The 2022 United Nations Climate Change Conference, also referred to as COP27, was the 27th conference held in Egypt from the 6th to the 20th of November. It marked the 30th anniversary of the adoption of the United Nations Framework Convention on Climate Change. In the past 30 years, the negative impacts of environmental changes have made themselves virtually unignorable, forcing the world as a whole to come together and fight for the health of our planet. Slowly but surely we begin to better understand the science behind climate change and what actions or tools are needed to create a positive impact that counteracts its effects.

Europe net zero goals

In 2015, the world adopted the Paris Agreement and put in place action plans to achieve the 1.5-degree set objective as well as the net zero emissions by 2050 goal. Since the COP26 in Glasgow, the United Nations was again called upon to act rapidly if those goals are to be successfully reached – by thinking collectively in addition to the necessary political will, the decisions made in the COP27 conference exhibit the opportunities for transformation and resilience needed for the future environmental health. We now have a much clearer understanding of the climate crisis as well as how to address it effectively.

Science has been clear in its urgency to promote the reduction of greenhouse gasses and the importance of ensuring the availability of the needed means for developing countries attempting to weigh in on global efforts. Since the Real Estate sector contributes to 40% of total net greenhouse gas emissions, it’s important to understand how to implement the new requirements of the corporate sustainability reporting directive (CSRD) regulation in order to ensure the protection of asset value. Especially considering that these new regulations will take effect by 2023, ensuring compliance and fast action for proper strategy implementation are going to be pertinent for the success of the ambitious goals set out by the EU Green Deal.

The vision

The COP27 was especially important as it set out to commemorate the science behind climate change by building on agreements, pledges, and commitments made in the subsequent conferences between 1992 in Rio and 2021 in Glasgow. The goal was making proactive decisions to help accelerate the global climate action of emissions reduction, scaled-up adaptation efforts, and increasing the flow of necessary financial resources – keeping in mind the application of these rule-based ambitions in developing countries worldwide where the aspect of “transition” is still the first priority.

As set out by the Paris Agreement, the necessary stakeholders must come together to limit global warming well below 2 degrees Celsius, working hard towards the 1.5-degree celsius target. Country representatives know that these goals require bold initiatives and immediate actions from all parties, especially those in a position to lead by example. This year’s UN Climate Change Conference worked on elevating the original implementation of the Non-financial Reporting Directive (NFD) suggested in Glasgow for COP26 by emphasizing the role of science, the importance of working together to ensure equal opportunities, and the strategic financial implementation that comes along with these actions.

By materializing the necessary contribution of 100 billion USD dollars annually, the path towards proper adaptations of the goals set out can include the trust needed between developed and developing countries in order to achieve tangible results in a balanced fashion. Partnership and collaboration will help deliver the four goals where a sustainable economic model can flourish. In order to transform the way we interact with our planet, all sectors of society must work to introduce new solutions and innovative techniques, re-educate and replicate climate-friendly solutions in both developed and developing countries around the globe.

Read more: An ESG index for the real estate industry that arrives just in time

The EU Green Deal

On the 11th of December 2019, the President of the European Commission, Ursula Von Der Leyen, announced the European Green Deal – a pact adopted by the EU to become the first climate-neutral continent in the world by 2050 – with 1/3rd of the €1.3 trillion investment from NextGenerationEU planned to finance the EU Green Deal. The deal set out to improve the well-being of future generations and current citizens by lowering the net emissions of greenhouse gasses by 55% in 2050, equal measures and resources for all countries by providing:

- 3 billion trees planted by 2030

- Fresh air, clean water, healthy soil, and biodiversity

- Renovated, energy-efficient buildings

- Healthy and affordable food

- More public transport

- Cleaner energy and cutting-edge clean technological innovation

- Longer lasting products that can be repaired, recycled and re-used

- Future-proof jobs and skills training for the transition

- Globally competitive and resilient industry

The newest implementation of the EU green deal occurred during the recent COP27 conference with the adoption of the newly improved NFRD: the CSRD. Companies will now be required to publish detailed information on their sustainability efforts in order to increase accountability, prevent divergent standards of sustainability, and ease the transition into an economy that can support the necessary sustainability measures.

1. CSRD

The NFRD stated the obligation of companies to report how their business model affects their sustainability, so as to ensure the enablement of the financial market participants subject to the Sustainable Finance Disclosures Regulation (SFDR) to collect the needed information to remain transparent. Now, with the CSRD, companies must also report on how external sustainability factors (such as climate change or social struggles) influence their activities so investors have a clear idea of an asset’s level of sustainability. In this light, the CSRD is requiring a more detailed report, obligating bigger companies to include reports on “social” and “governance” matters – better integrating the S and the G of ESG consciousness.

“The new rules will make more businesses accountable for their impact on society and will guide them towards an economy that benefits people and the environment. Data about the environmental and societal footprint would be publicly available to anyone interested in this footprint. At the same time, the new extended requirements are tailored to various company sizes and provide them with a sufficient transition period to get ready for the new requirements.”

Jozef Síkela, Minister for Industry and Trade

What are the key takeaways from the CSRD?

Here are some important takeaways from the CSRD:

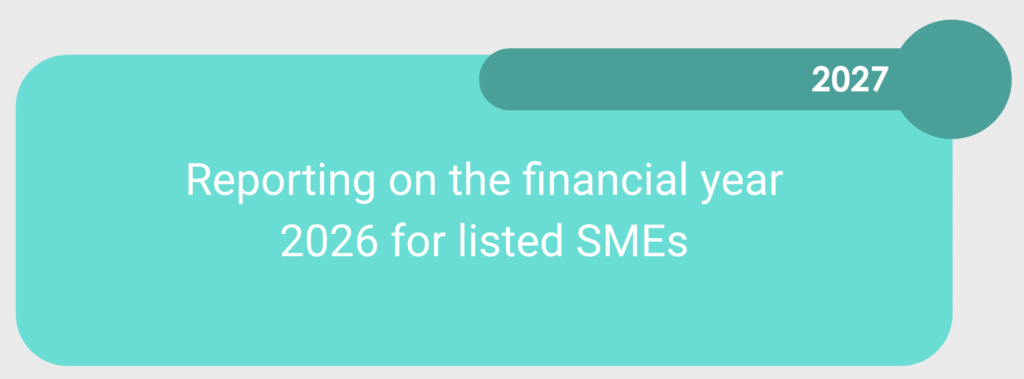

- The scope of what companies will be subject to the reporting has enlarged. All large and listed companies (except micro-undertakings) will be subject to the CSRD regulation. Small and medium enterprises (SMEs) will have simpler requirements and deferred timeline options by 2028.

- The European Financial Reporting Advisory Group (EFRAG) has decided to undertake the development of EU sustainability reporting standards which will apply to all those within the scope of the CSRD.

- The standards created by EFRAG will become relevant for all EU legislations such as the EU Taxonomy and the SFDR. This will contribute in time to the international initiatives in sustainability reporting to create frameworks for global convergence.

- A sustainability report will now have to include a digitalized management audit for the 2023 reporting period (published in 2024). These requirements motivate collective responsibility between the administrative, management, and supervisory bodies.

- Disclosure requirements will include an increased number of areas, including business models and strategies, targets, governance, policies, due diligence processes throughout the value chain, a description of risks and action plans to mitigate them, as well as information on the process behind identifying the relevant data.

- The sustainability reporting standards will clarify the specific information that needs to be disclosed regarding the environmental, social, and governance factors.

Read more: SFDR regulation: improving the ESG traceability of your real estate assets

The CSRD will be used to clarify the existing rules of sustainability information, enlarging the scope of affected companies so as to facilitate the adoption of a green and social transition. Disclosure of sustainability information will likely affect investment and funding in reference to whether they meet the standards designated by the EU Green Deal.

2. Next Steps

The CSRD further consolidates the relevance of the EU Green Deal and the endorsement of the goals it represents. After being signed by the President of the European Parliament and the President of the Council, it will be published and officialized, entering into force 20 days afterward, and implemented by member states 18 months later.

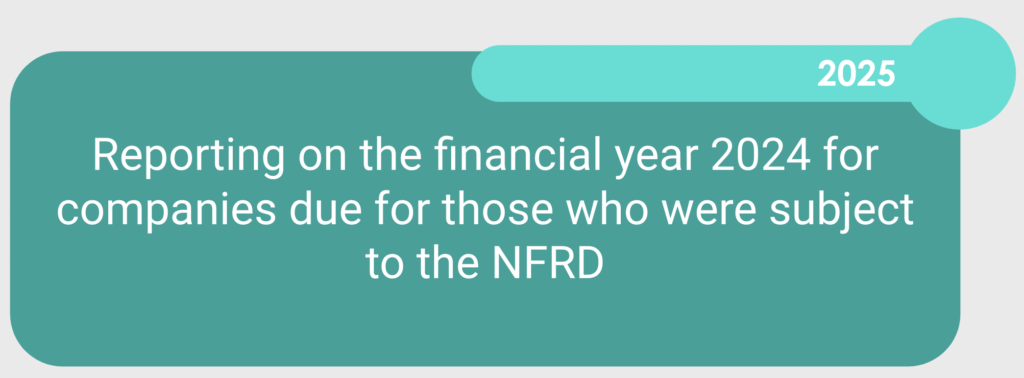

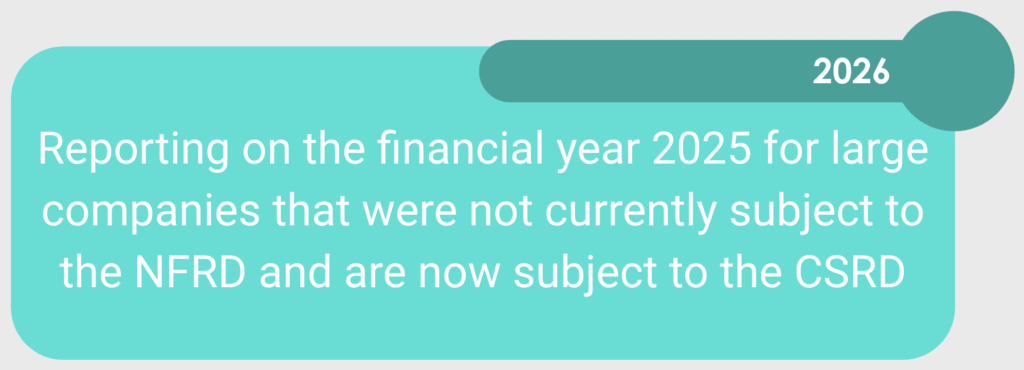

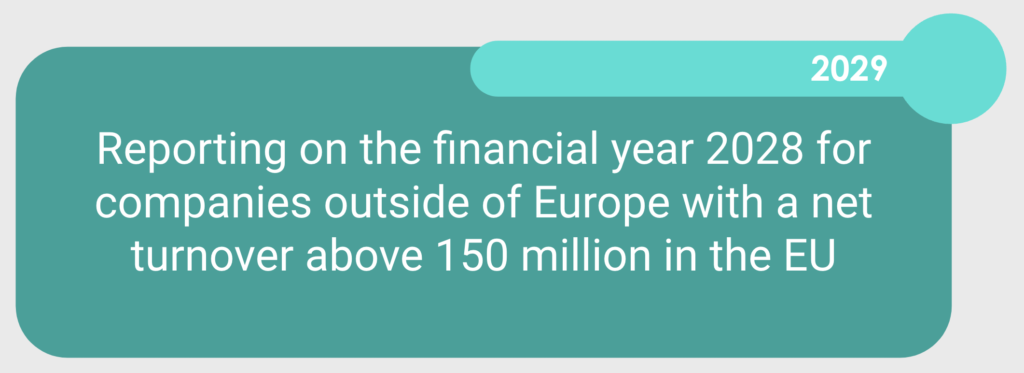

The application of the CSRD regulations will occur within four steps:

Effects on the Real Estate industry

The CSRD is intended to optimize the scope of the existing requirements, making it mandatory for Real Estate players to report on both their inward and outward ESG actions, with special consideration of social and governance factors. The proposed regulation will be in effect starting in 2023, so it’s essential to be prepared.

The ESG regulations in place specifically affect those in the Real Estate sector due to the role it plays on the net CO2 emissions, contributing to around 40% of the net emissions calculated. Therefore, to meet the EU climate and energy targets pronounced by the Green Deal, Real Estate players must commit to creating a proper strategic implementation of sustainable actions.

The CSRD not only increases the scope of the sustainability reporting requirements but also the scope of those who will be subject to it. It will specifically apply to any company that meets two of the three criteria below:

The concept of double materiality

The mandatory requirements will be a major game changer for the industry’s accountability of sustainable actions in terms of transparency, insight, risk and opportunities, augmenting the influence strong ESG scores have on investment value. In order to properly comply with these new regulations, the Real Estate industry must present long-term strategies for both inward and outward sustainability risks and opportunities – a concept referred to as double materiality. Double materiality relates specifically to the bi-conditional relationship between companies and climate change. Making proper materiality analysis will include not only the way a company’s activities impact climate change but also how climate change affects the financial materiality of the company, allowing for a big-picture overview of the interactions between the environment and business.

Read more: Climate risk challenges on the rise: considerations to evaluate your resilience level

To comply with the CSRD requirements, it will be crucial to do a materiality assessment and properly set the ESG goals in consideration of strategies that work based on these analyses in order to optimize long-term ESG impacts. Since the Real Estate market is stimulated by financial investments, understanding sustainability performance, as well as strategies for risk and opportunities of sustainable actions, are equally important for attracting capital and gaining competitive advantages. Therefore, it has become crucial to prepare the necessary management and internal stakeholders to comply with the vision and overall expectations of the EU Green Deal in order to succeed in creating virtuous Real Estate.