Based in Amsterdam, GRESB was created by a group of investors aspiring to compare their property assets’ ESG performance. The organization’s goal is to ensure that assets are sustainable, addressing today’s needs without impacting future generations. To this end, GRESB offers an annual assessment that compares property management companies based on ESG criteria. If you’re considering an assessment and would like to learn more about the process, read on!

First and foremost, let’s review the ESG (Environmental, Social and Governance) criteria that will be the focus of your assessment. Here’s a look the seven areas examined in 2019:

- Governance: over 90% of companies have incorporated ESG targets into their business strategies

- Policy and disclosure: participants are increasingly vigilant with regard to the diversity of governing bodies and employees

- Risks and opportunities: over the years, the number of policies against forced child labor has increased steadily

- Monitoring and energy management systems: smart meters are phasing out manual readings, enabling fast and efficient energy savings

- Performance indicators: property managers must report on all buildings, accounting for both common and private areas

- Building certifications: of the total surface area for 100,000 assets covered by the GRESB 2019 benchmark, 8.8% is certified at the point of construction and 15.8% at the point of operation – figures that are still very low

- Stakeholder engagement: in particular, the improvement of safety training with regard to employment issues

Responding to the GRESB questionnaire: where to start?

The prerequisite to a GRESB assessment is data collection. Often complex but nonetheless essential, this process will enable you to complete both the quantitative and qualitative portions of the questionnaire.

The qualitative aspects of the assessment are primarily concerned with stakeholder engagement: investors, tenants, employees, human resources, etc.

You’ll also be asked for information about your organization, for an understanding of how you manage your teams, your ESG policy, the establishment of committees, targets defined by your CSR department, etc.

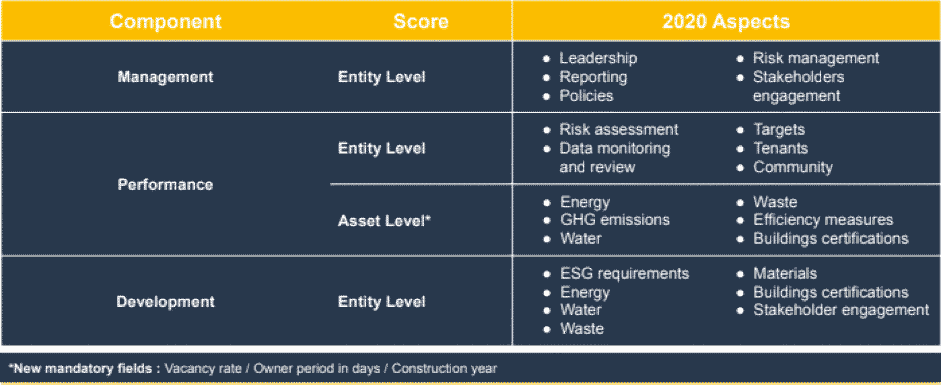

For the quantitative questions, you’ll need to report information on an asset-by-asset basis concerning some of the year’s criteria: kilowatt-hours of energy, cubic meters of water, tons of waste – to name just a few.

You can see here that it’s now mandatory to provide the year of construction, precise date of acquisition and vacancy rate for each asset. At the entity level, required data includes details on stakeholder engagement, materials used, water consumption, etc.

Once all your information has been gathered, you’ll be ready to enter and save it on the GRESB portal. To facilitate this step, GRESB has developed an API (Application Programming Interface) that simplifies the upload of your quantitative data and makes form completion faster and more efficient.

And last but not least comes the assessment itself. At this stage, GRESB examiners will go through all of your information for comparison with other property players. After all, benchmarking was one of GRESB’s founding principles!

The GRESB assessment is an opportunity to take stock of your ESG performance and restructure it for more effectiveness. If you don’t have an ESG strategy, the assessment helps you define one that suits your needs and priorities. Download our presentation to learn all you need to know about the GRESB process and try to maximize your score!