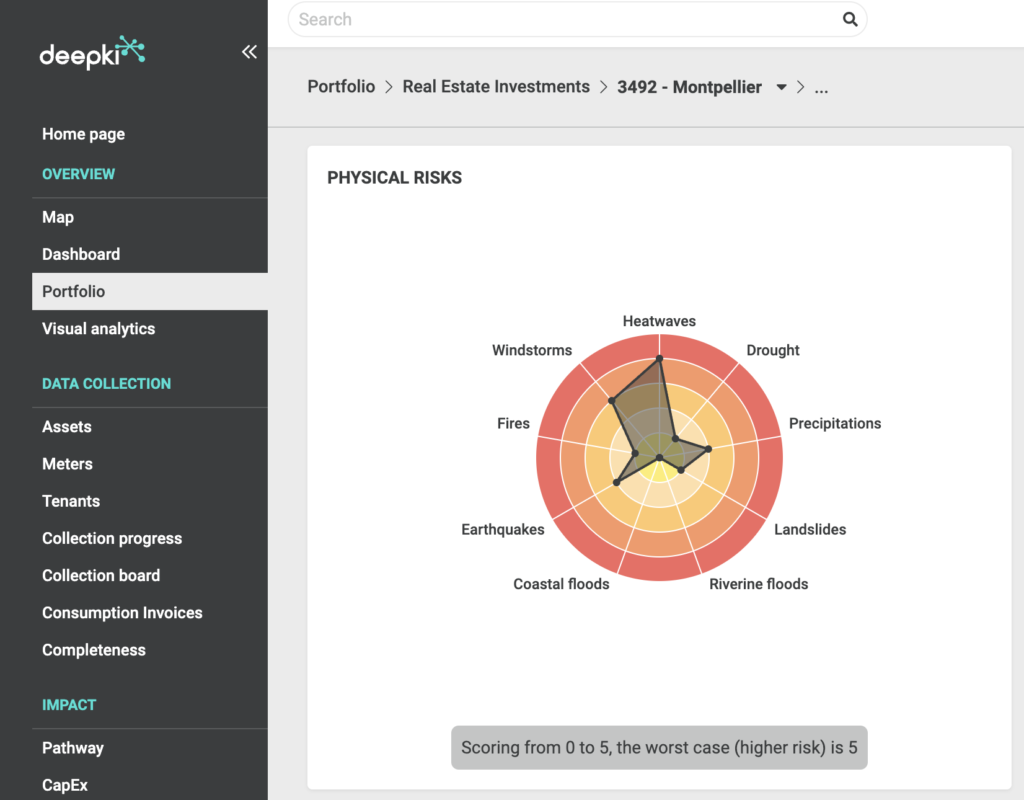

You can visualize the physical risks on an asset level with the radar chart below.

We take climate data and boil it down to an actionable 0-5 score for heat, storm, fire, drought, and flood hazards; where zero represents “no risk” and five “extreme risk”.

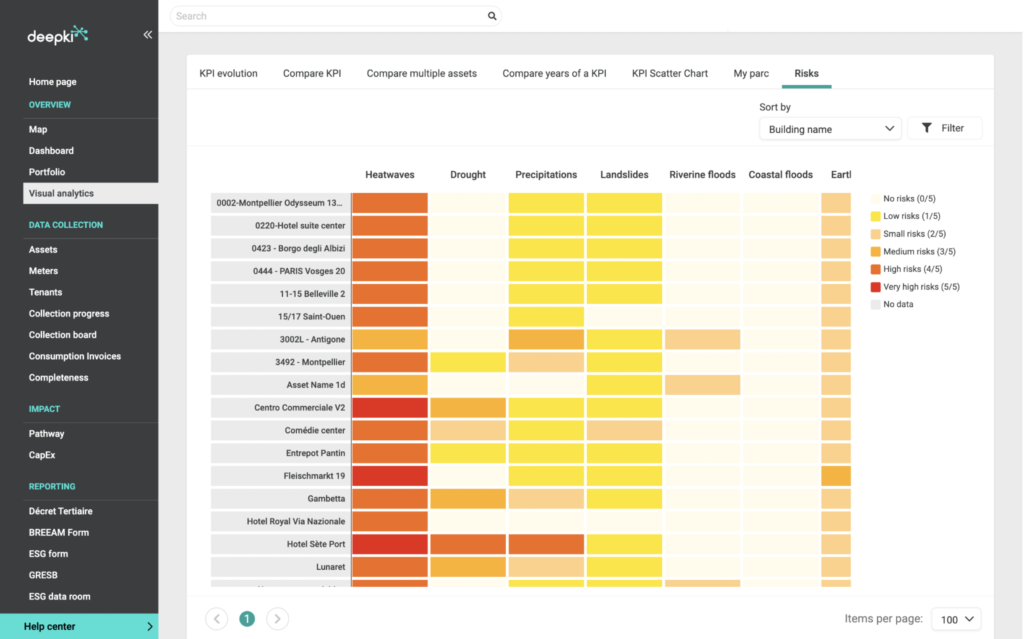

The visual analytics tool allows customers to visualize it at the portfolio level.

In general, the best way to manage climate risk is to first evaluate and understand it. Every asset may be different, but there are recommended steps you can take to assess risks at both the asset and portfolio levels:

- Evaluate and prioritize: Help to understand and choose where to focus the efforts / determine which physical and transition risks are most important and which are less important (using criteria such as the probability of a risk occurring or the severity of that risk).

Map building exposures: thanks to Deepki Ready’s features you can determine which buildings are exposed to risks, and the degree of their exposure.

- Understand portfolio impact: Our team of consultants helps you interpret these risk ratings when making important decisions.

- Take action to ensure the safeguarding of your asset or portfolio.

If you want to learn more about how Deepki Ready™ can help you protect the value of your portfolio, don’t hesitate to contact us!

Conclusion

Climate change presents a number of challenges – but also opportunities – for the real estate sector. Leading real estate investment managers and institutional investors need to increasingly recognize climate risk as a core real estate issue, and how it affects their decisions at the market level as well as at the asset level, investors can both make a positive impact on the environment and make profitably safe investment decisions. Property owners and investors that move quickly and decisively can capitalize on potential rewards while adapting their portfolios to extreme weather events and other climate-related risks.

According to the Global Commission on the Economy and Climate, about US$90 trillion in infrastructure investment is needed globally by 2030 to achieve global growth expectations. Infrastructure investment needs to be both scaled up, and, due to climate risk, integrate climate objectives. By doing so, it will increase resilience to climate change impacts. A number of institutions have already started the process. However, it needs to be done in a far more systematic way, making best practices the norm. Where does your portfolio stand in terms of climate risk exposure? Assess your exposure to climate change and optimize your strategy with Deepki.