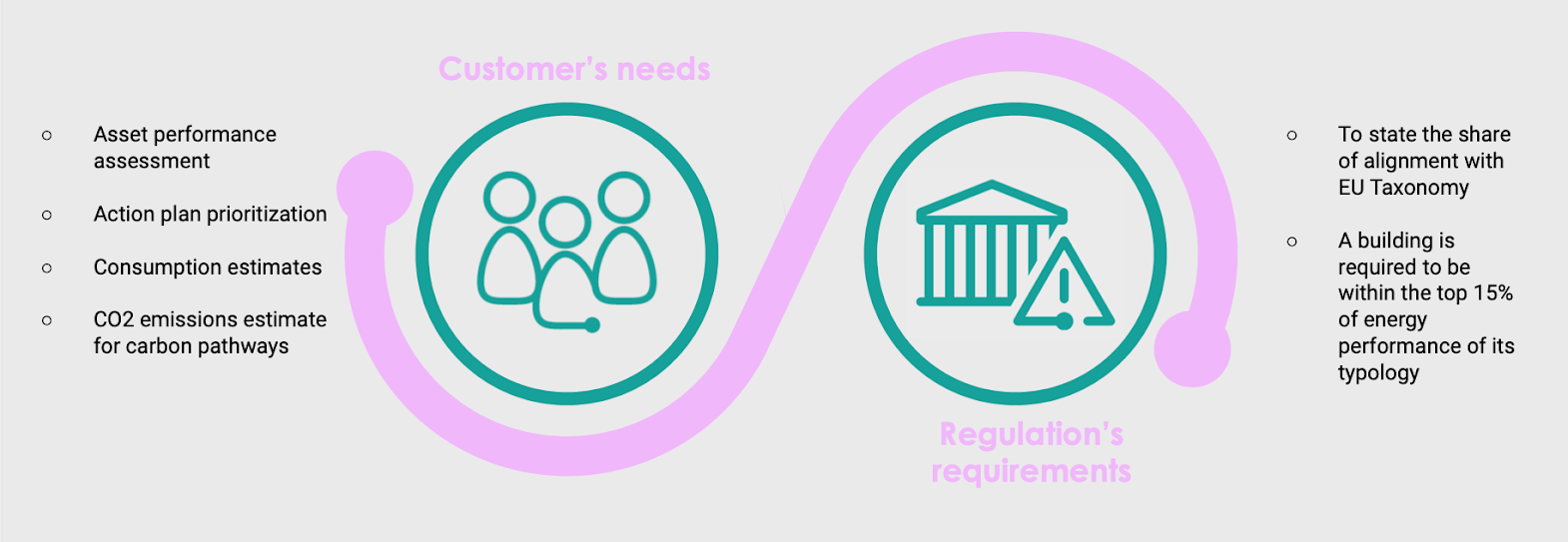

Deepki has just launched the updates for the ESG index that give further insight to real estate actors regarding the environmental performance of the European real estate market. Around the world, ESG regulations are not only evolving fast but are also multiplying annually as we approach the 2030 goal set out by the Paris Agreement. To tackle these new requirements, major real estate players seem to lack market standards on which to compare their own scores and analyze their performance. This particular need has pushed Deepki to move faster on the evolution of its ESG index, first launched in November of 2022 in partnership with IEIF. Recently, Deepki has published two new benchmarks in its ESG Index in hopes of helping real estate players get a clearer picture of the environmental performance of their assets.

Read more: How do I comply with the EU Taxonomy?

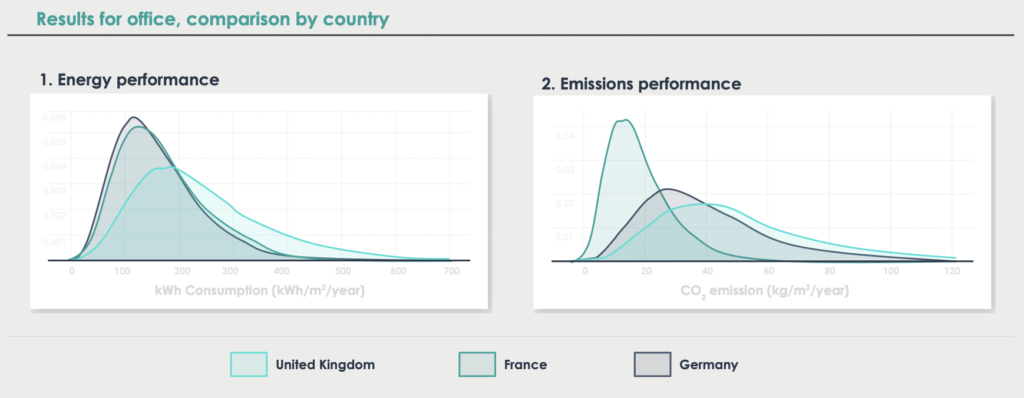

The ESG index has received additional support from the German Sustainable Building Council (DGNB) and the Royal Institution of Chartered Surveyors (RICS) and is now a recognized tool at the European level. It represents the first European benchmark that measures real estate’s ESG performance from real consumption data. The index will now contain three benchmarks; primary energy consumption, final energy consumption, and CO₂eq emissions. These benchmarks provide values for the average, the top 15% and top 30% best performing assets, classified by typology and country. Deepki and supporting partners are convinced that the new values will further help real estate players understand where they stand in the sector’s effort to reach net zero.

Let’s talk data

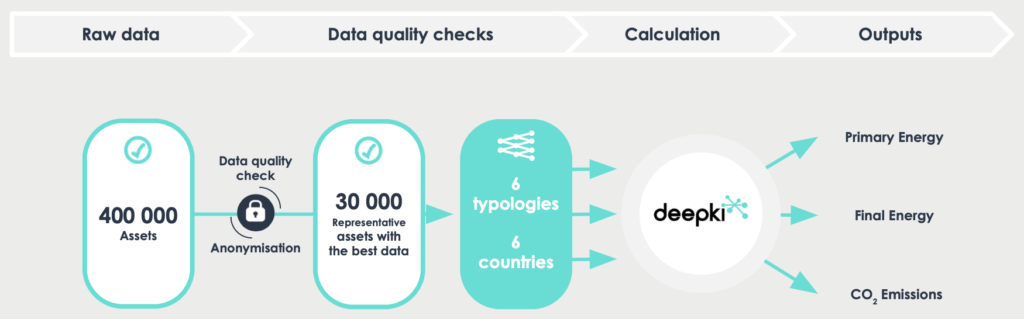

With standardized methodology, the ESG Index provides occupiers, owners and property managers with a clear vision of the real estate sector’s current standing on the road to net zero, as well as a reference in which to measure their own asset’s performance. The ESG Index is calculated from Deepki’s database of over 400,000 assets with energy consumption data from across 50 countries. Deepki is able to publish in-depth insights on the industry’s ESG performance by asset type (offices, retail, residential, logistics, healthcare, hotels) and location (the UK, France, Germany, Italy, Spain, Benelux, Europe). Moreover, due to the capacity of collecting real and automatic data, the ESG Index is able to offer a quality of data unparalleled in Europe.

The Index will now also provide values for final energy consumption, as well as an estimation of carbon emissions in terms of CO2eq. Primary energy consumption (PE) measures the total domestic energy demand, while final energy consumption (FE) refers to the energy consumed as it is charged on an energy bill. Final energy is converted into primary energy thanks to a national energy mix coefficient, and CO₂ equivalent emissions are then determined using an official database of emission factors.

Deepki’s SaaS platform: Deepki Ready™

Deepki has developed a robust methodology to carry out the ESG benchmark. Beyond the methodology, Deepki is a SaaS company with a vast European database; around 400,000 buildings are monitored for their energy consumption by the company. The quality of the database relies on the collection of raw data derived directly from the source. Through the Deepki Ready™ SaaS platform, Deepki is able to automatically collect data from the buildings it monitors, avoiding the human error that can exist when declaring consumption data.

Read more: Data collection: going for a pragmatic approach

The raw data itself goes through a quality check where around 30,000 assets with the best data are chosen to form a control group, in consideration of different asset typologies and sub-typologies from 6 different countries. The goal of these calculations is to help those in the industry successfully meet the regulatory reporting requirements, judge their performance in relation to their peers, and to better understand energy consumption data in real estate.

“RICS shares the desire to bring the entire market together around common indicators to better guide the real estate sector towards net zero in a consistent, transparent way. In this respect, the ESG Index is an important step toward the creation of a common reference. We look forward to continuing our cooperation with Deepki and other industry players on the basis of common standards such as our International Building Operation Standard (IBOS), and through the creation and dissemination of industry knowledge through our World Built Environment Forum (WBEF)”.

Sander Scheurwater, Head of Public Affairs, Americas, Europe, Middle East & Africa, at RICS

Quality Checks

Deepki collects actual consumption data from buildings by automatically collecting invoices from suppliers or directly via a connection to their database, which guarantees the quality of the data and its traceability throughout the calculation process. This ability to collect real data and trace it back to its source makes Deepki the only player not to be blind to the origin and context of the data analyzed. This allows it to do more quality control than any other initiative but also to enhance the relevance and accuracy of other controls. For example, by collecting data meter by meter, and having the expertise of property managers mobilized on its application, Deepki makes sure to collect heating consumption data.

The quality control pipe, given the extent of Deepki’s database, allows us to have perfect quality and to build a reliable representative sample of the European real estate market. What the pipe ensures includes, but it is not limited to; heating energy consumption, monthly data completeness for the annual duration, ensuring that data collection does not decrease by more than 60%, and representativity (ensuring that the typology is in line with national reference standards).

Methodological Assumptions

Deepki has some of the most qualified data scientists that have been able to build a cutting-edge methodology with a true scientific approach, so you can rest assured that our ESG/real estate experts have taken many accounts into consideration to ensure a scientific approach to the quality checks that exist behind the scenes.

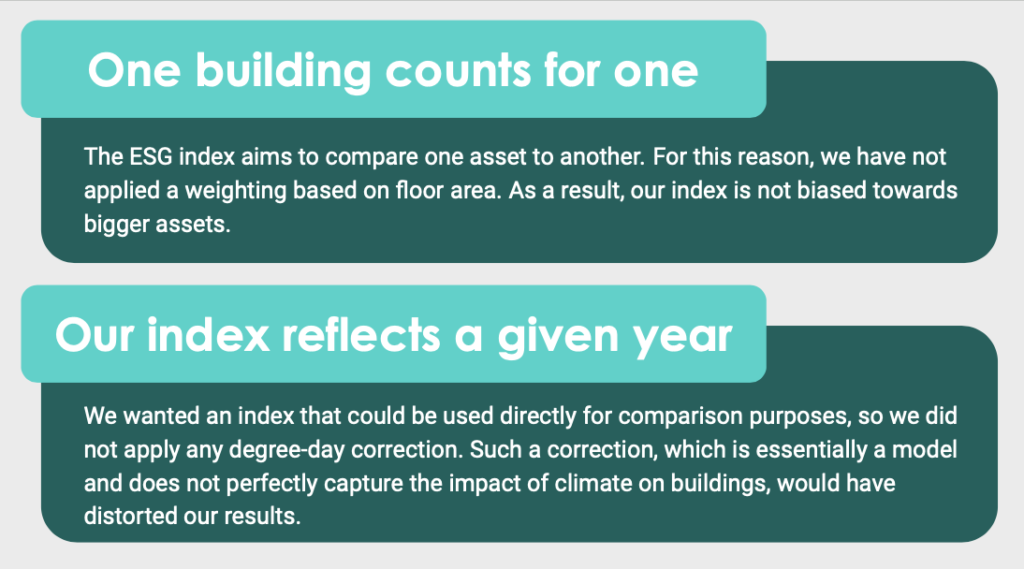

In order to properly aid real estate players, Deepki is aware that the index must be (and is) used to compare one asset to another, and thus biases in favour of bigger assets would not have properly mirrored the goal of the EU Taxonomy to highlight the best-performing assets. To help identify where to redirect investment flow, Deepki has decided to control for certain measures to ensure assessment is consistent with an asset-based approach:

About building typologies

Making the transition towards a sustainable business world means facing challenges together. To ensure company transparency and compliance when it comes to ESG scores, more information is required from companies to ensure that the proper steps and measures are in place. Deepki’s pivotal methodology allows for the analysis of the whole real estate market’s energy performance on a European market level, accommodating these rapid changes in regulatory requirements and providing the information needed to accurately assess asset compliance even when challenges arise with missing information.

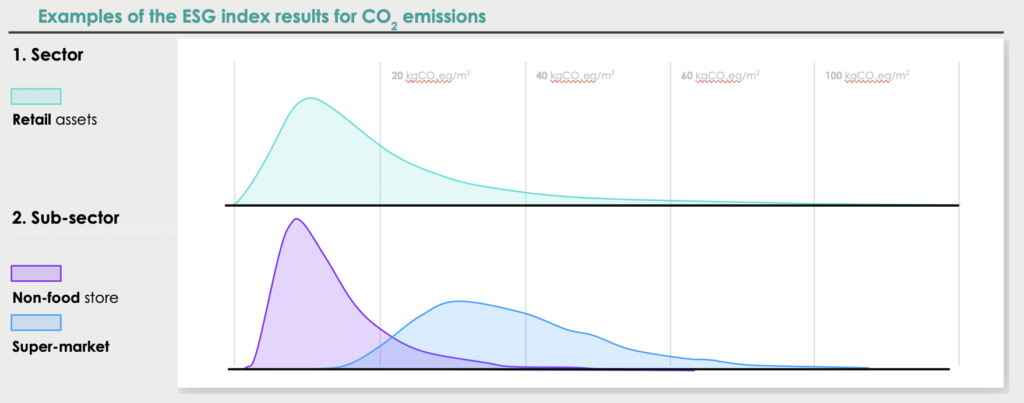

This is made possible by the data collection capabilities of Deepki, which has been operating for almost 9 years. But it is also made possible by the diversity of Deepki’s clients, which include investors as well as occupiers (e.g. supermarket chains) through which it is possible to access consumption data for the whole building for the most complicated typologies. Building typologies refer to the categorization of buildings according to their essential characteristics, functions, and size. Deepki’s ESG index is composed of the six different building typologies that are classically divided within the industry, including;

- Offices

- Retail

- Hotel

- Residential

- Logistics

- Healthcare

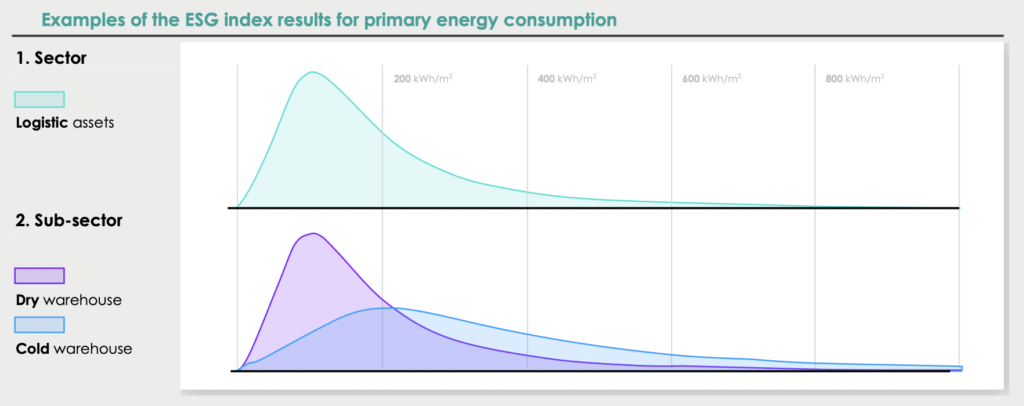

Deepki knows the precise characteristics of the buildings. We have a register of more than 60 building sub-typologies which allows us to have a precise classification of every asset we monitor. We then aggregate these “micro-typologies” into “macro-typologies”. For the most complex typologies (e.g. Retail) we have defined an aggregation key for the sub-typologies in accordance with public references on the structure of the national building stocks in order to represent the true decomposition of the sector. The EU taxonomy only requires the division of two major categories; residential and non-residential buildings. Deepki is currently the only company that is able to produce more precise data on the different macro-typologies. It takes into account sub-typologies as well, providing a more precise distribution to the market.

Read more: The next major topics within the EU taxonomy: biodiversity, waste, water, and pollution

The broad documentation of data within the SaaS platform allows Deepki to guarantee that the logistic typology, for example, is precise on either side of its micro-typology divisions that may be found in the market, such as cold or dry warehouses. Having the data of micro-typologies available is a great advantage for the precision that comes with Deepki’s index. For example, the macro typology ‘logistics’, is composed of the micro-typologies of both dry and cold warehouses, but not all micro-typologies existing within macro-typologies produce the same consumption profile – cold and dry warehouses are quite different. Therefore the ESG index has been designed to be consistent with the EU Taxonomy, but it also considers micro-typologies as important factors to get trustable statistics and ensure a more accurate understanding of the market’s performances beyond residential or non-residential typologies.

“DGNB sees this Index as an opportunity for real estate players to assess and compare themselves against a benchmark based on real data and check their alignment with the EU Taxonomy. This is particularly useful as it is not yet possible to determine the EPC grade.”

Seema Issar, In-Use Buildings & Sustainable Finance Manager at The German Sustainable Building Council (DGNB)

For more information: contact us

Energy Consumption – A deeper look

The EU taxonomy currently requires real estate actors to declare their ESG scores in terms of primary energy consumption. Deepki’s index allows for different energy mixes across European countries to be translated into a common standard so that investors can properly analyze their performance in comparison to other countries. Examining the type of energy consumed (electricity, gas, nuclear, etc.) distinguishes between companies that are performing highly. The first release of our index was reflective of the EU taxonomy, publishing in primary energy consumption – but we are now excited to announce that Deepki’s ESG Index has expanded it’s potential to include final energy consumption, primary energy consumption and CO2eq emissions benchmarks.

Since the ESG index is based on actual consumption data (which is, therefore, on final energy), the primary energy and CO2eq thresholds are then derived from a data conversion process. Deepki knows the energy mix of each building (at the meter level), which makes it possible to associate the energy mixes to the distribution of energy performance. This allows Deepki to do a relevant and precise conversion before computing any thresholds – on this basis, conversion factors are used for each energy source. We use internationally recognised emission factors (ie. IEA) and primary energy factors from national registers. For the CO2eq results, Deepki does a location based conversion covering scope 1 and 2.

Why is this new addition important? Simply put, energy performance and emission performance are not the same things. To get a broader picture of a building’s energy consumption is to realize the different carbon footprint of the given energy mix. Considering final energy consumption enables a deeper analysis of the energy performance of a specific building. By looking into the detailed information of each individual building (available to us through our comprehensive platform), we are able to assess the typical consumption with the associated typical energy mix; to have a multidimensional analysis in primary energy, final energy, and CO2eq. The incentive behind collecting these types of data is to access the energy mix values of different buildings so that our methodology can be representative of these typologies and their specific energy mixes. For example, in France, most residential buildings consume gas, while offices are more likely to consume electricity. Without these specific values, our ESG index would not be able to publish in primary energy/CO2.

Read more: An ESG index for the real estate industry that arrives just in time

About the CO2 & final energy update

Using automatic data collection, Deepki Ready™ centralizes ESG data into a single place, projects future performance, forecasts capital expenditures, and streamlines compliance reporting to help you manage your asset portfolio. Our ESG index allows major real estate players to assess their asset performance using a precise measurement tool with the intention of helping the industry prioritize the needed actions and aid reporting in terms of regulations. Although the ESG index gives a measure of industry performance in terms of the more generic typologies (that coincide with the market’s structure and divisions), we also offer a sharper assessment of asset by asset through the advisory services provided by Deepki.

“By making this index publicly available, we are offering a unique opportunity for the European Real Estate market, not only to help Real Estate players to assess their portfolio, but also to encourage dialogue with other organizations with the aim to converge and establish a common methodology.”

Vincent Bryant, CEO and co-founder of Deepki, and Emmanuel Blanchet, COO and co-founder of Deepki.

With this second publication, Deepki, IEIF, DGNB, and RICS look to encourage dialogue about the importance of having a frame of reference for both energy efficiency and carbon emissions at a national and European level, which will be of use to all professionals within the industry.

To help you understand how these new additional values can be used as a tool to further your ESG strategy, Deepki has a webinar featuring Fabrizio Varriale from RICS and Théo Caillierez Castaing Senior ESG consultant at Deepki. Download the replay using the link below!