An unprecedented number of participants took part in last year’s GRESB assessment: 2084, compared to 1820 in 2022. This trend highlights a widespread shift towards taking measures to meet climate goals. The growing number of entities reporting on their ESG data through GRESB illustrates the need to optimize assets’ ESG credentials to improve funds’ attractiveness, increase stakeholder engagement, and more.

This year, Deepki once again supported its clients with their GRESB reporting, helping 144 funds submit to GRESB, representing 23% of all funds submitted. Overall, results showed a total increase of +310 points and +14 stars across all funds compared to 2022.

Understanding the GRESB assessment process and scoring

The GRESB assessment results take into account ESG performance and sustainable practices for global real estate and infrastructure funds, companies, and properties. The assessment involves three key steps: gathering ESG data, completing the assessment, and receiving a scoring and star rating. To complete the assessment, companies must submit a form covering various ESG criteria, such as entity and reporting characteristics, environmental management systems, performance indicators, building certifications, and more. Once the form is submitted, GRESB will provide a score out of 100 and rank the funds from 1 to 5 stars.

This assessment, while voluntary, highlights the necessity for real estate entities to demonstrate a solid commitment to complying with regulations. It further emphasizes the importance of awareness, transparency, and disclosure of sustainable practices. Submitting to GRESB also reflects a commitment to ESG standards and regulatory frameworks.

2023: breaking new ground

2022 was a year of transition, seeing the implementation of the new GRESB Standards Development Process. These standards were developed to ensure the foundation’s independence and provide more transparency. This newly formalized process was driven by stakeholders’ feedback and an effort to ensure the GRESB standards remain relevant. As a result, the industry faces the challenge of integrating new ESG considerations and advancements without neglecting the maturity achieved on fundamental ESG topics. Moreover, the differences between countries and regions contribute to diverse perspectives. It also adds to the importance of considering the needs and priorities of a wide range of stakeholders. The combination of these factors ultimately led to the implementation of new standards, with an aim to keep the assessment relevant and aligned with the evolving ESG landscape.

The 14% rise in GRESB participation in 2023 also saw the emergence of new trends within the market. Emerging tendencies focus on DEI considerations (Diversity, Equity, Inclusivity), embodied carbon, biodiversity, and cyber risks. For now, half of all entities indicated net zero targets within the GRESB assessment in 2023, indicating a strong shift towards carbon neutrality, representing a major milestone for the industry as a whole.

The European real estate market’s transition toward net zero is driven by increased regulatory pressure. Notably, the UK market saw a considerable drop in carbon emissions, emphasizing the growing number of real estate stakeholders taking significant strides to reach net zero. For example, the housing sector saw a 13% decrease in its carbon emissions (ESG Index, 2023). Considering country-specific differences is important for understanding market norms and aligning data accurately with each country’s specific energy metrics. To better understand this shift toward net zero, take a look at our updated 2023 ESG Index.

Identifying the main challenges of the GRESB process

Every entity looking to submit to GRESB must follow an intricate process. Although the path to align with the process appears clear, it can be challenging. These challenges can be broken down into five key areas: stakeholder collaboration, compliance reporting, data coverage and verification, score optimization, and completing the assessment. The assessment is subject to a vast number of various criteria, hard deadlines, and repetitive tasks such as the completion of numerous forms. As a result, collaboration between stakeholders can be complex and time-consuming, ultimately jeopardizing the success of the process.

Real estate entities and leading asset management companies felt the challenge of improving their portfolios’ data coverage to meet the GRESB assessment requirement as they used multiple data-collection tools across funds. To efficiently complete the assessment, it is imperative to achieve a high degree of data coverage, which requires support. For instance, a leading investor and owner-operator managing a global portfolio exceeding £20 billion AUM, a client of Deepki since 2022, encountered challenges during its GRESB assessment due to limited resources, difficulty meeting submission deadlines, and a high volume of repetitive, low-value tasks.

Solutions to these challenges include automatically populating forms with data collected by the platform, focusing on data quality and coverage. Deepki Ready, a highly collaborative tool, was able to provide automated data collection and centralize GRESB-related tasks via a dedicated module within a unique platform.

Find the right path with Deepki

At Deepki, we understand the challenges real estate companies encounter when navigating the GRESB submission. As an accredited GRESB Global Partner, we are committed to providing effective support and solutions.

Deepki Advisory’s team of experts provides tailored services to implement effective action plans. Customers can also benefit from the Deepki Success service, which helps with implementation and provides product training sessions and materials to optimize workflows.

Deepki’s data intelligence platform

Given the volume of data customers must gather for the GRESB submission, there is a risk of inaccurate or missing data. For example, one investor managing a fund reporting to GRESB without a data management system was able to use the Deepki Ready platform, its features, and its services to overcome these challenges and optimize its submission.

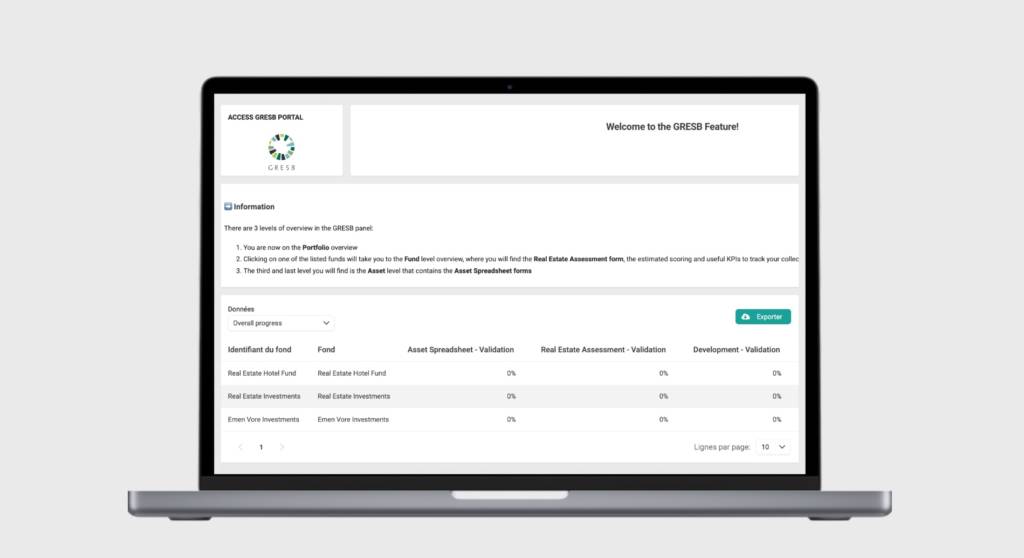

Deepki Ready’s data collection is characterized by its coverage and accuracy. The intelligent platform’s efficient, long-term data collection and pre-filled forms facilitate quantitative and qualitative data collection. The platform itself includes a dedicated GRESB module. At the fund level, find all assessment forms in one place, along with your data, easing stakeholder collaboration. At the asset level, automated data collection within the platform means your GRESB assessment is automatically populated. Deepki Ready then generates the final GRESB deliverables required to achieve a top grade and offers a score prediction.

Swiss Life Asset Managers France, a leading institutional asset manager, contacted Deepki for support with the first submission of its French assets to GRESB. This resulted in a 26/30 Average Management Score for all French funds and a 2/5 average score from GRESB. Deepki also provided forms for collecting quantitative data for electricity, gas, and water consumption. Simultaneously, the Deepki Ready platform facilitated the collection of qualitative data,for instance, ESG (environmental, social, and governance) goals and pledges, thereby obtaining an overall vision at the fund and asset levels.

Read more: Enhance your GRESB score with Deepki ReadyTM.

…supported by ESG and carbon experts

In addition to a centralized data platform, Deepki’s team of dedicated ESG consultants is able to track activity, follow progress, and anticipate the actions necessary for a successful submission. Customers are offered support and resources throughout the entire process. As a first step, Deepki experts provide training sessions and materials to understand the platform and its features, along with dedicated exchanges regarding the challenges they encounter. Customers are then supported by an ESG data collection and analysis team. The experienced team also assists them in identifying and mobilizing the relevant stakeholders, managing operations and resources, and providing continued support. Last but not least, dedicated GRESB specialists and energy management engineers assist each customer in optimizing their GRESB grade and ultimately shaping an efficient ESG strategy.

This support was provided to Azora, a Spanish-based, independent asset management group. They collaborated with Deepki to establish and implement their global ESG strategy and report to GRESB. They benefited from personalized support from Deepki’s customer success and ESG advisory teams, with monthly meetings to ensure all objectives were successfully met. These regular meetings gave Azora an advantage, providing an opportunity to anticipate relevant adaptations to their ESG strategy.

Download Azora’s case study to learn more about our process.

Journey to net zero, together with a human guide

Analytics

An ESG data collection and analysis team helps you with achieving optimal data coverage and data reliability.

Engineering

Project management professionals work with your team to gather the relevant stakeholders, manage project operations and resources, and offer continued, pluriannual support.

Dedicated GRESB specialists and energy management engineers assist in optimizing your GRESB grade and shaping your ESG strategy moving forward.

Get ahead of GRESB 2024

As 2024 is well underway, real estate stakeholders should focus on upcoming dates regarding the GRESB submission. It represents a long process that requires foresight and organization. April 1st marked the opening of the GRESB Portal for the 2024 Assessment. Any real estate company that wants to take the assessment needs to start thoroughly the assessment process.

Deepki guides its clients, helping them anticipate the GRESB process and achieve outstanding results. This highlights its significant impact on the market. Substantial improvements in its customers’ results in 2023 established Deepki as a key GRESB Global Partner and a solid solution provider.

These examples highlight the confidence that real estate stakeholders can place in Deepki’s support in responding to the assessment. In addition to offering time-saving solutions to its customers, Deepki promises enhanced data reliability, functional advantages, and service improvements and facilitates GRESB applications.

Thanks to effective tools, including the GRESB panel in Deepki Ready, the Deepki Advisory teams, or the support provided by Deepki Success, real estate stakeholders can confidently take on the GRESB assessment and improve their scores. Watch Deepki’s webinar on the topic to get a head start on the assessment.

WEBINAR REPLAY

GRESB 2023 Regional Insights EMEA results

In this webinar, GRESB and Deepki will dive into key industry topics and trends, exploring how you can become more efficient and achieve more with your ESG practices. With guests Axa Investment Manager and LGIM.